In the markets:

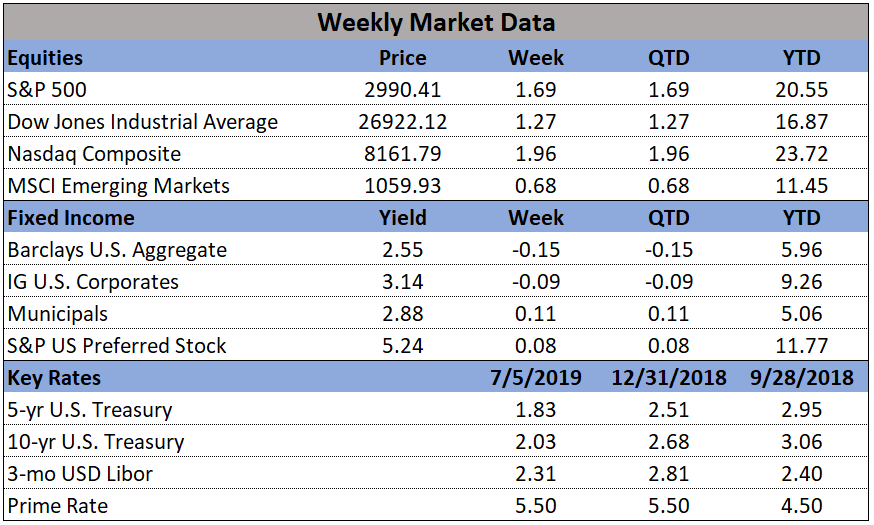

U.S. Markets: The major U.S. indexes ended the week in the green with several hitting new highs during the week. The Dow Jones Industrial Average rose 1.2%, or 322 points, to close at 26,922. The technology-heavy NASDAQ Composite rose 1.9% ending the week at 8,161. By market cap, the large cap S&P 500 rallied 1.7%, while the S&P 400 mid cap index added 1.1% and the small cap Russell 2000 brought up the rear with a gain of 0.6%.

International Markets: Canada’s TSX retraced last week’s decline by closing up 1.0%. Across the Atlantic, the United Kingdom’s FTSE gained 1.7% - its fifth consecutive weekly gain. On Europe’s mainland, France’s CAC 40 rose 1.0%, Germany DAX gained 1.4%, and Italy’s Milan FTSE added 3.5%. In Asia, China’s Shanghai Composite rebounded 1.1% and Japan’s Nikkei finished up 2.2%. As grouped by Morgan Stanley Capital International, developed markets managed a 0.7% gain, while emerging markets ticked up just 0.1%.

Commodities: Precious metals finished down, dropping at the end of the week in response to the surprisingly-strong U.S. jobs numbers. Gold retreated $13.60 to $1400.10, a decline of 1.0%. Likewise, Silver finished the week down -2.2% to $15.00 an ounce. Oil had its first down week in three, retreating -1.6% to $57.51 per barrel. The industrial metal copper, viewed by analysts as a barometer of global economic health due to its variety of industrial uses, retreated -1.1%.

U.S. Economic News: The number of people applying for first-time unemployment benefits fell by 8,000 to 221,000 last week, remaining near their lowest levels in 50 years. The reading bested economists’ forecasts of claims dropping to 223,000. The more stable monthly average rose by 500 to 222,250. Jobless claims remain well-below the 300,000-threshold analysts use to indicate a “healthy” jobs market. Analysts note hiring has slowed during the first half of 2019, but there’s been no indication that companies are cutting jobs. Continuing claims, which counts the number of Americans already receiving benefits, also fell 8,000 to 1.69 million. That number is reported with a one-week delay.

The Labor Department’s monthly Non-Farm Payrolls (NFP) report showed the U.S. added 224,000 jobs in June as worries about the economy dissipated and hiring rebounded. The increase in new jobs easily beat the consensus forecast for 170,000 new jobs. The improved hiring last month dispels (at least for now) the threat of a dramatic slowdown in economic growth. Escalating trade disputes and a slowing global economy have weighed on exports an undermined the confidence of consumers and businesses. Supporting the prospect of continued economic growth, the U.S. and China agreed last week to delay pending tariffs and return to negotiations. Paradoxically, the NFP also showed the unemployment rate ticking up to 3.7% from 3.6%, but it was because more than 300,000 people came off the sidelines and entered the labor force in search of work. Still, the unemployment rate remains near a 50-year low.

Manufacturing activity in the United States grew at its slowest pace in more than two years as global trade tensions continued to rise. The Institute for Supply Management (ISM) reported its manufacturing index fell 0.4 point to 51.7 last month. The index hit a 14-year high of 60.8 last August but has steadily declined since. Despite the decline, the reading still managed to exceed economists’ forecasts of 51.3. In the details, customer orders were flat - its weakest reading since late 2015 - while inventories contracted. Exports managed a slight gain. The index is compiled from a survey of executives who order raw materials and other supplies for their companies. Some analysts noted that the survey was conducted during a tense period with China and Mexico. Thomas Simons, senior money market economist at Jefferies LLC stated, “Relations with both China and Mexico have improved since this survey data was collected, so next month should be better”.

ISM also reported that the much larger services side of the economy grew last month at its slowest pace in almost two years. ISM’s index of service-oriented companies such as banks, restaurants and hospitals slipped 1.8 points to 55.1 last month, matching its lowest reading since summer of 2017. While numbers over 50 are still viewed as positive for the economy, the index has trended lower since hitting a high of 60 less than a year ago. In the details, the sub-index for business production dropped 3 points to 58.2, while new orders declined 2.8 points to 55.8 and employment fell 3.1 points to 55. Altogether it was still good news, as 16 of the 17 industries tracked by ISM said their businesses were expanding. The only one to contract was the arts and entertainment industry.

The Commerce Department reported that the U.S. trade deficit surged 8.4% in May, hitting its highest level of the year. The trade deficit rose $4.3 billion to $55.5 billion. Economists had forecast a deficit of $54.4 billion. In the details, U.S. exports rose 2% to $210.6 billion as the U.S. shipped more soybeans, planes, autos and networking equipment. However, imports increased a larger 3.3% to $266.2 billion as the U.S. imported more foreign autos, oil, semiconductors, computers and cell phones. The trade gap with China rose slightly in May to $31.1 billion, but that number is running behind last year’s pace due to U.S. tariffs. Overall, the U.S. is still on track to record a larger annual trade deficit in 2019 than last year because trade gaps have expanded with other key partners like Mexico, Europe and Canada.