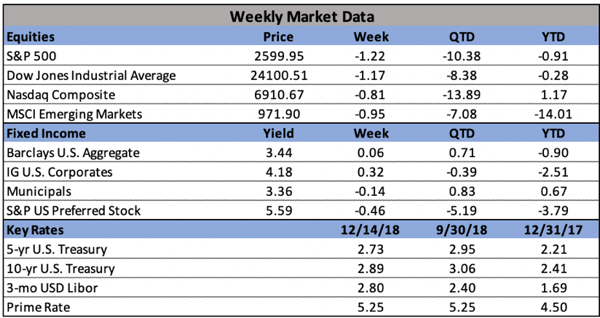

In the markets:

U.S. Markets: The major U.S. indexes finished the week lower as a midweek rebound was retraced by a rout on Friday. The Dow Jones Industrial Average shed 288 points or -1.2% to end the week at 24,100. The technology-heavy NASDAQ Composite gave up -0.8% closing at 6,910. By market cap, small cap and mid cap stocks continued to bear the brunt of the selling with the small cap Russell 2000 index falling -2.6% and the mid cap S&P 400 index declining -2.7%. The large cap S&P 500 index fell just half the decline of small cap and mid cap, losing -1.3%.

International Markets: Canada’s TSX followed last week’s decline with a further -1.4%. Bucking the trend in North America major markets in Europe managed a positive close for the week. The United Kingdom’s FTSE rebounded 1%, while France’s CAC 40 and Germany’s DAX gained 0.8% and 0.7% respectively. In Asia, China’s Shanghai Composite ended the week down after last week’s gain, shedding -0.5%. Japan’s Nikkei fell a deeper -1.4%. As grouped by Morgan Stanley Capital International, developed markets retreated -0.5%, while emerging markets were off just -0.1%.

Commodities: Precious metals were unable to profit from the week’s volatility. Gold gave up -0.9% or $11.20 to end the week at $1241.40 an ounce. Likewise, Silver retreated -0.4% and ended the week at $14.64 an ounce. Energy retraced most of the last two weeks of gains as West Texas Intermediate crude oil retreated -2.7% to end the week at $51.20 per barrel. The industrial metal copper, viewed by many as a barometer of global market health due to its wide variety of uses, managed a slight gain, up 0.1% for the week.

In the US economy:

The number of Americans applying for new unemployment benefits plunged by 27,000 last week to 206,000. The decline in applications puts claims back to near a 50-year low. Economists had forecast a reading of 226,000. A few weeks ago, new claims had risen to an eight-month high of 235,000 raising questions about whether the labor market has cooled—this report suggests it perhaps it hasn’t. The more stable monthly average of new claims fell by 3,750 to 224,750. Continuing claims, which counts the number of people already receiving unemployment benefits, rose by 25,000 to 1.66 million. That number is also near its lowest levels since 1972.

Despite rising economic worries, the number of job openings in the United States remained near a record high in October, the Labor Department reported. Job openings picked up 1.7% to 7.079 million. The reading signals that companies are still seeking to hire more workers to keep up with rising sales. Job openings first hit a record high of 7.3 million in August and have remained near that number since. Information and media, real estate, and education led the increase. The quits rate, rumored to be closely watched by the Federal Reserve presumably because one would only quit a job for a more lucrative one, fell a tick to 2.6% among private sector employees. It was the first decline in six months. The rate of people quitting had hit its highest level in 17 years toward the end of summer.

Sentiment among the nation’s small business owners hit a 7-month low last month according to the National Federation of Independent Business. The NFIB’s small-business optimism index fell 2.6 points to a seasonally-adjusted level of 104.8. Most of the decline came from lower expectations of future sales and business conditions. In the details, only two of the components remained flat (plans to increase employment and expected credit conditions) while the rest declined. Of note, a record number of respondents continued to voice that a scarcity of “qualified” workers remained their top business concern. In addition, more than a third reported having job openings they could not fill. Reflecting the tight labor market, a net 25% of firms (the highest share since December of 1989) plan to raise worker compensation in the next three months.