In the markets:

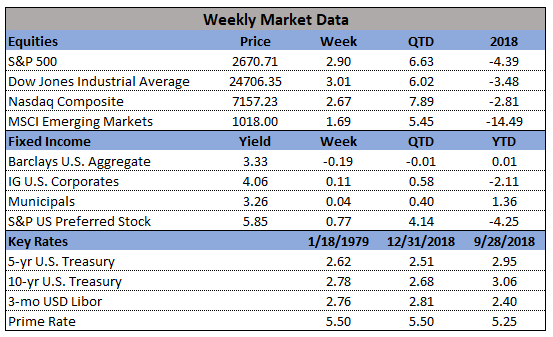

U.S. Markets: U.S. stocks recorded their fourth consecutive week of positive returns, continuing to build on their very strong start to 2019. The gains pulled most of the large-cap benchmarks out of correction territory, back to within 10% of their recent highs. However, the NASDAQ Composite and the smaller-cap benchmarks remained below that threshold. The Dow Jones Industrial Average surged 710 points, or 3.0%, last week closing at 24,706. The technology-heavy NASDAQ Composite rallied 2.7% ending the week at 7,157. By market cap, the large cap S&P 500 rose 2.9%, while the mid cap S&P 400 added 3.0% and the small cap Russell 2000 gained 2.4%.

International Markets: Like the U.S., major international markets were also in the green across the board. Canada’s TSX Composite rose 2.4% while the UK’s FTSE managed a 0.7% gain despite Prime Minister Theresa May’s Brexit deal failing to gain approval. On Europe’s mainland, France’s CAC 40 rose 2.0%, Germany’s DAX added 2.9%, and Italy’s Milan FTSE gained 2.2%. In Asia, China’s Shanghai Composite rose 1.7%, while Japan’s Nikkei gained 1.5%. As grouped by Morgan Stanley Capital International, emerging markets rose 2.0% last week and developed markets gained 1.7%.

Commodities: Given that precious metals are traditionally a “safe-haven” in times of market weakness, it comes as no surprise that they finished down for the week in which equities were strong. Gold retreated 0.5%, closing at $1282.60 an ounce, while Silver fell -1.6% to $15.40 an ounce. Oil continued its sharp rebound, rising 4.8% to $54.04 per barrel of West Texas Intermediate crude—its third consecutive weekly gain. Copper, viewed by some analysts as a gauge of world economic health due to its variety of industrial uses, finished the week up 2.1%.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits fell slightly last week to a five-week low, though more federal workers sought financial assistance due to the government shutdown. The Labor Department reported initial jobless claims declined by 3,000 to 213,000, lower than the consensus forecast of a 220,000 reading. New claims fell to their lowest level since early December and are nearing the 50-year low of 202,000 reached last September. The less-volatile monthly moving average of new claims declined by 1,000 to 220,750. Continuing claims, which counts the number of people already receiving unemployment benefits, rose by 18,000 to 1.74 million.

A Note on Small Cap Stock

Companies with small market capitalization’s, so-called “small caps”, have traditionally acted as a “canary in the coal mine” for the larger market since they tend to be more domestically focused and more sensitive to growth worries than their larger cap counterparts. Given that, Andrew Lapthorne, analyst at Societe Generale, is concerned that small cap companies have been taking on a massive amount of debt over the last few years, far outstripping their earnings growth (EBITDA on the chart below) and greatly increasing their balance sheet leverage. Lapthorne notes, “If you have leverage and your share price is weak, that compounds the problem.” And a small company with balance-sheet problems can’t do what the big boys do — raise money by going back to the markets with bond issues, he notes.

Looking Ahead

Though it feels like the same every week, we can't look ahead without considering the ongoing trade worries. Consumer sentiment is at an all time low as the trade war takes its toll on both the United States and China. 37 days remain in the 90 day trade truce and are counting down without any news of an oncoming agreement.

Although the markets have recovered impressively from their December lows, they may meet resistance if investors are not reassured on trade and growth. China is seeing their largest economic slowdown in two decades, with rippling effects across Europe and the United States. The US is also feeling the heat, with soybean farmers continuing to seek alternative markets despite the massive $876B farm bill, as well as the dollar declining through most of 2019.

Finally, the World Economic Forum in Davos is throwing off several negative signals (explaining some amount of the Tuesday decline in equities), but a light in the dark came when UBS Chairman Axel Weber predicted the central banks would cease the rate hikes in 2019.