Major U.S stock indices rebounded this week as fears about a full blown war with Syria and Russia subsided. Hence our Short Term Indicator turned completely Bullish.

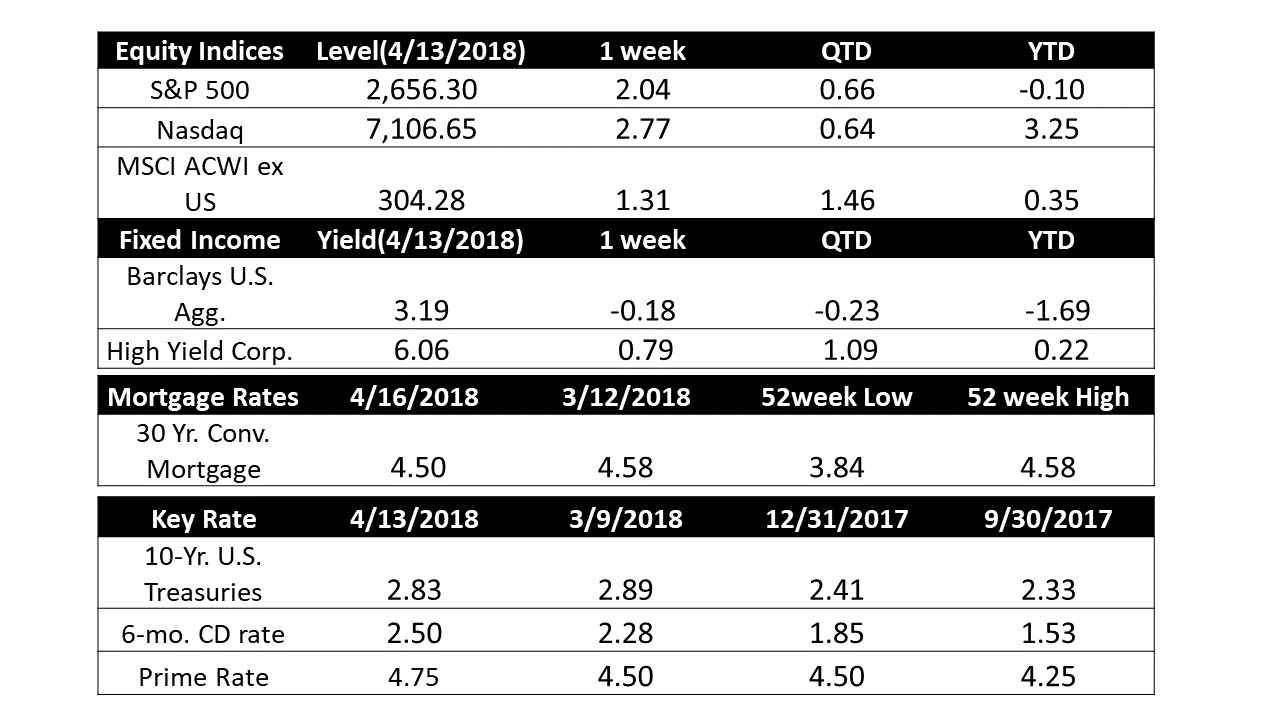

- U.S. Markets: Stocks recorded solid gains and reversed the previous week’s losses, but volatility remained. Investors appeared to be more focused on the turbulent political theater going on in Washington rather than the first quarter’s upcoming corporate earnings reports. The Dow Jones Industrial Average added 427 points last week, closing at 24,360 - a gain of 1.8%. The technology-heavy NASDAQ Composite led all major U.S. indices by vaulting 2.8% to end the week at 7,106. By market cap, the large cap S&P 500 added 2.0%, while the mid cap S&P 400 and small cap Russell 2000 rose 1.6% and 2.4%, respectively.

- International Markets: Almost all major international markets finished in the green. Canada’s TSX gained 0.4%, while the United Kingdom’s FTSE rose 1.1%. On Europe’s mainland, France’s CAC 40 added 1.1%, Germany’s DAX gained 1.6%, and Italy’s Milan FTSE rose 1.8%. In Asia, China’s Shanghai Composite finished the week up 0.9%, Japan’s Nikkei added 1.0%, and Hong Kong’s Hang Seng surged 3.2%. As grouped by Morgan Stanley Capital International, developed markets finished up 2.0%, while emerging markets added 1.0%.

- Commodities: Precious metals added to their recent shine with Gold rising 0.9% or $11.80 to $1347.90 an ounce. Silver, which trades similarly to gold, added 1.8% and closed at $16.66 an ounce. The big commodity story was in energy, where a rally lifted crude oil to prices not seen since 2014. West Texas Intermediate crude oil surged 8.6% to $67.39 per barrel. Copper, viewed by some analysts as an indicator of global economic health due to its variety of industrial uses, rose a third straight week, up 0.4%.

- U.S. Economic News: The Labor Department reported that the number of people applying for new unemployment benefits fell by 9,000 to 233,000 last week, remaining near a 45-year low. The less-volatile monthly average of new claims rose by 1,750 to 230,000. Companies continue to report reluctance to letting employees go due to the shortage of skilled labor, and the unemployment rate remains near a 17-year low of 4.1%.

- Prices at the wholesale level increased more than expected in the Labor Department’s latest reading, leading some analysts to speculate that inflation will be picking up this year. The Labor Department said its Producer Price Index (PPI) for final demand rose 0.3% last month, following a 0.2% increase in February. Over the past year, core PPI is up 2.9%, the biggest increase since August 2014.

- Consumer prices posted their first drop in almost a year on (temporarily) lower energy prices. The Labor Department reported its Consumer Price Index (CPI) slipped 0.1% last month, its first drop since May of last year. Economists had forecast the CPI to remain unchanged. However, over the past 12 months through March the CPI increased 2.4% - its largest annual gain in a year. The so-called Core CPI, which excludes the volatile food and energy components, climbed 2.1%. Core CPI is now well above the 1.8% annual average increase over the past 10 years. The biggest contributors to the increase were healthcare costs and rising rents. Healthcare costs rose 0.4%, with prices for hospital care shooting up 0.6% and the cost of doctor visits rising 0.2%.

- Consumer sentiment slipped to a 3-month low as worries about how the Trump’s administration’s trade policies will impact the U.S. economy seemed to prompt a dip in consumer confidence this month. The University of Michigan reported its consumer-sentiment index was 97.8 this month, down from its 14-year high of 101.4 set in March. The reading missed economists’ expectations of a 100.0 reading. In a note to clients, JP Morgan Chase economist Daniel Silver wrote, “Some softening in sentiment is not too shocking given the weakening in equity markets over the past few months as well as what seems to be a string of negative headlines in the news.”

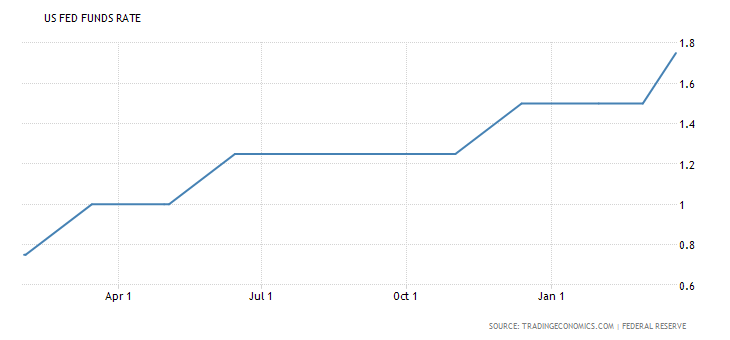

- Minutes from the Federal Reserve’s meeting in March released this week revealed that “all” of the participants saw more interest-rate hikes as likely – no longer just “a majority”. The conversation centered on “how much” tightening would be needed rather than “whether” to hike at all. Several Fed officials thought the Fed might have to raise interest rates to a level that would act as a restraining factor for economic activity (some also argued that it might become necessary to signal this possibility in upcoming statements). The minutes showed the Fed is confident in its outlook that the economy would recover from its sluggish first quarter and that inflation would move up towards its 2% target. For more information click here

Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.

Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.