In the markets:

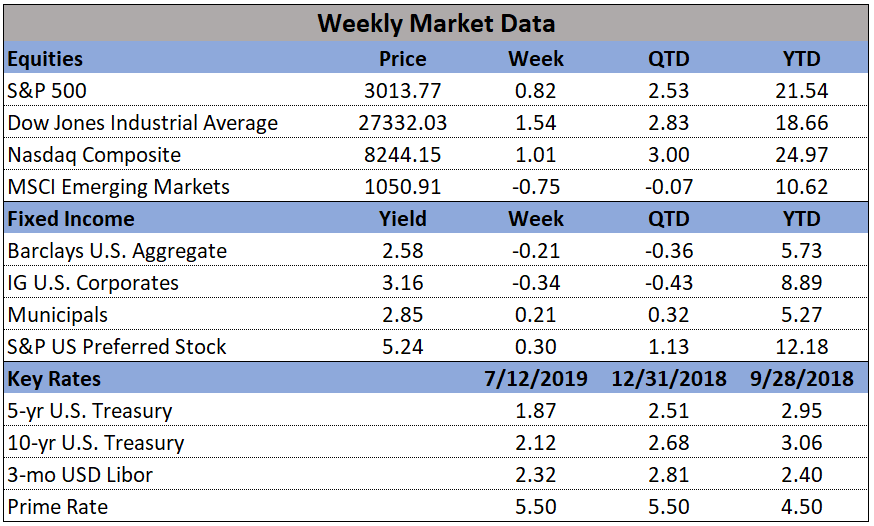

U.S. Markets: The major U.S. indexes ended the week mixed even as large-cap benchmarks hit new highs. The large-cap S&P 500 and the Dow Jones Industrial Average each hit new record highs this week, while the technology-heavy NASDAQ composite also performed well. The smaller cap indexes, though, recorded modest losses for the week. The Dow Jones Industrial Average rallied over 400 points to close at 27,332, a gain of 1.5%. The NASDAQ added 82 points, or 1.0%, finishing at 8,244. The large cap S&P 500 gained 0.8%, while the mid cap S&P 400 retreated -0.3% and the Russell 2000 finished down -0.4%.

International Markets: Unlike the Dow Jones Industrials and the S&P 500, most international indexes finished lower for the week. Canada’s TSX finished down a third of a percent while the United Kingdom’s FTSE was off -0.6%. On Europe’s mainland, France’s CAC 40 fell -0.4%, Germany’s DAX lost -2.0% and Italy’s Milan FTSE gained 0.9%. In Asia, China’s Shanghai Composite retreated -2.7%, while Japan’s Nikkei ended down -0.3%. As grouped by Morgan Stanley Capital International, developed markets finished down -0.6% while emerging markets fell -0.2%.

Commodities: Gold recovered last week’s loss by adding $12.10, or 0.9%, to close $1412.20 an ounce. Silver added 1.6% finishing the week at $15.24 an ounce. Crude oil rallied 4.7% to close at $60.21 per barrel of West Texas Intermediate while the industrial metal copper, seen by analysts as a barometer of global economic health due to its wide variety of uses, added 1.2%.

U.S. Economic News: The number of people applying for first time unemployment benefits fell last week to its lowest level in more than three months. The Labor Department reported initial jobless claims fell by 13,000 to 209,000 last week. Economists had estimated new claims would total 221,000. The less-volatile monthly average of new claims also declined, falling 3,250 to 219,250. The number of claims remains well-below the key 300,000 threshold that analysts use to indicate a “healthy” jobs market. Thomas Simons, senior money market economist at Jefferies, LLC stated, “The labor market remains very tight, layoff activity is low, and there is no evidence in the economic data that suggests that these conditions will change any time soon.”

The Labor Department’s Job Opening and Labor Turnover Survey (JOLTS) report showed job openings in the U.S. fell slightly to 7.32 million in May, but remained near record highs. Companies hired 5.73 million people in May, down from 6 million in the prior month. The decline in hiring wasn’t a surprise as the U.S. only added 72,000 new jobs that month according to its monthly employment figures. In the JOLTS details, hiring has slowed in manufacturing and other export-heavy industries due to ongoing trade tensions and a weaker global economy. The much larger services side of the economy is still seeing strong growth, however. For the 15th consecutive month, job openings outnumbered the unemployed - there were 1.3 million more job openings than the number of people officially classified as unemployed.

Americans paid more for rent, clothes, and cars last month, but overall inflation was largely held in check by falling energy prices. The Bureau of Labor Statistics reported the consumer price index rose 0.1% in June whereas economists had forecast no change. Over the past 12 months, the cost of living slipped 0.2% to a four-month low of 1.6%. Core inflation, which strips out food and energy, rose 0.3% last month—its biggest increase in a year and a half. From the same time last year, core inflation ticked up 0.1% to 2.1%. Inflation has eased in 2019 to a 2% rate or less, confounding predictions that a tight labor market and record economic expansion would generate higher prices.

At the producer level, prices rose a modest 0.1% in June, indicating that inflation remains under control at the wholesale level, too. Prices at the wholesale level were up 1.7% over the past 12 months, its lowest rate in more than two years. Excluding food, energy, and trade margins, the “core PPI” was flat last month after two consecutive months of 0.4% gains. The annual rate of increase in core prices declined 0.2% to 2.1%. Within the main subcomponents, prices for goods fell 0.4%, the most since January. However, more than 60% of the drop can be traced to a 5% decline in gasoline prices, the government said. A notable exception: the price of corn surged 19.9% due to the difficult growing conditions—its biggest increase in almost 4 years.

Sentiment among the nation’s small business owners dipped in June predominantly due to “uncertainty” surrounding the slowdown in global trade and May’s stock market tumble. The National Federation of Independent Business (NFIB) small-business optimism index declined 1.7 points to 103.3—missing the consensus forecast of 104.0. In the details, six of the ten components fell, while three improved and one stayed the same. Owners’ plans to increase employment and to spend on capital equipment both declined, as well as expectations of higher sales in the future. In its statement, the NFIB noted increased costs due to tariffs may soon be passed on to customers. “Some tariff inflation pressures may be surfacing as the percent of firms raising selling prices rose significantly, with 30% of owners reporting recent changes in China trade policy negatively impacting their business,” the group said in its release.

Minutes from the Federal Reserve’s June meeting supported views that the central bank is prepared to cut interest rates at their meeting at the end of July. According to the summary of last month’s discussions, “many” Federal Reserve officials said they would be willing to cut interest rates if risks and uncertainties “continued to weigh on the economic outlook.” And that is exactly how the economy has performed, according to Fed Chairman Jerome Powell, in testimony before Congress this week. In testimony, Chairman Powell stated the economy has not picked up since the last Fed meeting and repeated that the Fed is ready to act to support demand. The minutes revealed that Powell has the backing of most Fed officials for a move.