U.S. stocks recorded solid gains for the week, lifting most of the major indexes to all-time highs. The technology-heavy NASDAQ Composite index performed the best, crossing the psychologically-significant 8,000 threshold for the first time in history.

U.S. Markets: The Dow Jones Industrial Average gained 174 points last week to close at 25,864, up 0.7%. The NASDAQ Composite surged 2.1% to close at 8109. By market cap, the large cap S&P 500 led the way rising 0.93%, while the small cap Russell 2000 and mid cap S&P 400 added 0.9% and 0.5%, respectively.

International Markets: Canada’s TSX fell -0.6%, while in Europe the United Kingdom’s FTSE fell -1.9%. On Europe’s mainland, France’s CAC 40 and Germany’s DAX were off -0.5% and -0.3%, respectively while Italy’s Milan FTSE declined a much larger -2.3%. In Asia, China’s Shanghai Composite plunged -4.2%, but Japan’s Nikkei followed last week’s advance with a further 1.2% gain. As grouped by Morgan Stanley Capital International developed markets finished the week down -0.5%, while developed markets rose a tiny 0.03%.

Commodities: Precious metals finished the week in the red with Gold down half a percent to $1206.70 an ounce and Silver, off a much steeper -2.4% to $14.44 per ounce. Major energy markets were up for the week. West Texas Intermediate crude oil added 1.6% closing at $69.80 per barrel, while North Sea Brent crude oil added over 3% to end the week at $77.71 per barrel. Copper, also called “Dr. Copper” by some analysts due to its seeming ability to forecast global economic health, finished the week down -1.1%.

August Summary: U.S. markets worked higher during the month of August. The Dow Jones Industrial Average rose 2.2%, the Nasdaq Composite gained 5.7%, and the large cap S&P 500 added 3%. The mid cap S&P 400 matched the performance of the large caps by rising 3%, while the small cap Russell 2000 gained 4.2%. International markets, by contrast, were almost all down in August. Canada’s TSX fell -1%, the United Kingdom’s FTSE gave up over -4%. On Europe’s mainland, France’s CAC 40 fell -1.9%, Germany’s DAX was off -3.5%, and Italy’s Milan FTSE plunged -8.8%. In Asia, China’s Shanghai Composite was off -5.3% while Japan’s Nikkei was a lonely gainer, improving by 1.4%. As grouped by Morgan Stanley Capital International, emerging markets finished the month down -3.8%, while developed markets were off -2.2%. Gold declined by -2.2% in August, while Silver plunged a much larger -7.2%. The industrial metal copper declined -5.7% in August. Brent crude oil rose 4.7%, along with West Texas Intermediate which added 1.5%.

U.S. Economic News: The Labor Department reported initial U.S. jobless claims at 213,000 last week, a rise of 3,000 from the previous week. Economists had forecast a reading of 212,000. More notably, the monthly average of claims, smoothed to iron out the weekly volatility, fell by 1,500 to 212,250—its lowest level since December 1969. Companies continue to report difficulty in finding skilled labor and are reluctant to cut any jobs. Continuing claims, which counts the number of people already receiving benefits, declined by 20,000 to 1.71 million. Thomas Simons, senior money market economist at Jefferies LLC noted, “Current claims levels continue to reflect a labor market that is very tight.”

Home price growth remained positive but retreated from its rapid growth of earlier this year, according to the latest reading from S&P/Case-Shiller. The S&P/Case-Shiller national home price index rose a seasonally adjusted 0.3% in June, up 6.2% for the year, while the more narrowly focused 20-city index added 0.1%, a 6.3% annual gain. Economists and housing market analysts have stated that prices couldn’t continue their earlier rate of growth, and it appears the market finally got the message. Both growth rates are still double the rate of inflation and wage gains, but a step in the right direction for bringing house prices back into the range of more buyers. In the details, the West continues to be the best with Las Vegas leading the way, followed by Seattle and San Francisco. New York, which has been hit by recent tax-law changes, was the only metro area to decline in June.

Americans’ confidence in the economy soared to an 18-year high, hitting levels last seen during the dot.com boom, reflecting the surging growth in the economy and the lowest unemployment rate in almost two decades. The Conference Board reported its Consumer Confidence index jumped 5.5 points to 133.4 in August, the highest level since October of 2000. Americans were confident about both the present and the future.

The nation’s consumers continued spending in July. The government reported consumer spending rose sharply in July for the fifth month in a row as the economy got off to a good start for the third quarter. Consumer spending rose 0.4% in July, while incomes rose 0.3%. However, the good news comes with a cost. Higher spending and faster economic growth have also fueled inflation with the Personal Consumption Expenditures (PCE) Index, the Federal Reserve’s preferred inflation gauge, rising to an annualized 2.3% from 2.2% in July - its highest level since April 2012. In addition, the yearly increase in core PCE, which strips out the volatile food and energy categories, hit 2% for the first time since March and only the second time since 2012. The increase in prices gives the Federal Reserve the green light for another interest rate increase at the end of September.

Sentiment among the nation’s consumers retreated from lofty levels last month according to the latest reading from the University of Michigan. UMich’s Consumer Sentiment index was 96.2 in August, down 1.7 points from July’s reading. Still, that was higher than the 95.5 expected by economists. In the details, most of the pullback was due to a decline in the current economic conditions index, which fell to its lowest level in almost two years. The causes for the decline were a less-favorable assessment of buying conditions as prices and interest rates continued to rise. Inflation expectations for the next year rose to 3% while expectations for the next five years hit 2.6%, the highest level in four years. Still, sentiment is trending higher and economists aren’t expecting a slowdown in consumer spending.

It turns out the stellar U.S. economic growth in the second quarter was even stronger than originally reported. Gross Domestic Product (GDP) was revised up an additional 0.1% to 4.2%, thanks to higher government spending and business investment. Economists had expected GDP to remain unchanged. The strong growth, along with the biggest tax cuts in 31 years helped corporations cash in their biggest 12-month gain in four years. Adjusted corporate profits before taxes climbed 3.3% in the second quarter, up an impressive 7.7% over the past year. Jim Baird, chief investment officer at Plante Moran Financial Advisors stated, “The bottom line is that the economy remains on a solid growth path and still appears to have the potential to remain on a positive track for some time to come.”

International Economic News: Considering that three-quarters of Canada’s exports go to the U.S., it is up to Canada to decide whether it wants to make a deal with the United States or have a smaller economy. Trade negotiations between the White House and Canadian leaders fell apart on Friday after an impasse over dairy products were further inflamed by comments by U.S. President Trump suggesting that he would refuse to offer Canada any concessions. Canadian Foreign Minister Chrystia Freeland said that her government would not sign on to an agreement unless it was good for Canadians. “My job is to ensure this agreement works for Canadian workers, Canadian families and Canadian businesses,” she said. The trade talks are to resume Wednesday, with U.S. and Canadian negotiators saying they would still seek consensus.

The Bank of England (BoE) reported lending in the U.K. economy is down, suggesting that consumers are becoming more cautious. The BoE reported new consumer credit lines stood at 0.817 billion pounds in July, down from 1.521 billion pounds in June, well below economists’ forecasts of 1.50 billion pounds. Net lending to individuals came in at just 4.0 billion pounds, well below the 5.4 billion pounds reported in June. With U.K. wage growth stagnant, the figures hint at the potential for lower rates of retail sales and economic performance over the coming months. Along with consumer spending, the housing market may also be slowing. Mortgage approvals for July stood at 64.77k, down from the 65.37k reported in June and below consensus forecasts for 65k.

Europe’s largest economy will likely record the world’s largest trade surplus three years running, according to German financial research institute CES. CES predicts Germany will end the year with a trade surplus of $299 billion. Germany’s economy is growing in other areas as well. The Bundesbank reported the country’s second quarter growth rate was regaining momentum and should remain stable despite trade tensions. The economy grew by a healthy half-percent over that quarter. The German government reported a $56 billion revenue surplus in the first six months of 2018, according to Germany’s national statistics office, Destatis.

Stock prices in the world’s second-largest economy are indicating that China is in bad shape, but steel prices are telling a very different story. The Nanhua rebar steel futures index is up 22% this year, while China’s Shanghai Composite is off over 16%. Larry Hu, head of greater China economics notes steel prices reflect the current state of the real economy while stocks represent market sentiment on the outlook for growth. Stock investors have worried about slowing economic growth as Beijing tries to reduce the country’s reliance on debt, but the resilience of the nation’s steel market shows the real economy is actually quite healthy. Despite China’s slow transition from a manufacturing-driven economy to a consumption-based one, the steel industry is closely watched because it is a huge part of China’s manufacturing base. Chinese industry giant Baosteel announced that profits in the first half of the year rose 62.2% year-over-year to 10.01 billion yuan ($1.47 billion).

Amid concerns over a trade war with the United States, Japan and China agreed to bolster economic cooperation between the two countries. The Finance Minister of Japan, Taro Aso, said the economies of both countries are “in an important phase” at the outset of a meeting with his Chinese counterpart Liu Kin. Officials from the finance ministries and central banks of the two neighbors also joined the China-Japan Finance Dialogue. During the meetings, Japan and China voiced agreement that trade protectionism will not benefit any country. Aso said Tokyo and Beijing are making efforts to “achieve tangible results” for an envisioned summit in October between Prime Minister Shinzo Abe and Chinese President Xi Jinping.

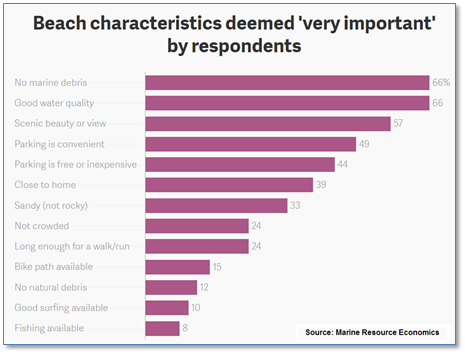

Finally: As summer unofficially comes to an end this Labor Day weekend (summer doesn’t officially come to an end until September 22), most families have already wrapped up their summer beach vacations. But what exactly defines a good beach? In a survey of Americans of what is “very important” when considering a nice beach, ‘no marine debris’ and ‘good water quality’ led the rankings with ‘scenic beauty or view’ closely behind. At the bottom of the list, respondents appear not to care whether fishing or surfing was available.

- Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.