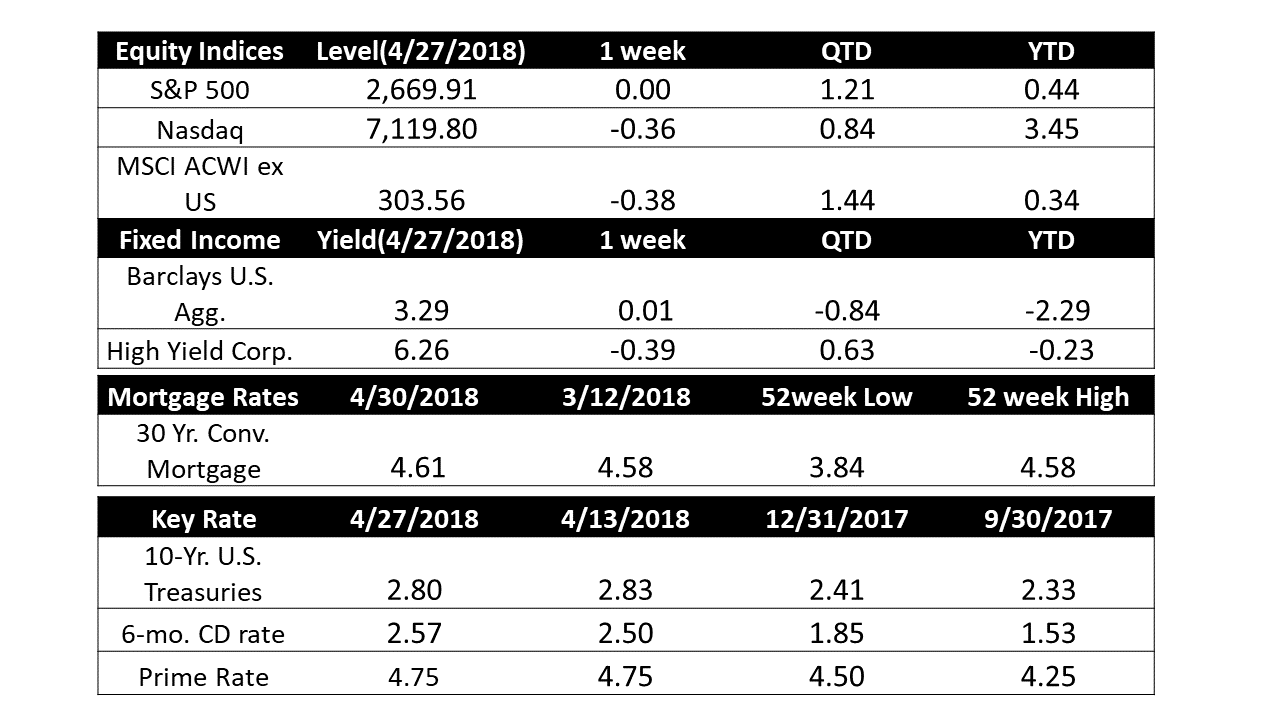

This past week the U.S. 10- Year Treasury yield broke 3% for the first time since 2014, triggering a temporary stock selloff. The U.S. 10-Year Treasury yield ended the week at 2.96%. In the meantime our Short Term Indicator remained Bullish.

- U.S. Markets: The major U.S. indexes finished the week flat to modestly lower as the busiest earnings week of the season came to a close. This week, 168 of the companies in the S&P 500 - representing 42% of its market capitalization - reported first-quarter profits. The Dow Jones Industrial Average reversed last week’s gain falling ‑151 points to close at 24,311, a loss of -0.6%. The technology-heavy NASDAQ Composite finished the week down -0.4%, closing at 7,119. By market cap, large caps fared the best. The S&P 400 mid cap index fell ‑0.4% and the Russell 2000 small cap index retreated ‑0.5%, while the large cap S&P 500 index ticked down just ‑0.01%.

- International Markets: Canada’s TSX followed last week’s gain with an additional 1.2% rise. The United Kingdom’s FTSE 100 also had a strong week, rising 1.8%. On Europe’s mainland, major markets also finished the week in the green. In Asia, China’s Shanghai Composite added 0.4% and Japan’s Nikkei gained 1.4%. As grouped by Morgan Stanley Capital International, emerging markets finished the week flat, while developed markets were off -0.1%.

- Commodities: Precious metals ended down for the second week. Gold ended the week at $1323.40 an ounce, down ‑1.1%. Silver fell a much steeper ‑3.9%, closing at $16.50 an ounce. In energy, West Texas Intermediate crude oil had its first down week in three, giving up -0.44% and ending the week at $68.10 a barrel. Copper, seen by some analysts as an indicator of global economic health due to its wide variety of uses, finished the week down ‑2.8%.

- U.S. Economic News: The number of Americans seeking new unemployment benefits fell to their lowest level since 1969 last week, the latest indication that the roaring labor market is showing no signs of slowing. The Labor Department reported Initial Jobless Claims fell by 24,000 to 209,000 last week, far below economists’ forecasts of a 230,000 reading. Overall, the jobs market can be summed up as “excellent”. Practically all workers who want a job can find one and companies are still hiring at a rapid pace. Companies’ biggest complaint continues to be a shortage of skilled workers to fill needed roles.

- Sales of existing homes continued to rise despite a worsening supply crunch, according to the National Association of Realtors (NAR). Last month existing-home sales were at a 5.60 million seasonally-adjusted annual pace, up 1.1% from February but still down 1.2% from the same time last year. The median sales price for a home sold in March was $250,400, up 5.8% compared to a year ago. Homes were on the market for an average of just 30 days, bringing the available supply of homes down to a very low 3.6 months of inventory. Six months of inventory is generally considered a healthy housing market. Sales were very mixed by region. In the Northeast, sales surged 6.3% and in the Midwest sales rose 5.7%. In the West, sales dropped 3.1% and in the South, sales ticked down 0.4%.

- Research firm IHS Markit reported American companies in the manufacturing and services sectors grew last month in a reflection of the steadily expanding U.S. economy. In manufacturing, IHS Markit’s flash U.S. Manufacturing Purchasing Managers’ Index (PMI) rose 1 point to 56.5, touching a three-and-a-half year high. A similar survey of service-oriented businesses also rose, edging up 0.4 points to 54.4. Flash readings are based on approximately 85-90% of total responses each month, with the final readings coming later. Chris Williamson, chief business economist at IHS Markit stated, “After a relatively disappointing start to the year, the second quarter should prove a lot more encouraging.”

- Confidence among the nation’s consumers rebounded in April with a small gain that put the index back near an 18-year high. The Conference Board reported the Consumer Confidence Index climbed to 128.7 this month, up 1.7 points from March. In the details of the report, the present situation index, which measures consumers’ feelings of current conditions, rose to 159.6 from 158.1. The future expectations index advanced 1.9 points to 108.1. Americans were more optimistic about their own finances and felt that jobs were easy to find, the survey showed. Lynn Franco, director of economic indicators at the board stated, “Overall, confidence levels remain strong and suggest that the economy will continue expanding at a solid pace in the months ahead.”

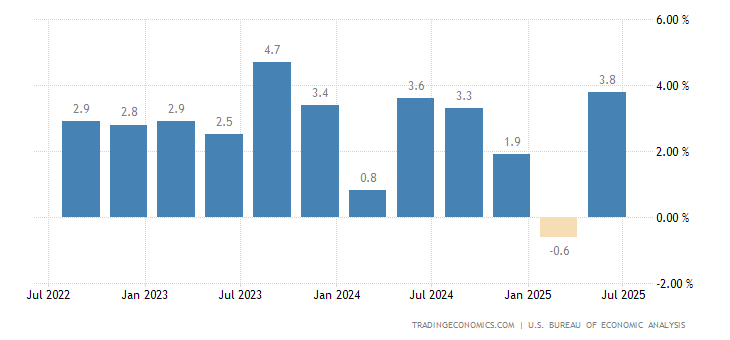

- Gross Domestic Product for the first quarter grew a solid 2.3% as businesses stepped in to fill the gap left by consumers. The U.S. economy expanded in the first three months of the year, as business investment doubled to 12.3%, while consumer spending rose just 1.1%--its smallest increase in almost five years. Analysts believe consumers took a break on spending to pay off their bills and rebuild their savings following a robust holiday season. Severe bouts of bad weather may also have hampered spending. Businesses picked up the slack, however, with business investment and spending on equipment both rising sharply. The biggest corporate tax cuts in 30 years are believed to have helped give a lift to investment in the first quarter.

- International Economic News: Louis Vachon, head of the National Bank of Canada, states that the Canada has a permit problem—and its hurting the economy. Vachon stated the Canadian economy is splitting into two extremes, a “permit economy” where resource and manufacturing companies face delays and roadblocks for project approvals, and a booming service and technology economy. Vachon notes that the export numbers generated by the “permit economy” are well below potential along with private investment in those sectors. However the service industry is doing “extremely well”, Vachon said. “That’s why the major urban areas are booming and the startup scene is really accelerating in Canada.”

- Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.