In the markets:

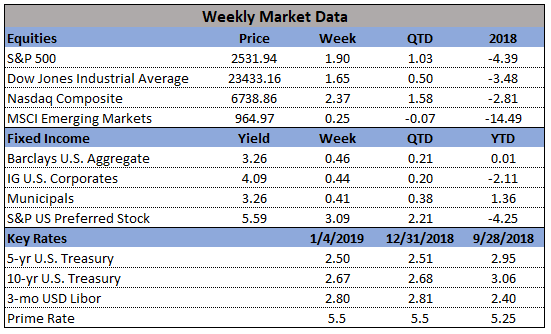

U.S. Markets: U.S. stocks managed a second consecutive week of gains as market weakness midweek gave way to a powerful rally on Friday. The week started off on a positive note, as President Trump tweeted that he and Chinese President Jinping had made “big progress” in trade talks. However, at midweek Apple CEO Tim Cook warned investors that the company was lowering its quarterly revenue guidance - its first such cut in 15 years - triggering a 10% tumble in Apple stock that dragged major indexes sharply lower. The Dow Jones Industrial Average rose 370 points, ending the week at 23,433, a gain of 1.6%. The technology-heavy NASDAQ Composite rose 2.3%. By market cap, the large cap S&P 500 index ended up 1.9%, while the mid cap S&P 400 added 2.3% and small cap Russell 2000 added 3.2%.

International Markets: Canada’s TSX rebounded 1.4% last week, a second week of gains. In Europe, the United Kingdom’s FTSE rose 1.5%, and on Europe’s mainland France’s CAC 40 rose 1.2%, Germany’s DAX gained 2.0%, and Italy’s Milan FTSE added 2.8%. In Asia, China’s Shanghai Composite rose 0.8%, but Japan’s Nikkei finished down -2.3% - its fifth consecutive negative week. As grouped by Morgan Stanley Capital International, developed markets added 2.1%, while emerging markets added 1.2%.

Commodities: Precious metals managed to hold their gains despite the strength in the stock market. Gold finished the week up 0.2% to $1285.80 an ounce. Silver rose a third straight week, gaining 2.3% to $15.79 an ounce. Oil managed a rebound after three weeks of losses, popping 5.8% to $47.96 per barrel. Copper, viewed by some analysts as an indicator of global market health due to its variety of uses, ended the week down -1.3%.

2018 wrap-up:

All major US indexes posted negative returns for the year, finishing off 2018 with the worst December since 1931. The week ending the 28th of December showed small glimmers of an oncoming rally, but domestic and global stocks remained in the red for the year-to-date and quarter-to-date time frames. The final week of December heralded mixed returns, ultimately locking in losses for 2018.

In the US economy:

Taking every analyst and expert by surprise, the U.S. economy added 312,000 new jobs in December, blowing away expectations for a gain of just 175,000. The reading brought total employment gains for the year to a three-year high of 2.64 million. Ironically, the strong jobs number actually raised the unemployment rate to 3.9% from a 49-year low of 3.7%, as more Americans entered the workforce in search of jobs. In addition, the Labor Department reported an upwardly-revised 176,000 new jobs were created in November versus the 155,000 originally reported, and October’s gain was also raised to 274,000 from 237,000.

The number of Americans filing new claims last week for unemployment benefits climbed by 10,000 to 231,000. Economists had expected just 220,000 new claims. Jobless claims are often volatile during the holiday season, making them less reliable as an economic indicator at this time of year. Nonetheless, the reading was the third consecutive increase. Overall, however, the reading remained low by historical standards. The four-week average of claims, used by analysts to smooth out the volatility of the weekly number, slipped by 500 to 218,750. Both one-week and the four-week numbers still indicate tight labor market conditions. Continuing claims, which counts the number of people already collecting unemployment benefits, rose by 32,000 to 1.74 million. That reading remains near a 45-year low.

The U.S. added the most private-sector jobs in almost two years, according to private payroll processor ADP. ADP reported employers added 271,000 jobs in December, far above economists’ forecasts who expected a gain of 175,000. It was the highest number of job gains since February of 2017. In the details, small companies added 89,000 jobs, while medium sized businesses added 129,000 and large companies added 54,000.

U.S. manufacturers reported the slowest rate of expansion in 15 months, research firm IHS Markit reported. IHS said its manufacturing Purchasing Managers Index (PMI) dropped 1.5 points to 53.8 in December. It was the fifth decline in the past seven months, and the most since December 2015 as factory activity continued to moderate. New orders and output both grew at their slowest rates in over a year, reflecting softer demand. In addition, payrolls increased at their weakest pace since June 2017. In what could be an ominous sign for the overall economy, the level of optimism among senior executives about the 12-month growth outlook dipped to its lowest level since late fall of 2016. Chris Williamson, chief business economist at IHS Markit stated in the release, “The PMI survey also revealed signs of slower demand growth from customers, as well as rising concerns over the impact of tariffs.”

Looking ahead:

Although stocks rallied for the first week of 2019, investors are still skittish after the blasting that occurred in 2018. US President Donald Trump and Chinese President Xi Jinping meet today (Monday, January 7) to continue discussions on the ongoing trade dispute. The people interviewed on the subject were optimistic concerning the possible outcomes.

The US Government continues its shutdown with no end in sight. This has resounding repercussions for the country as a whole, but not necessarily on the markets. Historically, the stock and bond markets have been relatively flat when the government is in shutdown, with stocks posting an average of -.6% since 1976.

In conclusion, we are relatively bullish on 1Q 2019! The trade dispute seems to be on its last legs, the next Fed interest rate hike is months away, and most recession fear seems to have been assuaged. Companies will fully realize the benefits of the tax cut in the coming months, and will hopefully use the proceeds to add serious value. Without further ado, Happy New Year!