U.S. stocks were volatile during the holiday-interrupted week but finished predominantly on the upside. Continuing the pattern of recent weeks, both the technology-heavy NASDAQ Composite index and smaller-cap benchmarks outperformed.

U.S. Markets: The Dow Jones Industrial Average added 185 points to close at 24,456, up 0.8% for the week. The NASDAQ Composite rebounded from last week’s decline, rising 2.4% to 7,688. By market cap, the large cap S&P 500 index gained 1.5%, while the mid cap S&P 400 index added 1.9% and the small cap Russell 2000 surged 3.1%.

International Markets: Canada’s TSX rebounded 0.6%, while across the Atlantic the United Kingdom’s FTSE fell a second week, down -0.3%. On Europe’s mainland major markets finished green. France’s CAC 40 rose 1.0%, Germany’s DAX added 1.5%, and Italy’s Milan FTSE gained 1.4%. In Asia, China’s Shanghai Composite continued its decline, dropping another -3.5%, while Japan’s Nikkei ended down -2.3%. As grouped by Morgan Stanley Capital International, developed markets finished the week up 0.9%, while emerging markets rebounded a slight 0.2%.

Commodities: Precious metals were mixed last week as Gold managed a slight 0.1% gain to finish the week at $1255.80 an ounce, while Silver was off -0.8% closing at $16.07. Oil had its first down week in three as West Texas Intermediate crude oil declined half a percent and ended the week at $73.80 per barrel. In what may be a concern going forward, the industrial metal copper had its fourth week of significant declines, dropping -4.8%. Copper prices are seen by some analysts as an indicator of global economic health due to its wide variety of industrial uses, and its price movements are thought to provide insight into global industrial production.

U.S. Economic News: The U.S. added 213,000 jobs in June, another healthy gain that shows companies are still eager to fill open positions despite the dwindling pool of available workers. The gain exceeded economists’ forecasts of an increase of 200,000. However, in a bit of a paradox the unemployment rate actually rose 0.2% to 4% after hitting an 18-year low in May.

Initial claims for new unemployment benefits hit a 6-week high last week but remained near their lowest levels in decades. The Labor Department reported that initial jobless claims rose by 3,000 to 231,000, exceeding economists’ forecasts of a 225,000 reading. The less volatile monthly average of claims increased by 2,250 to 224,500. Claims have remained under the 250,000 level for over nine months, signaling an extremely robust labor market. The number of people already receiving benefits, known as continuing claims, climbed by 32,000 to 1.74 million. That number is reported with a one-week delay.

In the services sector, most companies saw a pickup in business last month according to the ISM non-manufacturing index. The non-manufacturing index rose 0.5 points to 59.1 in June, beating market forecasts of 58.3. June’s reading was the highest since February as business activity and new orders rose faster and price pressures eased.

International Economic News: Strong job growth returned to Canada where its economy added 31,800 jobs in June, according to Statistics Canada. In addition to the new jobs, Canada’s wage growth remained healthy and more people entered the workforce.

Governor of the Bank of England Mark Carney now has more confidence in the United Kingdom’s economy saying recent data had given him “greater confidence” and that weak first-quarter growth “was largely due to the weather.” In a speech at the Northern Powerhouse Summit in Newcastle, Mr. Carney said: "Overall, recent domestic data suggest the economy is evolving largely in line with the May Inflation Report projections, which see demand growing at rates slightly above those of supply and domestic cost pressures building."

The International Monetary Fund (IMF) cut Germany’s 2018 economic growth forecast to 2.2%, saying rising protectionism and the threat of a hard Brexit expose Germany’s economy to significant short-term risks. While downgrading Germany’s 2018 forecast from 2.5% in April, the IMF raised its 2019 forecast to 2.1% from 2.0%. "Short-term risks are substantial, as a significant rise in global protectionism, a hard Brexit, or a reassessment of sovereign risk in the euro area, leading to renewed financial stress, could affect Germany's exports and investment," it said in a report. Given Germany's rapidly aging society, IMF directors recommended further expanding public investment in infrastructure and education as well as setting more incentives for private investments. "Such measures would bolster productivity growth, further lift long-term output, and reduce Germany's large current account surplus," it said.

A Reuters poll showed China’s second-quarter economic growth is expected to have slowed slightly from the previous quarter as the government’s efforts to tackle debt risks weigh on activity and a looming trade war with the U.S. threatens exports. The economy has already felt the pinch from a multi-year crackdown on riskier lending that has driven up corporate borrowing costs, forcing the central bank to pump out more cash by cutting reserve requirements for lenders. The poll of 55 economists showed growth in gross domestic product likely eased a tick to 6.7% in the second quarter from the same time a year earlier. "The synchronized slowdown in domestic and external demand is likely to put pressure on economic growth in the second half," said Lian Ping, chief economist at Bank of Communications. Lian said he expected GDP growth to slow to 6.6 percent in the third quarter and stay steady in the fourth quarter, bringing full-year growth to 6.7 percent - above the government's target of around 6.5 percent.

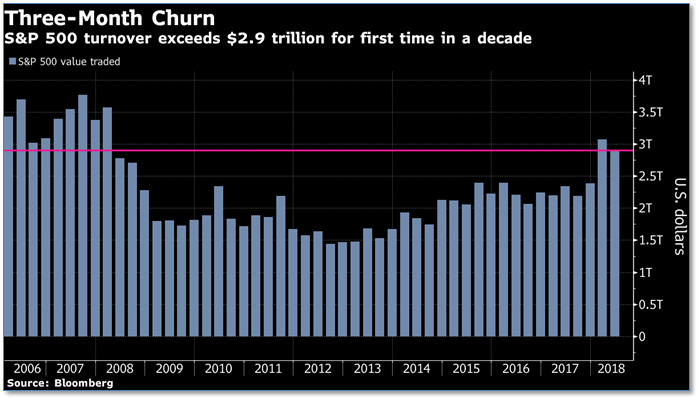

Finally: Analysts are beginning to take note of a concerning development in the market— extremes in market turnover. Trading is through the roof in many major market indexes and across asset classes. In the S&P 500 index alone, investors traded more than $2.9 trillion worth of shares since the beginning of the year—a level last seen in early 2008, right before the financial crisis really hit. JP Morgan Chase strategist Nikolaos Panigirtzoglou wrote in a note, “Market turnover tends to be high when uncertainty is high, as institutional investors continuously reshuffle their portfolios. Negative growth revisions coupled with political and policy risks including the Italian crisis and trade war risks are creating a lot more uncertainty this year relative to last year.”

- Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.