The major U.S. market indexes finished the week flat to slightly higher in light trading ahead of the long holiday weekend

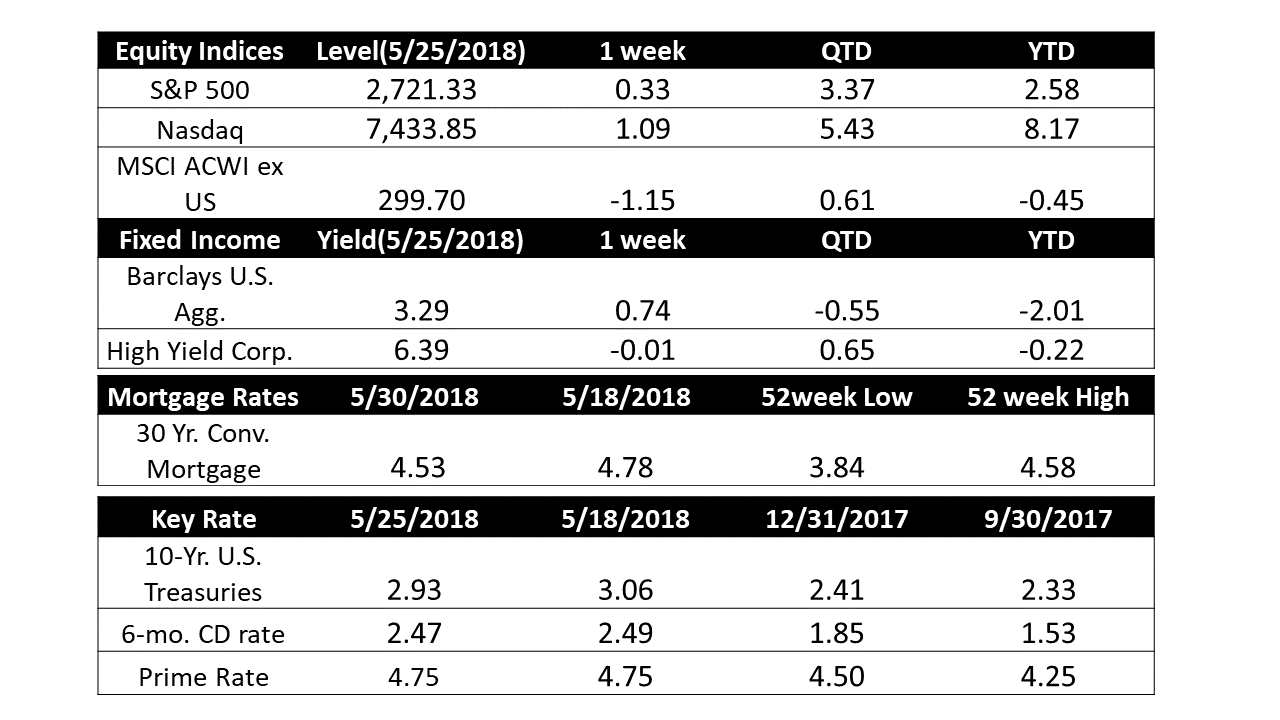

U.S. Markets: The Dow Jones Industrial Average edged up 38 points, ending the week at 24,753, a gain of 0.2%. The technology-heavy NASDAQ Composite added 1.1%, closing at 7,433. Large caps outperformed smaller caps with the large cap S&P 500 gaining 0.3% for the week, while the mid cap S&P 400 added 0.2% and the small cap Russell 2000 ending up just 0.02%.

International Markets: Canada’s TSX gave up half of last week’s gain by falling -0.5%. Across the Atlantic, the United Kingdom’s FTSE also reversed last week’s gain, retreating -0.6%.

As grouped by Morgan Stanley Capital International, emerging markets rose 0.8% while developed markets were off -1.6%.

Commodities: Precious metals regained some of their luster with Gold rising 1%, or $12.40, to end the week at $1303.70 an ounce. Silver, likewise, ended up 0.6% closing at $16.55. In energy, crude oil plunged on news that OPEC was planning to increase production as early as June to prevent further price increases from weighing on demand. West Texas Intermediate crude oil fell -4.9% to $67.88 a barrel, while North Sea Brent crude oil was off -2.6% to $76.45. Copper, viewed by some analysts as an indicator of global economic health due to its variety of industrial uses, finished the week up 0.5%.

U.S. Economic News: The number of people seeking new unemployment benefits rose to a 7-week high, but analysts were quick to point out that the increase is probably tied to seasonal swings in education-related employment such as cafeteria workers and bus drivers. The Labor Department reported that initial jobless claims rose by 11,000 to 234,000 last week, exceeding economists’ forecasts of a reading of 219,000. The nationwide unemployment rate remains at an

extremely low 3.9%.

Sales of newly-constructed homes slipped in April, down 1.5% from March but still up 11.6% from the same time last year. The Commerce Department reported new homes were at a 662,000 selling pace, missing economists’ estimates of 682,000. Year-to-date sales are 8.4% higher than in the same period in 2017. The median sales price of a new home last month was $312,400—0.4% higher than a year ago. The slightly slower sales pace caused the available inventory to creep up. There is currently a 5.4 months’ supply of homes available on the market, still below the 6 months generally considered to be a balanced housing market.

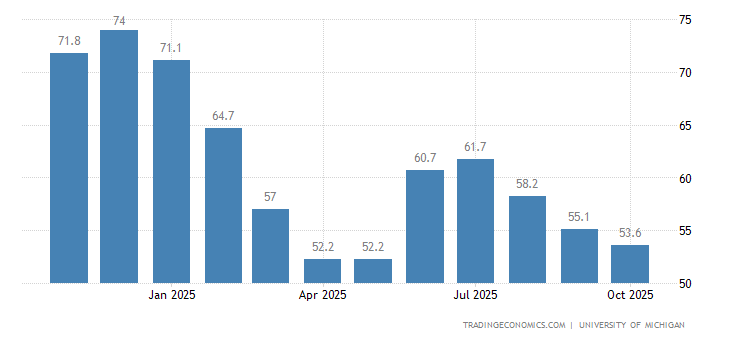

Sentiment among the nation’s consumers came in weaker than expected in the final reading for May. The University of Michigan’s survey of consumer attitudes dipped to 98.0 from 98.8, missing economists’ expectations of a 98.9 reading. Richard Curtin, chief economist of the survey, said in a statement, “The May survey, however, found that consumers anticipated smaller income gains than a month or year ago, even though they anticipate the unemployment rate to stabilize at its current 18-year low.” Overall, Americans remain optimistic about the economy. Incomes are rising, job openings are at a record high, and layoffs and unemployment are at their lowest levels in decades. For more information click here

Interest Rate: Minutes from the latest Federal Reserve Open Market Committee meeting revealed support for a rate hike in June and that the committee was not concerned about inflation pressures at the moment. The minutes stated,“Most participants judged that if incoming information broadly confirmed their economic outlook, it would likely soon be appropriate for the FOMC to take another step in removing policy accommodation.” Although inflation hit the Fed’s 2% target in its latest reading in March, officials were not convinced it would remain there for long.

International Economic News: The Bank of Canada has highlighted rising household debt and imbalances in the real estate market as the two chief vulnerabilities in the Canadian financial system in the event of a recession.

And analysts note that the housing market itself may be the trigger for the next recession. In most developed economies the housing market is the lynch pin that binds together the construction, finance, insurance, and real estate sectors of the economy. Tighter mortgage rules and higher interest rates have weighed on Canada’s once high-flying real estate market, with home sales in Toronto having their worst start to the year since 2009. Still, analyst David Doyle of Macquarie Capital Markets notes, roughly half of all economic weakness during recessions since the Second World War is tied to fluctuations in residential investment, he calculates, and the extent to which Canadian output and employment are currently reliant on this single sector is “unprecedented.”

The United Kingdom’s economy just posted its worst quarterly GDP figures for the last five years according to the UK’s Office for National Statistics. The ONS reported weak household spending and falling levels of business investment dragged the economy down to a 0.1% growth rate in the first quarter. Rob Kent-Smith of the ONS

Our Short Term Indicator remains Bullish.

- Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.