In the markets:

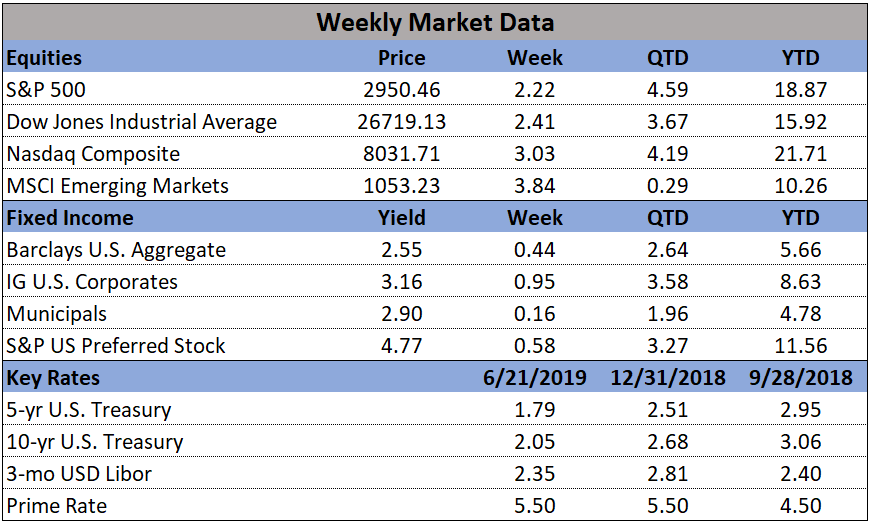

U.S. Markets: The Federal Reserve held rates steady and reinforced investor expectations for an interest rate cut later this year, powering strong gains for stocks and lifting the large cap S&P 500 index to a new record high. The Dow Jones Industrial Average surged 629 points to 26,719, a gain of 2.4%. The technology-heavy NASDAQ Composite rose over 3% regaining the 8,000-level and closing at 8031. By market cap, the large cap S&P 500 index rose 2.2%, while the mid cap S&P 400 gained 1.5% and the small cap Russell 2000 added 1.8%.

International Markets: Canada’s TSX rose 1.4% while the United Kingdom’s FTSE gained 0.8%. On Europe’s mainland, France’s CAC 40 added 3.0%, Germany’s DAX rose 2.0%, and Italy’s Milan FTSE gained 3.8%. In Asia, China’s Shanghai Composite surged 4.2% and Japan’s Nikkei rose 0.7%. As grouped by Morgan Stanley Capital International, developed markets rose 2.5% last week, while emerging markets jumped a robust 4.9%.

Commodities: Gold surged to a multi-year high, rising $55.60 to $1400.10 per ounce, a gain of 4.1%. Silver also finished the week up, rising 3.3% to $15.29 an ounce. Oil surged 9.4% as tensions with Iran spiked and a refinery fire broke out in Philadelphia. West Texas Intermediate crude oil ended the week at $57.43 per barrel. The industrial metal copper, watched by analysts as an indicator of global economic health due to its variety of uses, finished the week up 2.9%.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits fell last week to a one-month low and holding near their lowest level in decades. The Labor Department reported initial jobless claims fell by 6,000 to 216,000. Economists had estimated new claims would only decline by 2,000. The more stable monthly average of new claims, used by analysts to smooth out the more volatile weekly number, edged up by 1,000 to 218,750. Continuing claims, which counts the number of people already receiving benefits, declined by 37,000 to 1.66 million. These claims are near their lowest level since the early 1970’s.

Builders broke ground on fewer homes last month, as housing starts slipped, but the number of building permits rose indicating stronger growth ahead. The Commerce Department reported builders started new homes at a 1.269 million annual pace in May, down 0.9% from April’s pace and down 4.7% from the same time last year. However, the number of applications for permits rose to a seasonally-adjusted 1.3 million annual rate—0.3% higher than April’s rate. The government’s reports on new-home construction and sales are collected from small samples and are often volatile. To get a better read, analysts often look at the year-to-date number, which in this case shows starts are 3.0% lower than during the same period last year.

Sentiment among the nation’s home builders declined this month as old worries continue to weigh on the construction industry. The National Association of Home Builders (NAHB) reported its builder sentiment index fell 2 points to 64, missing the consensus forecast of a one-point increase. The NAHB attributed the decline to the same now-familiar headwinds: the cost of labor, materials, and land. In the latest report, the group also added “excessive regulations” to the list. In the details, the gauge of current sales conditions fell one point to 71, while expectations of sales over the coming six months fell 2 points to 70. Buyer traffic declined a point to 48.

Despite the pessimism among builders, real estate agents report the housing market remains strong. The National Association of Realtors (NAR) reported sales of previously-owned homes were 2.5% higher in May, at a 5.34 million seasonally-adjusted annual pace. The reading beat the consensus forecast of a 5.28 million rate. In addition, the median selling price in May was $277,700—a 4.8% annual increase and the 87th consecutive month of annual price increases. By region, the Northeast saw a 4.7% jump in sales, while in the Midwest sales were up 3.4%. In the South and West sales also ticked up, but by a lower 1.8%. At the current pace of sales, it would take 4.3 months to exhaust available supply, still well below the 6-month threshold that’s traditionally been considered a marker of a balanced market. Properties stayed on the market for an average of 26 days in May, up a bit from 24 days in April but still a sign of a strong seller’s market.

In a pair of reports from research firm IHS Markit, both its flash manufacturing and services Purchasing Managers Indexes (PMIs) dropped to multi-year lows. IHS Markit said its flash manufacturing PMI dropped 0.4 point to 50.1 in June—its worst reading since September of 2009. In addition, its flash services PMI fell to 50.7 from 50.9—its worst reading since March 2016. In its release, Markit noted private-sector output growth has lost momentum in each month since February. In addition, production volumes barely rose and respondents noted “greater risk aversion”. Chris Williamson, chief business economist at Markit tweeted, the “big change since Q1 is that US manufacturing weakness has now spread to services”.

Manufacturing activity in the New York region took a sharp turn for the worse according to the latest data from the New York Federal Reserve. The New York Fed’s Empire State business conditions index posted its largest-ever drop into negative territory this month, declining 26 points to -8.6—its first negative reading in more than two years. Economists had expected a decline of “only” 7.8 points to positive 10. Readings below zero indicate a contraction in activity. The last time the index was negative was in October of 2016. In the details, there was broad-based weakness in the report. The key new-orders index plunged 21.7 points to -12, shipments fell 6.6 points to 9.7, while the index of future activity fell 4.9 points to 25.7. Josh Shapiro, chief U.S. economist at MFR Inc. stated the Empire State index result “was shockingly weak, raising a caution flag about the prospects for other manufacturing data later in the month.”

In the Philadelphia region, manufacturing conditions tumbled to just barely positive in June after registering a four-month high the previous month. The Philadelphia Fed reported its manufacturing activity index came in at just 0.3—down from 16.6 the prior month. In the details, the components declined in June, but remained in positive territory. The new orders index fell 2.7 points to 8.3, while shipments dropped 11 points to 16.6. The current price index plunged 17 points to just 0.6—its lowest reading since October of 2016. However on a positive note, 49% of firms surveyed expected acceleration in the growth rate of production in the third quarter.

In a move that was widely expected, the Federal Reserve left its key interest rate unchanged and signaled it is unlikely to cut borrowing costs for the rest of the year. However, the central bank also left itself plenty of room to maneuver by removing its pledge to be “patient” and stated it would “closely monitor” the economy in light of waning inflation and growing “uncertainties”. At the conclusion of its two day meeting the Fed held its benchmark fed funds rate steady between 2.25% and 2.5%, noting that the labor market “remains strong” and the economy continues to expand at a “moderate” pace. Inflation has tapered off and is running below the 2% level that the Fed considers healthy for the economy. The central bank has now cut its forecast for inflation in 2019, using its preferred gauge, to 1.5% from 1.8% — well below its 2% target. In addition, the Fed indicated if the economy weakens significantly or inflation continues trending lower, the Fed would be prepared to act. “The FOMC will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion,” the Fed said in a statement, dropping its recent buzzword about being “patient.”