U.S. stocks recovered a portion of the previous week’s steep losses, but the high-flying technology sector lagged the other benchmarks in this partial recovery. Our Short Term Indicator turned Bearish.

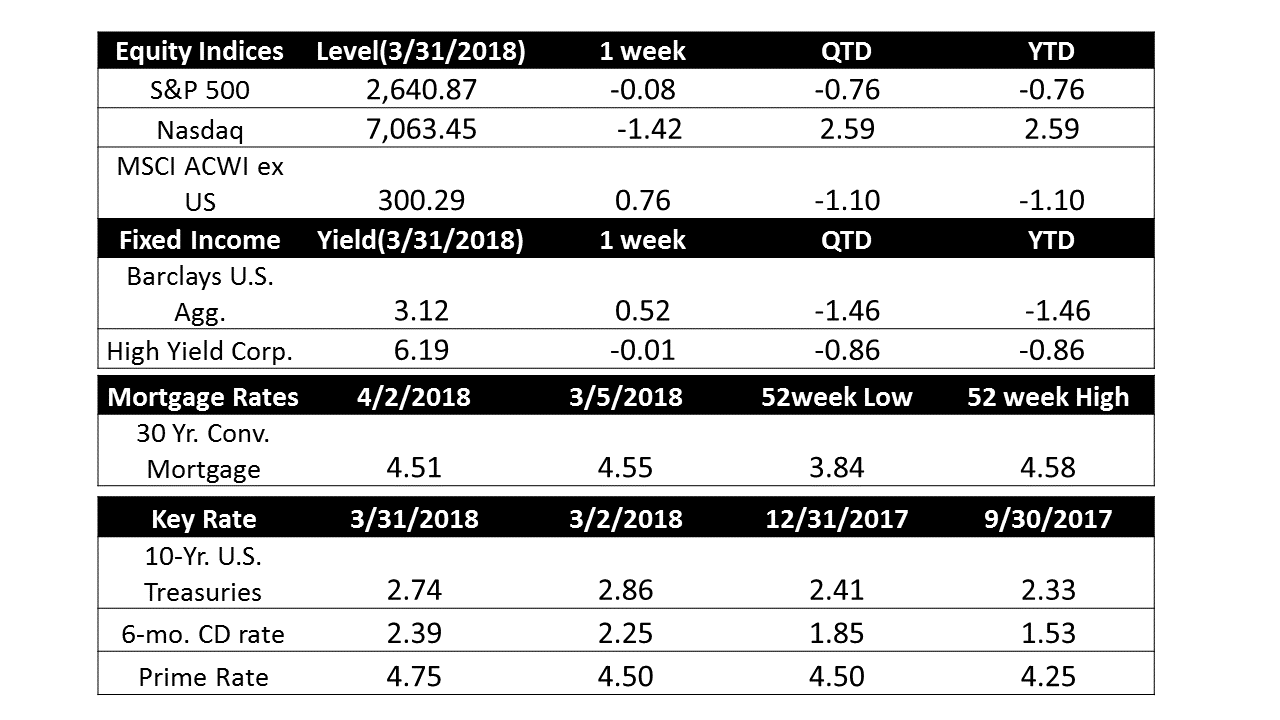

- U.S. Markets: U.S. stocks recovered a portion of the previous week’s steep losses, but the high-flying technology sector lagged the other benchmarks in this partial recovery. The Dow Jones Industrial Average climbed 570 points to close at 24,103, a gain of 2.4%. The technology-heavy NASDAQ Composite added 70 points to end the week at 7,063, a 1.0% rise. By market cap, the large cap S&P 500 index rebounded 2.0%, the mid cap S&P 400 index gained 2.1%, and the small cap Russell 2000 index rose 1.3%.

- International Markets: Most world markets also recovered portions of their March losses. Canada’s TSX gained 0.9% this week, and the United Kingdom’s FTSE which added 2.0%. In Asia, China’s Shanghai Composite rose 0.3%, and Japan’s Nikkei gained 2.6%. As grouped by Morgan Stanley Capital International, emerging markets rose 3.0%, while developed markets added 2.6%.

- Commodities: Precious metals gave up some of last week’s gains with Gold falling -1.7% to close at $1327.30. Silver retreated -1.9%, closing at $16.27 an ounce. Energy pulled back -1.4% with West Texas Intermediate crude closing at $64.94 per barrel. Copper, viewed by some analysts as a barometer of world economic health due to its variety of industrial uses, added 1.1%.

- March Summary: The Dow Jones Industrial Average lost 926 points, or -3.7%, while the NASDAQ Composite gave up 209 points, a -2.9% decline. By market cap, the S&P 500 retreated -2.7%, the mid cap S&P 400 gained 0.8%,and the small cap Russell 2000 rose 1.1%. Major international markets were down across the board in March. CAs grouped by Morgan Stanley Capital International, emerging markets rose 0.5% in March, while developed markets fell -0.8%. Precious metals were mixed in March. Gold rose 0.7%, while Silver fell -0.9%. Oil added 5.4% and copper ended the month down -3.4%.

- Q1 Summary: For the first quarter, the Dow Jones Industrial Average fell 616 points or -2.5%, while the NASDAQ Composite gained 2.3%. The S&P 500 and S&P 400 each declined -1.2%, while the small cap Russell 2000 fell just 0.4%. World markets were mixed for the quarter, but the bigger markets were all down. The Canada’s TSX fell -5.2%, the UK’s FTSE 100 lost -8%, while France and Germany lost -2.7% and -6.4%, respectively. The Shanghai Composite ended the quarter down -4.4%, while Japan's Nikkei lost -7.1%. As grouped by Morgan Stanley Capital International, emerging markets added 1.2% in the first quarter, while developed markets retreated -0.6%. Gold gained 1.1%, Silver added 9.8%, and Oil rallied 7.7%.

- U.S. Economic News: The number of claims for initial unemployment benefits fell 12,000 to 215,000 last week, hitting their lowest level since 1973. Economists had forecast claims to total 230,000. The more stable monthly average of claims eased by 500 to 224,500. Claims fell throughout most of the country with the biggest declines coming from the largest states: California, Texas, New York, New Jersey, and Virginia. The labor market is extremely strong with the unemployment rate down to 4.1%, the lowest in 17 years. Companies continue to report trouble finding skilled workers, and remain reluctant to let trained employees go. Continuing claims, the number of people already receiving benefits, rose by 35,000 to 1.87 million. That number is reported with a one-week delay. U.S. home prices are still on fire according to the latest data from S&P/Case-Shiller. The S&P/Case-Shiller national home price index rose a seasonally-adjusted 0.5% in the final quarter of last year, and was up 6.2% compared to

the same time the year before. The more narrowly-focused 20-city index rose a seasonally-adjusted 0.8% for the month, and was up 6.4% for the year. The West continued to have the hottest housing markets with Seattle, Las Vegas, and San Francisco all notching double-digit yearly price gains.

Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.

.