In the markets:

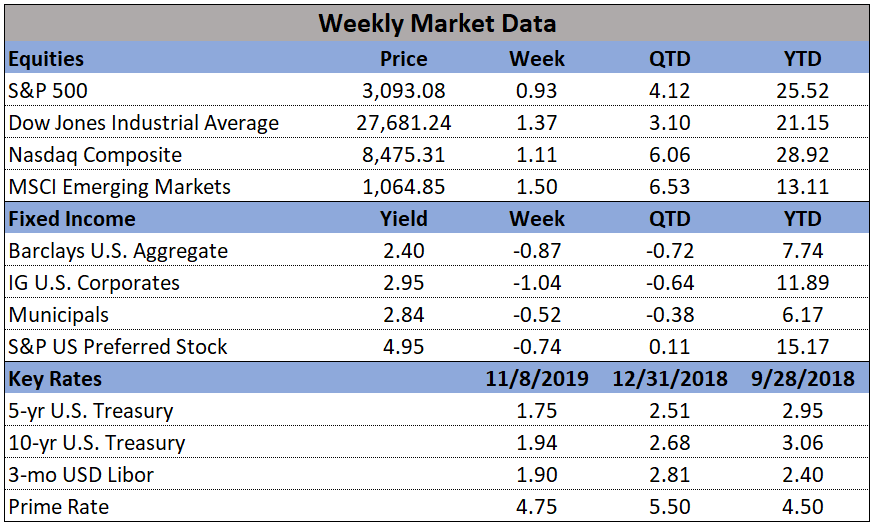

U.S. Markets: The Dow Jones Industrial Average joined the S&P 500 and NASDAQ Composite indexes in all-time high record territory, as optimism grew about a “phase one” trade deal between the U.S. and China. The Dow added 333 points to close at 27,681, a gain of 1.2%. The technology-heavy NASDAQ Composite added 1.1%, ending at 8,475. By market cap, the large cap S&P 500 rose 0.9%, while the S&P 400 mid cap index and Russell 2000 small cap indexes rose 0.8% and 0.6%, respectively.

International Markets: Major international markets were green across the board last week with Canada’s TSX adding 1.7% and the United Kingdom’s FTSE 100 gaining 0.8%. On Europe’s mainland, France’s CAC 40 rallied 2.2%, while Germany’s DAX added 2.1%. In Asia, China’s Shanghai Composite added 0.2% and Japan’s Nikkei gained 2.4%. As grouped by Morgan Stanley Capital International, developed markets rose 0.5% and emerging markets gained 1.1%.

Commodities: Precious metals sold off given the considerable strength in the equities markets. Gold declined -3.2% to $1462.90 an ounce, while Silver plunged more than twice gold’s decline, dropping -6.8% to $16.82 an ounce. Oil rebounded nicely from last week’s slight decline, adding 1.9%. West Texas Intermediate crude oil finished the week at $57.24 per barrel. The industrial metal copper, viewed as a gauge of world economic health due to its wide variety of uses, finished the week up 1.1%.

U.S. Economic News: U.S. jobless claims fell to a one-month low last week as the labor market remained strong, and the number of Americans seeking first-time unemployment benefits fell by 8,000 to 211,000. Economists had forecast new claims would total a seasonally-adjusted 215,000. Jobless claims fell the most in California, Georgia and Virginia. Claims had previously risen in California as wildfires and power outages kept many people from work. The monthly average of new claims, smoothed to iron out the weekly volatility, ticked up by 250 to 215,250. Continuing claims, which counts the number of people already collecting unemployment benefits, fell by 3,000 to 1.69 million. Those claims are near their lowest level since the early 1970’s.

The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) showed the number of job openings fell in September for a fourth consecutive month to 7.02 million. The reading is down from 7.3 million, the Bureau of Labor Statistics reported. Companies have cut back on hiring as the U.S. economy continues to grow more slowly. The “quits rate” component of JOLTS for the private sector ticked down from 2.7% to 2.6%. The quits rate is rumored to be one of the Federal Reserve’s key indicators of the health of the labor market as it’s presumed an employee would only leave a position for a more lucrative one. For all workers, including government employees, the reading fell to 2.3% from 2.4%.

The services side of the U.S. economy rebounded last month after hitting a three-year low, the Institute for Supply Management (ISM) reported. ISM stated its non-manufacturing index rose 2.1 points to 54.7 in October. Economists had expected the index to rise to lesser 53.8. Numbers over 50 indicate businesses are growing. Analysts believe the improvement was predominantly due to the recent thawing in trade tensions between the U.S. and China. Service-oriented companies haven’t been hurt as much by the trade dispute as manufacturing companies, but the spillover effects have resulted in slower growth. The services index is down 6 points from its post-recession peak set last year.

For the first time in almost five years, the productivity of American workers declined. The Labor Department reported that productivity declined at a 0.3% annual rate in the third quarter, reflecting a cutback in production as the economy slowed at the end of summer. Economists had predicted a 0.6% increase in productivity. The decline in productivity might be just temporary if the economy speeds up again, but it could also be a warning sign. Businesses reduced production in response to softer demand, especially for exports. The trade conflict between the U.S. and China has disrupted global supply chains and contributed to a world-wide slowdown in economic growth.

For a second consecutive month, consumers pulled back on their use of credit cards. U.S. consumer borrowing grew at its slowest rate in 15 months in September, according to Federal Reserve data. Total consumer credit increased $9.5 billion, down from a $17.8 billion increase in August. Economists had been expecting a gain of $15 billion. The September gain was well below the monthly average growth for the first eight months of the year of around $16 billion. It translates into an annual growth rate of 2.8%--the slowest since June 2018. T.J. Connelly, head of research at Contingent Macro Research stated, “The credit card spending trend appears to show that while consumers remain willing and able to spend, they are doing so only cautiously and are still reluctant to take on substantial debt.”

Sentiment among the nation’s consumers improved slightly this month, according to the University of Michigan. UofM’s consumer sentiment survey rose slightly to 95.7 this month, up 0.2 point from October. Economists had expected a reading of 95. In the details, consumers’ views on current conditions fell 2.3 points to 110.9, while their expectations of future conditions rose 1.7 points to 85.9. Economists follow readings on sentiment to get an insight into their spending, the backbone of the U.S. economy. Richard Curtin, chief economist of the survey stated, “Although consumers have become somewhat more cautious spenders, they see no reason to engage in the type of retrenchment that causes recessions.”