In the markets:

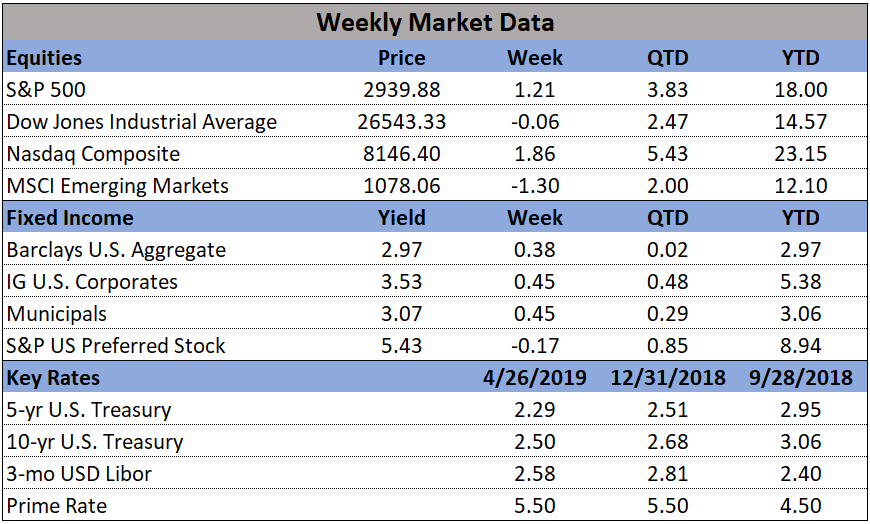

U.S. Markets: U.S. stocks recorded mixed results for the week with the technology-heavy NASDAQ Composite and smaller-cap indexes outperforming large caps. The S&P 500 Index hit record highs on Tuesday and again on Friday, rising 1.2% for the week. The NASDAQ Composite had its fifth straight week of gains adding 1.9%. The S&P 400 midcap index and small cap Russell 2000 index rose 1.1% and 1.7%, respectively. The Dow Jones Industrial Average, however, finished the week down 16 points, or -0.06%, to 26,543 following a disappointing earnings report from 3M.

International Markets: International markets didn’t fare quite as well as the U.S. Canada’s TSX ended the week flat while the UK’s FTSE 100 fell -0.4%. On Europe’s mainland, France’s CAC finished down -0.2%, Germany’s DAX rose 0.8%, and Italy’s Milan FTSE finished down -1%. In Asia, China’s Shanghai Composite plunged -5%, while Japan’s Nikkei rose 0.8%. As grouped by Morgan Stanley Capital International, developed markets finished down -0.3%, while emerging markets gave up -1.5%.

Commodities: After four consecutive weeks of declines, Gold managed a gain of 1% by finishing the week at $1288.80 an ounce. Silver also managed a positive close, rising 0.3% to $15.01 an ounce. Crude oil had its first down week in eight, retreating -1.2% and ending the week at $63.30 per barrel. The industrial metal copper, seen by some analysts as a barometer of global economic health due to its variety of uses, finished the week down -0.9%.

U.S. Economic News: The number of Americans claiming first-time unemployment benefits jumped by 37,000 to 230,000 last week, hitting a two-and-a-half month high. However, analysts were quick to note that the surge was likely related to the Easter holiday and spring break. Overall, claims remain near their lowest levels in 50 years. Economists had expected new claims to total 201,000. The four-week average of new claims, which smooths out the volatility of the weekly reading, rose by a smaller 4,500 to 206,000. Continuing claims, which counts the number of people already receiving benefits, rose by 1,000 to 1.66 million. Continuing claims are also near a 50-year low.

Sales of existing homes fell more sharply than expected last month, down 4.9% from February’s pace and missing economists’ estimates of a 5.3 million annual rate. The National Association of Realtors (NAR) reported existing-home sales ran at a seasonally-adjusted annual rate of 5.21 million in March. February’s surge was the strongest in nearly four years, and the NAR is attributing March’s decline to a return to normalcy after that spike. However, overall sales were down 5.4% versus the same time last year. In the details, the median price of a home sold in March was $259,400, up 3.8% from a year ago. In addition, at the current pace of sales there was a 3.9 months available supply of homes on the market, still well below the long-time average of 6 months that analysts use to indicate a “balanced” housing market. All regions saw a decline with sales in the Northeast down 3.9%, the South down 3.4%, the West off by 6%, and the Midwest with the biggest decline—7.9%.

Going in the opposite direction of existing home sales, sales of new homes rose 4.5% in March to a seasonally-adjusted annual rate of 692,000, beating the consensus forecast of a 656,000 rate. After months of stagnation, sales of newly-constructed homes finally gained momentum with March’s sales pace the strongest since November 2017. Year-to-date, sales are running 1.7% higher than from the same period last year. Analysts note that lower prices helped boost sales. The median price of a home sold in March was $302,700, 9.7% lower than the same period a year ago. At the current pace of sales, there is 6 months of available supply on the market.

Orders for goods expected to last at least 3 years, a.k.a. “durable goods”, grew at their fastest rate in over half a year last month as business investment continues to rebound. The Commerce department reported that durable-goods orders rose 2.7% in March, led by stronger demand for vehicles, planes, and networking equipment. Economists had expected only a 0.5% increase. Ex-transportation, orders rose a lesser 0.4%. A key measure of business investment known as core orders also showed strength. Core orders rose 1.3% in March, the third straight monthly increase. These orders, which exclude aircraft and military goods, have risen slightly more than 5% in the past year. Economist Andrew Hollenhorst of Citibank remarked, “A strong increase in core capital goods orders is a positive sign for rising business investment into the second quarter, consistent with our view that 2019 will be another year of solid activity.”

The sentiment of the nation’s consumers slipped this month, according to the University of Michigan. UofM’s consumer sentiment index fell 1.2 points to 97.2 in April, but it remained above analysts’ estimates of 97.0. Most notable in the report was that when respondents were asked their financial prospects for the year ahead, the percent who expect improvement over those who expect worsening finances reached their best level in 15 years. In addition, 60% answered that they expected to be better off financially over the next five years—a 7 year high. Economists from Oxford Economics wrote in a note to clients, “We continue to expect firmer consumer spending momentum ahead, after a soft 1.2% annualized advance in the first quarter. Upbeat consumer expectations continue to point to such a pickup.”

The U.S. economy grew 3.2% in the first quarter of 2019 the Commerce Department reported in its monthly Gross Domestic Product (GDP) report. The gain was well above forecasts of just a 2.3% increase. One factor that led to the increase was a sharp upturn in state and local government spending, which jumped 3.9% after a 1.3% drop in the prior three months. This was the fastest gain in three years. Also fueling the stronger GDP growth were stronger inventory building and trade activity. Analysts note the acceleration in growth in the first quarter is all the more remarkable considering the concern that surrounded the first-quarter outlook in December. Before the new year began, the Atlanta Fed’s “nowcast” GDP model projected just a 0.5% growth, and the flattening of the yield curve was fueling widespread talk of recession. The Federal Reserve is not expected to change its patient approach to interest-rate policy despite the strong report. Officials are expected to wait to see how the economy fares in the second quarter before making any decisions.