The major U.S. benchmarks ended the week lower with large-cap indexes holding up substantially better than the technology-heavy NASDAQ Composite and the smaller cap indexes. The Dow Jones Industrial Average gave up just 11 points to end the week at 26,447.

U.S. Markets: The major U.S. benchmarks ended the week lower with large-cap indexes holding up substantially better than the technology-heavy NASDAQ Composite and the smaller cap indexes. The Dow Jones Industrial Average gave up just 11 points to end the week at 26,447. The Dow Jones was alone, however. The NASDAQ plunged almost 258 points, or -3.2%, ending the week at 7,788. By market cap, the large cap S&P 500 index gave up -1.0%, while the S&P 400 mid cap index retreated -2.6% and the small cap Russell 2000 plummeted a huge ‑3.8%.

International Markets: Canada’s TSX ended down -0.8%, while the United Kingdom’s FTSE retreated -2.6%. On Europe’s mainland, France’s CAC 40 gave up -2.4%, Germany’s DAX fell -1.1%, and Italy’s Milan FTSE was off -1.8%. In Asia, China’s Shanghai Composite gained 0.9%, but Japan’s Nikkei was off -1.4%. As grouped by Morgan Stanley Capital International, developed markets gave up -2.3% last week, while emerging markets fell a much steeper ‑4.9%.

Commodities: Energy finished the otherwise dismal week in the green with West Texas Intermediate crude oil rising 1.5% to $74.34 per barrel and Brent North Sea crude up 1.7% to $84.11 a barrel. Precious metals finished the week mixed. Gold added 0.8% rising above the $1200-level to close at $1205.60 an ounce, while silver finished down -0.4% to $14.65 per ounce. Copper, viewed by analysts as a barometer of global economic health due to its variety of industrial uses, retreated a second week down -1.5%.

U.S. Economic News: Initial claims for new unemployment benefits returned to a near 49-year low, declining 8,000 last week to 207,000. The reading was far below economists’ estimates of an increase of 1,000 to 215,000. The four-week average of claims, which smooths out the weekly volatility, edged up by 500 to 207,000 claims. Hurricane Florence seems to have had a smaller effect on jobless claims than anticipated. Ian Shepherdson of Pantheon Economics stated, “The increase in jobless claims triggered by Hurricane Florence was very modest, and smaller than we expected.” Continuing claims, which counts the number of people already receiving unemployment benefits, fell by 13,000 to 1.65 million. That number is reported with a one-week delay.

Payrolls processor ADP reported the U.S. added 230,000 private-sector jobs in September, the most in seven months and well above the consensus forecast of 179,000. In the details of the report, small firms added 56,000 jobs, medium-sized added 99,000, and large companies added 75,000. Year-to-date payroll gains have averaged 204,000 per month, much stronger than the 179,000 average gain over the same time period last year. Services payrolls increased 184,000, led by professional and business services, while goods-producing payrolls climbed 46,000, led by construction. Mark Zandi, chief economist at Moody’s Analytics stated in an interview on CNBC, “This labor market is rip-roaring hot, and it is just going to get a lot hotter. The risk that this economy overheats is very high and this is just one more piece of evidence of that.”

The unemployment rate fell to a 48-year low of 3.7% in September as nonfarm payrolls expanded by 134,000, according to the Labor Department’s monthly Non-Farms Payroll (NFP) report. Of concern, however, is that the payrolls number missed the consensus forecast of 180,000. The headline could be a bit misleading for a couple reasons. First, the number was likely impacted by Hurricane Florence which struck the Carolinas last month and second, the prior two months readings were revised up a total of 87,000, bringing last month’s total up to 221,000 jobs on a net basis. Despite the smaller increase in payrolls it was still enough to lower the unemployment rate to its lowest level since December 1969. The bulk of hiring was concentrated in the professional, health care, construction, and manufacturing sectors. White-collar firms added 54,000 jobs and health-care providers filled 26,000 positions. Builders hired 23,000 workers and manufacturers 18,000. Employment fell among retailers, restaurants and hotels. The U.S. has added an average of 208,000 jobs a month through the first nine months of 2018, above the 182,000 pace over the same time last year.

Manufacturing activity retreated slightly last month. The Institute for Supply Management (ISM) reported its manufacturing index fell to a reading of 59.8 in September, down 1.5 points from August. Economists had expected a reading of 60.7. Despite the fall, the index remains near its highest level in 14 years and remains in a region historically associated with above-trend economic growth. Fifteen of the eighteen industries reported growth, with primary metals as the only industry reporting contraction. Conversely, research firm IHS Markit reported its U.S. Manufacturing Purchasing Managers Index (PMI) increased 0.9 points to 55.6 last month, its first gain in five months. In the PMI report, both output and new orders growth accelerated to their fastest pace in four months, although export orders flattened.

Services activity, which makes up the vast majority of the U.S. economy, was either at its highest level since August 1997 or at its weakest since January depending on which research firm you ask. The ISM Non-Manufacturing Index jumped 3.1 points in September to 61.6—its second highest reading on record. The increase followed a 2.8 gain the previous month, resulting in a record 5.9 point back-to-back month surge. The consensus was for a -0.5 point decline to 58. Conversely, Markit reported its U.S. Services PMI fell 1.3 points in September, its fourth decline in a row. Markit’s report noted that business activity continued its solid expansion, but the rate of growth eased. Chris Williamson, Chief Business Economist at IHS Markit noted, “Service sector business growth has eased considerably since peaking back in May but remains relatively solid. Some of the slowdown can be traced to capacity constraints, with new business once again rising at a steeper rate than firms were able to boost output.”

Federal Reserve Chairman Jerome Powell said this week that he did not see signs that inflation would spike despite the historical low unemployment rate. In a speech to the National Association for Business Economics Powell stated, “Many factors, including better conduct of monetary policy over the past few decades, have greatly reduced ... the effects that tight labor markets have on inflation.” The comments were in contrast to a long-accepted standard central bank theory known as the “Phillips curve”, which posits that tight labor markets lead to higher inflation. The explanation is that employers boost wages to compete for scarce workers and that the rising labor costs ultimately lead to higher costs for consumers. Powell noted that the Fed’s 2% inflation target policy seems to have held this phenomenon in check stating “People don’t expect higher inflation when they know the Fed will be aggressive to keep prices rising 2%.” The Fed’s baseline forecast shows unemployment rate remaining below 4% and inflation steady at 2% through the end of 2020.

International Economic News: With just a couple of hours to go before the midnight deadline on September 30th, Canada’s Trudeau administration agreed to sign the USMCA, or the United States-Mexico-Canada Agreement, which replaces the original NAFTA. The deal came after a year of tense negotiations between Canada and the U.S. Per the deal, Canada has agreed to limit its auto exports to the United States to 2.6 million vehicles which allows it to avoid the 25% tariff on automobile imports that the Trump administration was expected to impose. However, now that trade peace with the U.S. has been achieved the Canadian Prime Minister will have to deal with more deep-seated problems in the Canadian economy. Wage gains have barely budged since the beginning of last year, up just under 2.5%, while inflation has shot up on the back of higher energy prices. Economists expect that real wages—pay after accounting for inflation, will remain flat this year implying that workers have not shared in whatever prosperity there has been.

A survey of businesses in the United Kingdom revealed that Britain’s economy appears to have kept up most of its steady growth in the third quarter, but uncertainty remained high regarding Britain’s exit from the European Union. The IHS Markit/CIPS UK Services Purchasing Managers Index slipped 0.4 point to 53.9 in September, a tick below the median forecast. IHS Markit said Britain’s economy was on course to grow at a quarterly rate of just under 0.4% in the three months to September, the same as its average growth rate since the Brexit referendum in June 2016. Samuel Tombs, economist at Pantheon Macroeconomics stated the results put little pressure on the Bank of England to raise interest rates again before the March 2019 Brexit deadline. “The economy remains a long way from overheating and growth is likely to slow further if Brexit talks aren’t amicably concluded soon, given that firms are reporting ... that political uncertainty is weighing on budget setting and confidence,” he said.

With his popularity plummeting, French President Emmanuel Macron is trying a new tack to gain support—tax cuts. Macron has proposed tax breaks worth 6 billion euros ($6.9 billion) for middle and low-income earners while at the same time reassuring investors that his plans for a “new French prosperity” remain on track. “I will not change course,” Mr. Macron told the French newspaper Journal du Dimanche. “We’re in a moment when many political leaders before me have yielded,” he added. “But it’s more necessary than ever to move ahead with reforms.”

The German Finance Ministry reported that orders for German factory goods rose 2% in September as a bottleneck in the auto sector cleared and deals with customers outside Europe rose sharply. In its statement the Ministry said, “The strong increase in orders from non-European countries proves that German industrial products remain in demand worldwide, regardless of trade conflicts.” The bottleneck in the automotive sector stemmed from the introduction of a new pollution standard—the Worldwide Harmonized Light Vehicle Test Procedure. Despite the positive report, the German government revised down its economic growth forecasts for this year stating that it now expects the economy to grow just 1.7-1.8%, down from its previous estimate of 2.3%. In addition, it now expects expansion of 2.0% in 2019, lower than the 2.1% previously forecast.

Former Fed Governor Kevin Warsh stated that the U.S. and China are at risk of a “10 or 20-year” economic cold war, with relations between the two superpowers “probably as poor as they were before the Nixon administration”. Warsh made the remarks in an interview on CNBC and had been on President Trump’s short list of candidates for Fed chairman before Jerome Powell was chosen. Warsh used the term “cold war” meaning an economic standoff, not in reference to the multi-decade “mutually assured destruction” nuclear stalemate between the U.S. and the Soviet Union. Warsh noted ties between the two countries are deteriorating at both the government and business-to-business levels.

Christine Lagarde, head of the International Monetary Fund (IMF), called for an overhaul of Japan’s economic policy as the world’s third largest economy continues to battle persistent low inflation, sluggish growth, and a rapidly ageing population. Lagarde called for a “fresh look” at Japan’s economic policies, known as “Abenomics”, referring to Prime Minister Shinzo Abe. The policies combine an ultra-loose monetary policy with fiscal stimulus and structural reforms. Lagarde acknowledged that the basic principles of Abenomics “are still valid but need to be broadened, sustained and accelerated.” She warned that the economic challenges facing Japan will "only grow as Japan's population continues to age and shrink," noting that both the size of the economy and the population would contract by a quarter over the next 40 years. The IMF predicts a growth rate of 1.1% this year for Japan, declining to 0.9% next year.

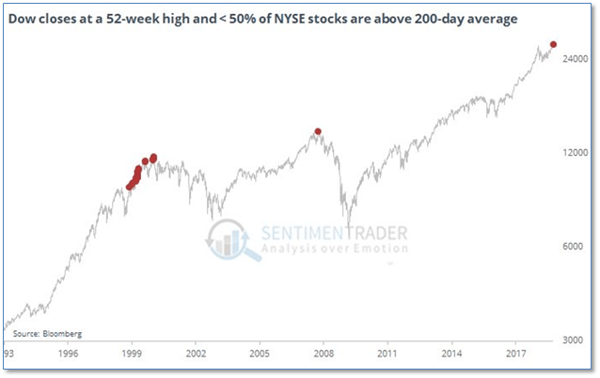

Finally: The Dow Jones Industrial Average notched its 15th record close of the year this week, but not all analysts were enthused. Jason Goepfert, president of Sundial Capital Research, noted that the overall market isn’t nearly as bullish as the Dow would indicate. The Dow Jones Industrial Average is made up of just 30 of the largest stocks traded, but for a bigger picture many analysts turn to measures that track the thousands of stocks traded by looking at a measure known as ‘market breadth’. The disconnect between the benchmark index and overall market breadth, such as is happening now, tends to occur when a narrowing group of stocks props up the overall market. Goepfert tweeted a chart showing past instances when the Dow hit a 52-week high at the very same time that less than 50% of all stocks traded on the New York Stock Exchange were above their long-term 200-day moving average. The last two times this scenario has happened were a cluster in 1999, right before the dot.com crash of 2000, and again in 2007, just before the financial crisis of 2008-9. (Chart from SentimenTrader)

Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.