The markets tumbled, and recorded the worst one day drop in recent years. Our Short Term Indicator changed to NEUTRAL for the past week.

- U.S. equities sold off, S&P 500 had worst week since January 2016 .All sectors in S&P 500 were negative

- Dow Jones Industrial Avg plunged most in one day since election, down 666 points on Friday, more than 750 points in aftermarket trading

- VIX Index spiked higher by 56% for the first time since

- Fed kept monetary policy unchanged at this time.

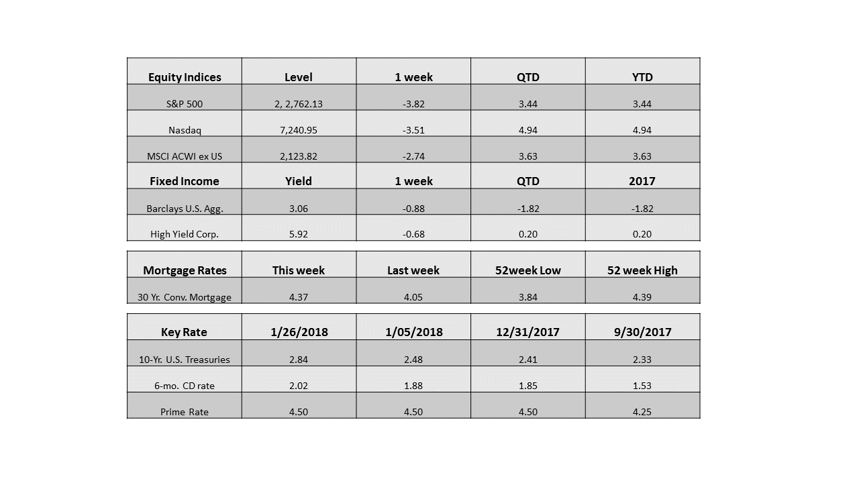

- U.S. 10-Year Treasury yield rose above 2.85% for first time since January 2014

- U.S. Payrolls rose more than expected

- U.S. Dollar reversed seven-week losing streak

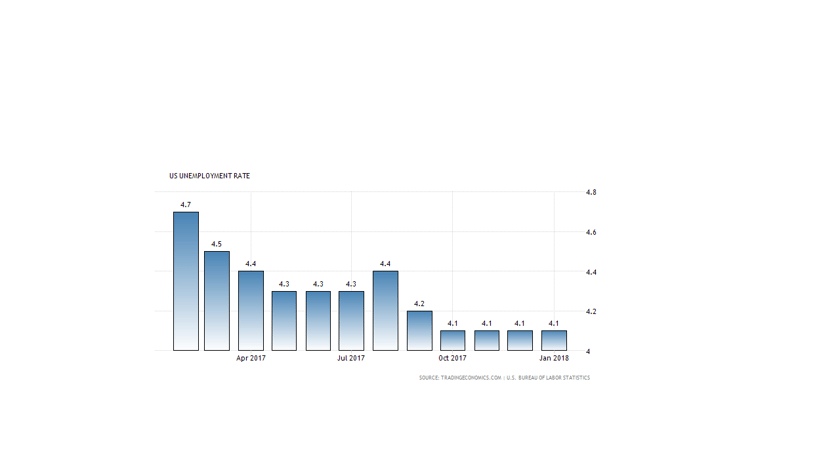

- US unemployment rate stood at a 17-year low of 4.1 percent in January 2018, unchanged from the previous month and in line with market consensus. The number of unemployed increased by 108 thousand to 6.68 million. For more information click here

Please visit our website www.pacificinvestmentreaserch.com for more insights . Email us at info@pacificinvestmentreserach.com if you have any questions.