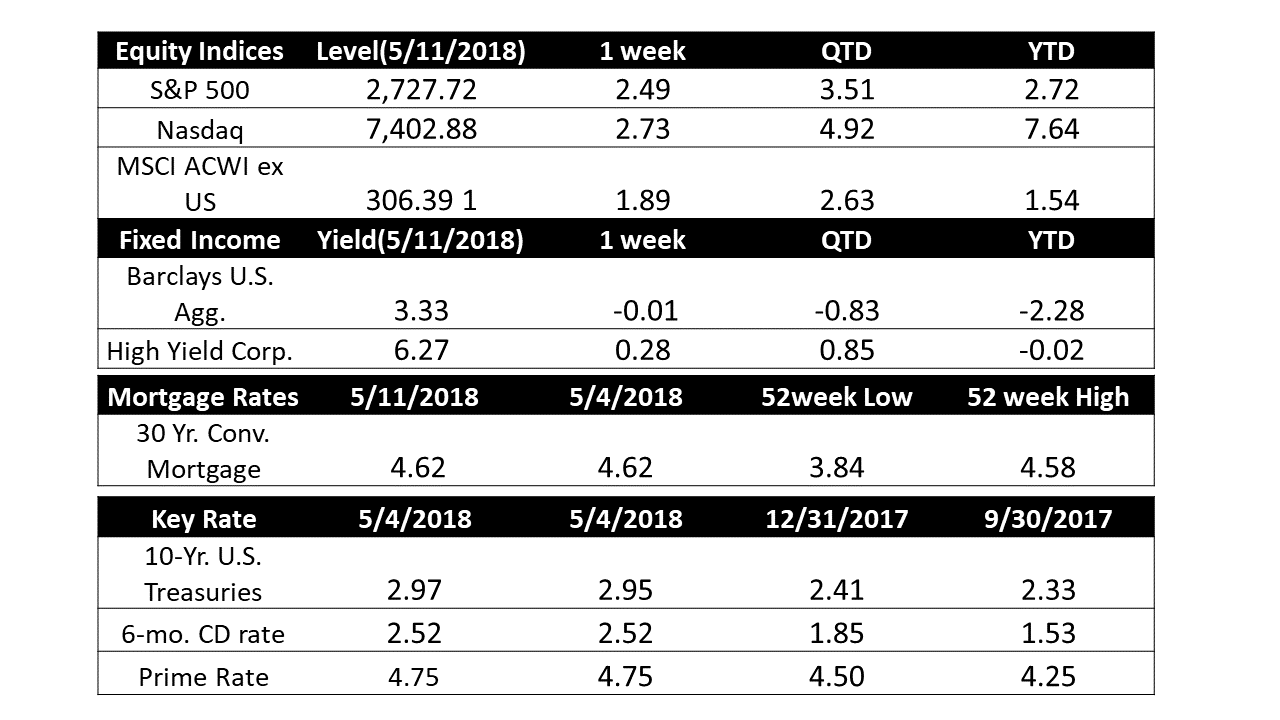

Stocks recorded solid gains this week as the major indexes moved back into positive territory for the year to date. In the meantime our Short Term Indicator remains Bullish.

U.S. Markets: The large cap S&P 500 achieved its best weekly advance in two months and closed above its key 100-day moving average for the first time since mid-March. The Dow Jones Industrial Average rallied 568 points, or 2.3%, to close at 24,831. The technology-heavy NASDAQ Composite added 2.7% closing at 7,402. By market cap, the large cap S&P 500 index gained 2.4%, while the mid cap S&P 400 and small cap Russell 2000 added 2.2% and 2.6%, respectively.

International Markets: Canada’s TSX closed up for the fifth consecutive week by rising 1.6%. Across the Atlantic, the United Kingdom’s FTSE recorded its seventh consecutive week of gains, adding 2.1%. On Europe’s mainland, France’s CAC 40 added 0.5%, while Germany’s DAX rose 1.4%, and Italy’s Milan FTSE retreated -0.7%. In Asia, China’s Shanghai Composite index rose 2.3%, its third straight week of gains. Japan’s Nikkei closed up for a seventh straight week rising 1.3%. Hong Kong’s Hang Seng index rebounded from last week’s drop and closed up 4%. As grouped by Morgan Stanley Capital International, developed markets rose 1.2% last week, while emerging markets gained 2.1%.

Commodities: Precious metals recovered from their weakness last week with gold rising 0.5%, or $8, to close at $1320.70 an ounce. Silver also finished up by 1.4% to end the week at $16.75 an ounce. West Texas Intermediate crude oil continued its ascent, rising four out of the last five weeks and closing at $70.70 per barrel, a gain of 1.4%. Copper, the industrial metal viewed by some analysts as a measure of global economic health, rose 0.84%.

U.S. Economic News: The number of people applying for new unemployment benefits held steady for the second week in a row, according to the Labor Department. New claims remained flat at 211,000 in the week ended May 5, the government reported. Economists had expected a slight rise to 215,000. The four-week average of new claims, used to smooth out the weekly volatility, fell by 5,500 to 216,000—its lowest level since December of 1969. Continuing claims, which counts the number of people already receiving unemployment benefits, rose by 30,000 to 1.79 million.

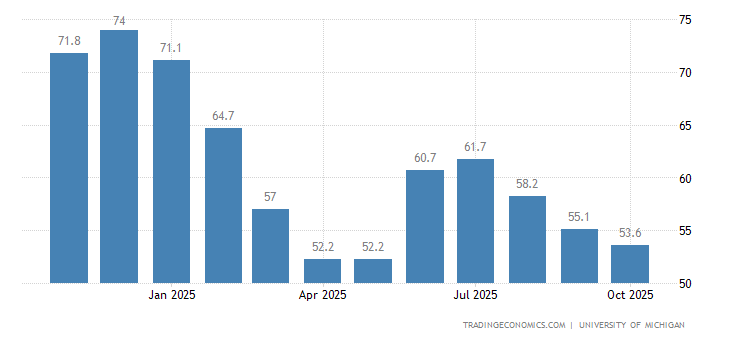

The University of Michigan's consumer sentiment for the US was steady at 98.8 in May of 2018, the same as in April and slightly above market expectations of 98.5. Preliminary figures pointed to a small uptick in near term inflation, a fall in income expectations, and stabilization of the unemployment rate at decade lows. For more on this click here

Sentiment among the nation’s small-business owners ticked up just a slight bit in April as the surge in optimism following last year’s tax cuts appears to b

e slowing its ascent. National Federation of Independent Business (NFIB) reported its small-business optimism index rose 0.1 point to 104.8 last month.

At the consumer level, the Labor Department reported that the Consumer Price Index (CPI) rose 0.2% last month after slipping 0.1% in March. In the 12 months through April, the CPI increased 2.5%. In the report, rising costs for gas and rental accommodations were tempered by a moderation in healthcare prices. Excluding the volatile food and energy components, the so-called core CPI edged up 0.1% after two straight monthly increases of 0.2%. Year-over-year, core CPI is up 2.1%. While the Federal Reserve has publicly stated it targets a 2% rate of inflation, the Fed uses a different inflation measure for this purpose. This measure, called the Personal Consumption Expenditures (PCE) price index is currently sitting at 1.9%. Economists expect the core PCE price index to breach the Fed’s target this month.

Sentiment among the nation’s consumers was slightly higher than anticipated for the first week of May, according to the University of Michigan. The University of Michigan’s survey of consumer attitudes about the economy came in at 98.8, in line with April’s revised result. While the overall index was unchanged, there was some movement in the components of the index. Consumers’ views of their current situation slipped 1.6 points, while the expectations component gained 1.1 points. In its release, survey director Richard Curtin noted that fewer consumers anticipated additional declines in the unemployment rate and that “Consumers have a remarkable track record for anticipating changes in the actual unemployment rate.”

International Economic News:

The Bank of England held interest rates steady as the bank played down signs of economic weakness. In its latest policy meeting the Bank of England voted to hold interest rates at 0.5%. The bank’s Monetary Policy Committee voted seven-to-two against raising interest rates immediately, with the majority stating that there was a need to “see how the data unfolded over coming months to discern whether the softness in the first quarter might persist.” Recall that the United Kingdom was hit with a significant winter storm in the first quarter, dubbed the “Beast from the East” by UK media. Mark Carney, governor for the Bank of England said, “The overall economic climate in the UK looks little changed this far.”

- Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.