In the markets:

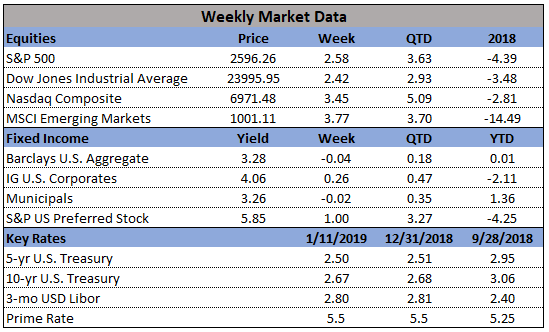

U.S. Markets: U.S. stocks rose for a third consecutive week as it appeared that leaders in China and the U.S. may be making progress in resolving their trade dispute. The small cap Russell 2000 index outperformed mid and large cap indexes, becoming the last major benchmark to emerge from bear market territory (a decline of over 20% from a recent high). The Dow Jones Industrial Average surged 562 points, or 2.4%, to close at 23,995. The technology-heavy NASDAQ Composite enjoyed its third consecutive week of gains, rising 3.5%. By market cap, the large cap S&P 500 index rose 2.5% and the mid cap S&P 400 index gained 4.7%, while the small cap Russell 2000 surged 4.8%.

International Markets: Canada’s TSX gained 3.6%, while the United Kingdom’s FTSE rose 1.2%. Markets were green on the European mainland as well. France’s CAC 40 rose 0.9%, Germany’s DAX added 1.1%, and Italy’s Milan FTSE gained 2.4%. In Asia, China’s Shanghai Composite rose 1.5% and Japan’s Nikkei rebounded 4.1% from five consecutive weeks of losses. As grouped by Morgan Stanley Capital International, emerging markets rose 2.6% last week while developed markets finished up 1.9%.

Commodities: Energy followed through with a second week of healthy gains. West Texas Intermediate crude oil surged for a second week, up 7.6% to $51.59 per barrel. Precious metals finished the week mixed. Gold added 0.3% to close at $1289.50 an ounce, while Silver retreated -0.8% to $15.66 an ounce. The industrial metal copper, seen as a barometer of world economic health due to its variety of uses, added 0.55% last week.

U.S. Economic News: The number of Americans seeking new unemployment benefits fell sharply last week, a positive sign for the labor market and the overall economy going into the new year. The Labor Department reported the number of initial jobless claims declined by 17,000 to just 216,000, significantly below the consensus estimate of 227,000. The more stable monthly average of new claims edged up slightly by 2,500 to 221,750. Continuing claims, which counts the number of people already receiving benefits, fell by 28,000 to 1.72 million. That number fell below the 2 million mark last spring for the first time since the turn of the century and has remained near a 45-year low for months. Prompted by the government shutdown, some 4,760 federal employees filed for benefits during the last week of December.

In the US economy:

The number of job openings fell to their lowest level since early summer in November, but the number of positions still far exceeds the number of unemployed Americans. The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) reported the number of job openings fell to 6.89 million from 7.13 million but remained well above the 6 million people classified by the government as unemployed. Declines in job openings affected most segments of the economy with construction hit particularly hard. However, openings for transportation and warehousing increased ahead of the holiday shopping season. The “quits rate”, known to be closely watched by the Federal Reserve, the rationale being that presumably one would only leave a position for a more lucrative one, fell for the second month in a row to 2.5% among private-sector workers. While near an all-time high, that number appears to be leveling off.

A sharp decline in energy prices and a stronger dollar put downward pressure on consumer prices, according to the latest reading of the Consumer Price Index (CPI). The CPI slipped 0.1% in December, its first decline since March and matching forecasts. The decline was led by a 3.5% decline in energy prices, the most since February 2016, due mostly to a drop in the price of gasoline. However, food price rose 0.4%, the most since May 2014. Removing the often-volatile food and energy categories, so-called “core” CPI rose 0.2%, matching estimates. Year-over-year, CPI moderated to 1.9% - its slowest pace since July 2017 - while core inflation remained essentially unchanged at 2.2%.

Looking ahead:

The government remains shutdown for the foreseeable future as tensions marinate inside the White House. Despite political upset, the markets posted solid gains for the entire week. President Donald Trump and Chinese President Xi Jinping met for a promising, but ultimately disappointing, trade negotiation. No deal is in sight as the 90 day truce continues into 2019.

Recession fears in the investor populace seem to be assuaged now that the market has risen off its December lows. Jobs are still at an all time high, but this indicator should be taken with a grain of salt, as employment rates tend to be a lagging indicator for the economy. Despite a promising start for equities, global economic slowdown is still playing a role in 2019.