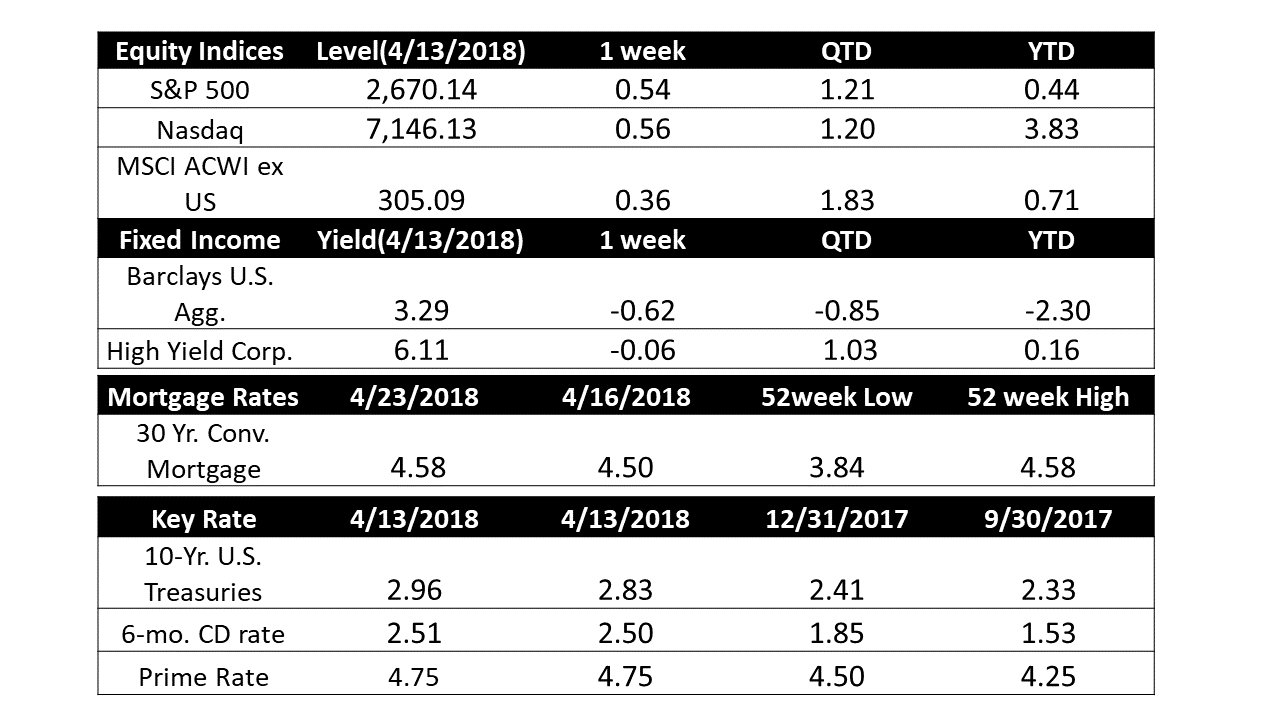

Both the S&P 500 and the tech heavy NASDAQ were up , the 10 yr. US Treasury edged up to 2.96% the highest level in 4 years . What's in store as we roll into this earnings season ? In the meantime our Short Term Indicator remained Bullish.

- U.S. Markets: U.S. stocks rose for a second week as first-quarter earnings reporting season began in earnest. The week began with somewhat of a relief rally as investors appeared reassured that Russia did not respond to the U.S., France, and UK’s air strike on Syria. But the enthusiasm waned by the end of the week, and stocks gave back most of their gains. Nonetheless, the Dow Jones Industrial Average rose 102 points, or 0.4%, to close at 24,462. The technology-heavy NASDAQ Composite added 0.6% to close at 7,146. By market cap, smaller caps showed relative strength over large caps with the S&P 400 mid cap index and small cap Russell 2000 index both rising 0.9%, while the large cap S&P 500 index added 0.5%.

- International Markets: Canada’s TSX added 1.4%, while the United Kingdom’s FTSE surged a fourth consecutive week by rising 1.4%. Asian markets were mixed, with China’s Shanghai Composite ending down -2.8% while Japan’s Nikkei gained 1.8%. As grouped by Morgan Stanley Capital International, developed markets rose 0.4%, while emerging markets retreated -0.7%.

- Commodities: Precious metals were mixed, with gold giving up some of the prior week’s gains while silver added to them. Gold ended the week down -0.7% closing at $1338.30 per ounce. In contrast, silver surged over 3%, ending the week at $17.16 per ounce. Oil followed last week’s strong gain with an additional 1.5% rise. West Texas Intermediate crude oil rose $1.01 to close at $68.40 per barrel. The industrial metal copper, used by some analysts as a barometer of global economic health due to its variety of uses, rose for a fourth consecutive week, up 2.1%.

- U.S. Economic News: Claims for new unemployment benefits fell slightly to 232,000 last week, remaining near a 45-year low, according to the Labor Department. Initial jobless claims have now held below 300,000 for 163 consecutive weeks, the longest streak for weekly records dating back to 1967. The reading reflects a booming jobs market where work is easy to find and companies are eager to find help. Initial jobless claims dipped 1,000 this week, slightly missing economists’ estimates for a 230,000 reading.

- US industrial production increased by 0.5 percent month-over-month in March 2018, following a downwardly revised 1 percent advance in February and beating market expectations of a 0.4 percent gain. Manufacturing and mining growth eased from the previous month, while utilities output rebounded sharply after being suppressed in February by warmer-than-normal temperatures.

- Housing starts in the US rose 1.9 percent month-over-month to an annualized rate of 1,319 thousand in March of 2018, following a downwardly revised 3.3 percent drop in February. It compares with market expectations of a 1,260 thousand rate. Starts of multi-family housings rebounded while the number of single-family starts was the lowest in three months.

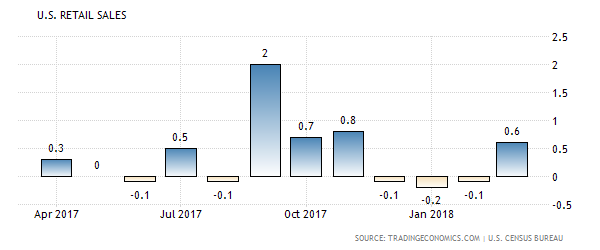

- US retail trade rose by 0.6 percent month-over-month in March 2018, recovering from a 0.1 percent drop in February and beating market expectations of a 0.4 percent gain. It was the first month of increase since November, mainly boosted by purchases of motor vehicles. Considering the first quarter of the year, retail sales went up 0.2 percent.

- Click here to get a complete coverage on all economic indicators

- International Economic News: The Bank of Canada maintained its key interest rate at 1.25% this week, and said it was carefully assessing the timing of future rate hikes amid a backdrop of moderating growth. The central bank cited “softness” in the economy as the reason for holding rates steady. Still, bank governor Stephen Poloz said rates are still likely to rise over time to manage inflation. The bank said slower first-quarter growth of about 1.3% was largely a result of housing markets’ responses to stricter mortgage rules and sluggish exports. The bank had predicted the economy to expand by 2.5% in the first three months of the year. “Canada’s economic growth has moderated, and the economy is operating close to capacity,” the bank said in its latest monetary policy report, which was released alongside the rate announcement.