In the markets:

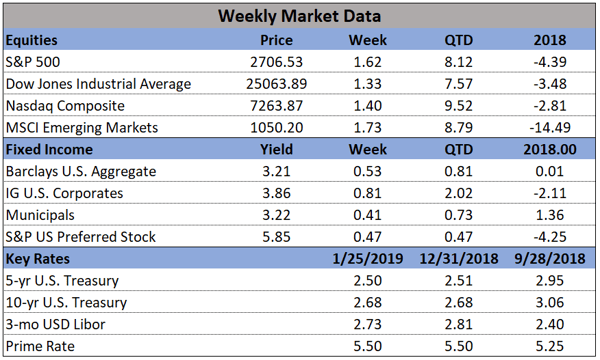

U.S. Markets: U.S. stocks finished the week notably higher due to strong rallies on Wednesday and Thursday. In a widely expected move, the Federal Reserve decided to keep rates steady, but investors were cheered by an unexpectedly dovish post-meeting statement. The Dow Jones Industrial Average rose 326 points to close at 25,063—a gain of 1.3%. The technology-heavy NASDAQ Composite added 1.4% finishing the week at 7,263. By market cap, the large cap S&P 500 rose 1.6%, while the mid cap S&P 400 and small cap Russell 2000 each rose 1.3%.

International Markets: Canada’s TSX rose 0.9% for the week. Across the Atlantic, the United Kingdom’s FTSE retraced last week’s entire decline by finishing up 3.1%. On Europe’s mainland, however, major markets were mixed. France’s CAC 40 rose 1.9%, while Germany’s DAX ended down -0.9%. In Asia, China’s Shanghai Composite added 0.6% and Japan’s Nikkei ticked up 0.1%. As grouped by Morgan Stanley Capital International, emerging markets rose 1.3%, while developed markets gained 0.8%.

Commodities: Precious metals had their second week of good gains as gold rose 1.9%, closing at $1322.10 an ounce. Silver rose 1.5% and finished the week at $15.93 per ounce. Crude oil resumed its rally after taking a break last week. Crude oil finished up 2.9% at $55.26 per barrel for West Texas Intermediate crude. The industrial metal copper, seen as a gauge of world economic health due to its variety of uses, rose 1.6%.

January Summary: For the month of January, the Dow Jones Industrial Average and NASDAQ Composite smartly rose by 7.2% and 9.7% respectively. Smaller cap indexes outperformed their large cap peers as the S&P 400 and Russell 2000 shot up 10.4% and 11.2%, while the large cap S&P 500 gained a lesser but still robust 7.9%. Canada’s TSX surged 8.5%, but outside of North America major market gains were less robust. The United Kingdom’s FTSE rose 3.6%. France’s CAC 40 and Germany’s DAX added 5.5% and 5.8%, respectively. China’s Shanghai Composite rose 3.6% and Japan’s Nikkei gained 3.8%. Developed markets rebounded 6.6%, while emerging markets surged 10.3%. Gold and silver each gained 3.4%, while copper added 2.9%. However, the big story in commodities was in energy, where oil rallied 18.5%.

U.S. Economic News: Initial claims for new unemployment benefits surged by 53,000 last week to 253,000, far above the consensus of a 16,000 increase. It was the biggest jump and to the highest level since September 2017. The number was likely influenced by filings from federal contractors and others impacted by the government shutdown. If this is the case, then initial claims should subside in the coming weeks. The four-week average of claims, used to reduce the short-term volatility, rose by 5,000 to 220,250. That number remains close to multi-decade lows and is consistent with tight labor market conditions.

The U.S. added 304,000 jobs in January as firms continue to hire at a robust rate despite global headwinds, according to the Bureau of Labor Statistics. The reading was the biggest increase in almost a year and blew away expectations for a modest gain of 172,000 nonfarm jobs. The economy has added an average of 241,000 jobs a month over the last three months, one of its best stretches in the nearly 10-year old economic expansion. Meanwhile, the unemployment rate ticked up to 4%. The Labor Department said the government shutdown did contribute to the higher jobless rate, but it had “no discernable impacts” on the surge in hiring last month.