The major U.S. indexes finished the week mixed with a drop on Friday erasing the week’s gains for the Dow Jones Industrial Average and the S&P midcap 400 index.

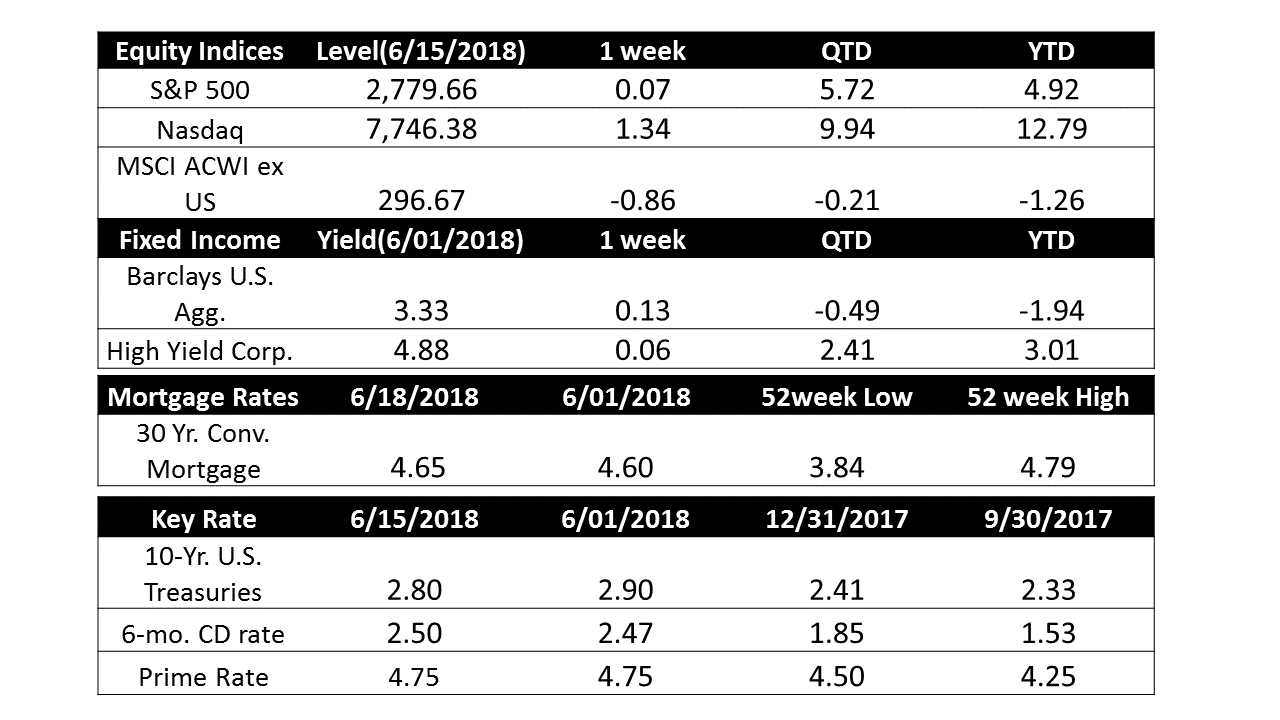

U.S. Markets: The Dow Jones Industrial Average gave up 226 points ending the week at 25,090, a loss of -0.9%. The technology-heavy NASDAQ Composite managed a 100 point gain to close at 7,746, a gain of 1.3%. By market cap, the large cap S&P 500 ended the week essentially flat, up just 0.4 point, the mid cap S&P 400 retreated -0.4% and the small cap Russell 2000 added 0.7%.

International Markets: Canada’s TSX rose a second consecutive week adding 0.7%, but in the United Kingdom the FTSE 100 index ended down -0.6%, its fourth straight weekly decline. On Europe’s mainland, France’s CAC 40 added 0.9%, Germany’s DAX rose 1.9%, and Italy’s Milan FTSE surged 3.9% (recovering all of the prior week’s decline). In Asia, China’s Shanghai Composite retreated for a fourth straight week, down -1.5% while Japan’s Nikkei had a second week of gains, rising 0.7%. As grouped by Morgan Stanley Capital International, developed markets were off -0.6%, while emerging markets declined a steeper -2.4%.

Commodities: Precious metals had a difficult week as Gold plummeted almost $30 an ounce on Friday to $1,278.50 an ounce, down -1.9% for the week. Silver, almost always more volatile than Gold, plunged -4.5% on Friday ending the week at $16.48 an ounce, a loss of -1.6%. Energy had its fourth consecutive week of losses. West Texas Intermediate crude oil ended down -1% closing at $65.06 per barrel. Copper, seen by some analysts as a barometer of global economic health due to its variety of industrial uses, retraced almost all of last week’s rally by retreating -4.7%.

U.S. Economic News: The number of Americans seeking new unemployment benefits dropped by 4,000 to just 218,000 last week, the third consecutive week of declines. Strong job gains and the lowest jobless rate in 18 years has fueled sales of new homes, cars, and other goods and services, keeping the economy on track and headed for its longest expansion ever.

Sales among the nation’s retailers jumped 0.8% in May, twice the amount economists had forecast. Sales at gas-stations rose sharply in May, reflecting the higher prices at the pump, and home centers also posted a big boost in sales. In a bit of a surprise, traditional brick-and-mortar department stores actually outpaced their internet rivals.

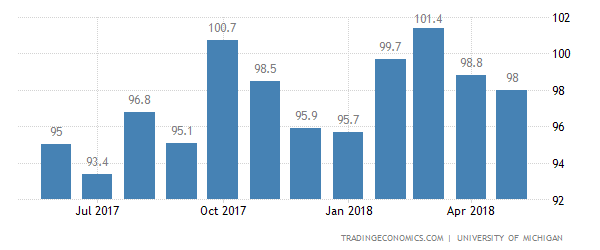

Sentiment among the nation’s consumers improved as rising wages offset the recent upturn in inflation. The University of Michigan’s Consumer Sentiment index for June rose to 99.3, a slight improvement over May’s reading. In the details, the assessment of current conditions rose 6.1 points to 117.9, but the survey also showed people may be a bit less enthusiastic about the future. For more information click here

Inflation at the consumer level is rising at the fastest pace in 6 years, the Bureau of Labor Statistics (BLS) reports. The BLS’ Consumer Price Index showed the cost of living increased 0.2% last month, in line with forecasts, and is up 2.8% over the last 12 months.

International Economic News: In spite of concerns over impending U.S. trade tariffs, the Canadian economy is gaining momentum according to the latest Royal Bank of Canada Economic Outlook report. After a lackluster second-half of 2017 and a weak beginning to 2018, the economy has strengthened and could be on the upswing for remainder of the year. Increased consumer spending, wage growth, and business investment have all contributed to Canada’s economic health. While not nearing the 3.0% growth pace of 2017, RBC Economics expects real gross domestic product (GDP) to average 2.0% in 2018, followed by a slight slowing to 1.8% in 2019. Craig Wright, Senior Vice-President and Chief Economist at RBC stated, “Financial conditions remain solid and the labor market is healthy. Wage growth continues to accelerate and it will blunt the impact that rising interest rates will have on household debt service costs."

- Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.