In the markets:

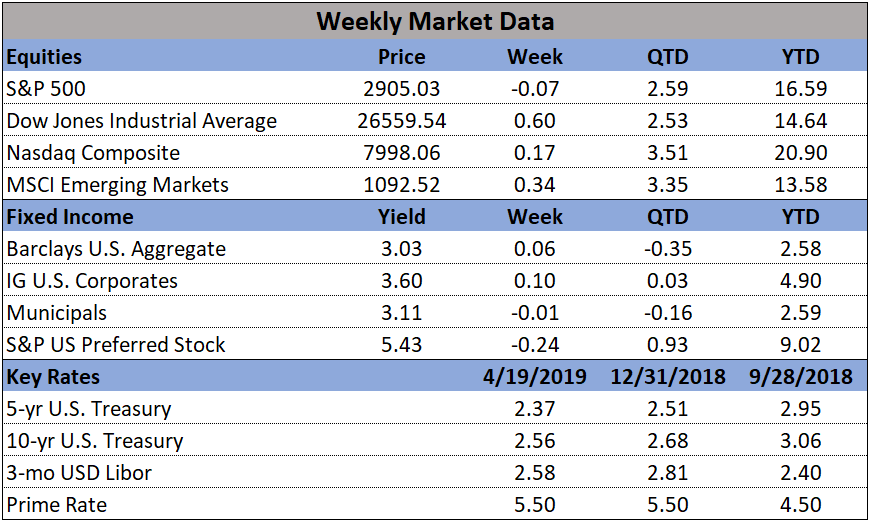

U.S. Markets: The major indexes finished the week mixed with smaller-cap indexes lagging the rest. The Dow Jones Industrial Average rose 147 points to close at 26,559, a gain of 0.6%. The NASDAQ Composite had its fourth week of gains adding a modest 0.2%. The large cap S&P 500 retreated a small -0.1%, while the mid cap S&P 400 gave up -0.6% and the small cap Russell 2000 declined -1.2%.

International Markets: Almost all major international markets finished the week in the green. Canada’s TSX had its fourth week of gains, adding 0.8%. In Europe, the United Kingdom’s FTSE rose 0.3%, and on Europe’s mainland France’s CAC 40 added 1.4% and Germany’s DAX surged 1.9%. In Asia, China’s Shanghai Composite added 0.8% and Japan’s Nikkei gained 1%. As grouped by Morgan Stanley Capital International developed markets rose 0.4%, while emerging markets added 0.5%.

Commodities: Precious metals continued to fall as Gold retreated almost $20 an ounce to $1276.00, a decline of -1.5%. Silver was essentially flat falling just a penny to $14.95 an ounce. Energy, on the other hand, continued its rally - now up seven weeks in a row. West Texas Intermediate crude oil added 0.3% finishing the week at $64.07 per barrel. The industrial metal copper, seen by some analysts as a barometer of world economic health due to its wide variety of uses, retraced the majority of last week’s gain and finished the week down -0.9%.

U.S. Economic News: The number of workers seeking new unemployment benefits fell to its lowest level since the height of the Vietnam War. The Labor Department reported initial jobless claims last week fell by 5,000 to 192,000—the fifth down week in a row. Economists had forecast a reading of 204,000. New claims have totaled less than 200,000 for the second consecutive week, an event that hasn’t occurred since Richard Nixon was president. Reduced layoffs, consistent hiring, and the lowest unemployment rate in 50 years have produced a strong labor market that continues to fuel an economic expansion that is now almost a decade old.

Sentiment among the nation’s homebuilders hit a 6 month high this month as the housing market continues to rebound. The National Association of Home Builders’ reported its monthly confidence index rose 1 point to 63 this month. The reading matched economists’ forecasts. In the report, the gauge of current sales conditions rose one point to 69, while the index that tracks expectations for the next 6 months fell a point to 71. The sub-index that measures traffic of prospective buyers jumped three points to 47. Many analysts remain optimistic about the housing market as mortgage rates remain low and concerns surrounding changes in the tax law in 2017 continue to recede.

Sales at the nation’s retailers surged last month - the latest report that the economy is firming up after weakness at the beginning of the year. The Commerce Department reported retail sales soared 1.6% in March, greatly exceeding forecasts of a gain of 1.1%. Sales of new cars and trucks rose 3.1%, the best performance of this year and giving the broader retail industry a boost. Vehicle sales represent about 20% of all retail sales. Less beneficially, consumers also spent more to fill up their gas tanks as the average price of gas rose almost 10% last month. Ex-auto and gas, retail sales still rose 0.9%. Among the winners were internet retailers, clothing stores, home-furnishing outlets, and grocers. Jim Baird, chief investment officer at Plante Moran Financial Advisors stated, “The bottom line is this: fears about the softening in the economy late last year were overblown. Taken in its totality, a broad swathe of data still paints a largely positive picture.”

The Federal Reserve’s Beige Book, a summary of anecdotes and commentaries on current economic conditions from each of its member banks, reported economic activity expanded at a “slight-to-moderate” pace last month and the beginning of this month. A “few” districts reported strengthening in activity. Overall, reports from the Fed’s respondents suggested sales were sluggish for both general retailers and auto dealers. However, home sales and tourism were bright spots. Agricultural conditions were weak as several Midwest districts reported widespread flooding. In addition, all reported the labor market remained tight, although the ability of firms to pass increased input costs to consumers was “mixed”. Overall, while not as downbeat as the prior report, the Beige Book did not characterize an economy firing on all cylinders.

Factory production in the New York region picked up somewhat this month, but nonetheless remained “fairly subdued” said the New York Federal Reserve this week. The New York Fed’s Empire State business conditions index rebounded to a reading of 10.1 from the nearly two-year low of 3.7 set in March, matching economists’ expectations. In the details, the new-orders index rose 4.5 points to 7.5 and shipments ticked up 0.9 points to 8.6. Of concern, however, the index for future business conditions dropped 17 points to 12.4—its lowest level in more than three years. Robert Brusca, chief economist at FAO Economics stated the future activity index “has been only weaker five times since January 2005 and four of those were in a recession.

A similar report from the Philadelphia Fed showed manufacturing in that region slowed significantly, declining from a reading of 13.7 in March to 8.5. Economists had expected a reading of 11. In the report, the new orders index climbed 14 points to 15.7, current shipments fell 2 points, while delivery times fell into negative territory for the first time in two and a half years. Similar to the New York Fed’s report, the index for the outlook for future activity fell to its lowest reading since February 2016. Manufacturing has struggled of late, with the Federal Reserve reporting that industrial production in the first quarter was the weakest since the third quarter of 2017. Joshua Shapiro, chief U.S. economist at MFR stated, “The fact that the new-order measure recovered nicely after two very weak months is an encouraging sign and suggests that the factory sector, while suffering from weak demand abroad and the effects of tariffs, is not sinking into a slump.”

Looking ahead:

Three catalysts have us feeling bullish in the markets for the next few weeks. The first is the paused Fed, which continues to allow markets to expand and react adequately to positive economic signals. The second is the continued decrease in unemployment and jobless claims. Despite the looming end of the economic cycle, companies continue to hire employees at record rates, signaling high business sentiment and adding further economic stimulus by boosting wage payouts. The third catalyst is the odd synchronized uptrend of both the equity and bond markets. Usually, risky and safe investments trade off, having generally uncorrelated relationships. We read this oddity as a sign that large amounts of side-line cash is being pumped back into both markets, which we view as very positive.