In the markets:

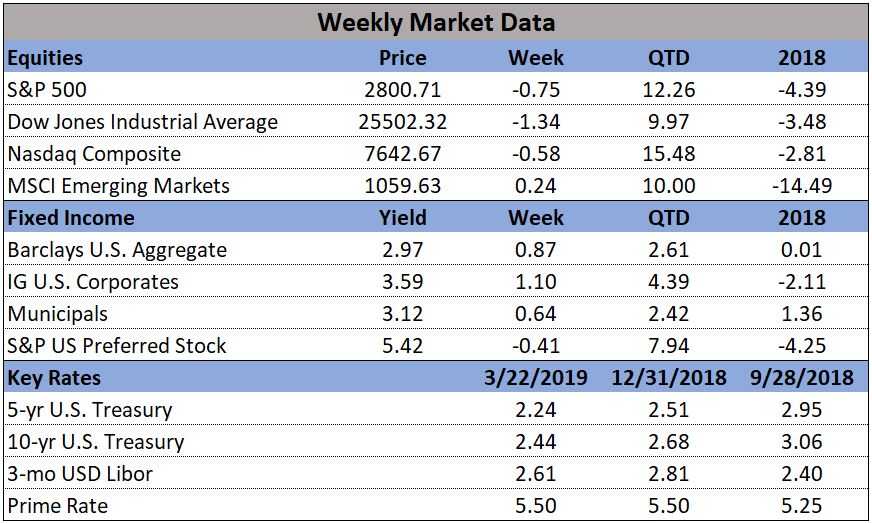

U.S. Markets: U.S. stocks closed lower for the week following a steep sell-off on Friday that took the broad market S&P 500 index down from nearly 6-month highs reached the day before. The Dow Jones Industrial Average gave back all of last week’s gains by falling 346 points, or -1.3%, to close at 25,502. The technology-heavy NASDAQ Composite fell 0.6% ending the week at 7,642. Smaller cap indexes fared the worst with the small cap Russell 2000 declining -3.1% and the mid cap S&P 400 falling -2.2%, while the large cap S&P 500 ended down -0.8%.

International Markets: Canada’s TSX finished the week down -0.3%, while in Europe major markets finished the week in the red. The United Kingdom’s FTSE gave up -0.3%, France’s CAC 40 fell -2.5%, and Germany’s DAX retreated -2.8%. In Asia, China’s Shanghai Composite finished up a second consecutive week by gaining 2.7%. Japan’s Nikkei also finished the week up by 0.8%. As grouped by Morgan Stanley Capital International, developed markets fell -1.4%, while emerging markets gave up -1.5%.

Commodities: Precious metals rose in response to the weakness in the equities markets. Gold gained $9.40, closing the week at $1312.30 an ounce, a gain of 0.7%. Likewise, silver added 0.5%, ending the week at $15.41 per ounce. Energy closed higher for a third consecutive week. West Texas Intermediate crude oil rose 0.9% to close at $59.04 per barrel. The industrial metal copper, seen as an indicator of global economic health due to its wide variety of uses, fell -2.2% last week. Copper has been down 3 out of the past 4 weeks.

U.S. Economic News: Despite a seemingly slower U.S. economy, the labor market remains resilient according to the latest figures. The Labor Department reported the number of Americans filing for new unemployment benefits last week fell by 9,000 to 221,000. Economists had expected claims to rise by 4,000 to 225,000. The less volatile monthly average of new claims rose by 1,000 to 225,000. Both numbers remain far below the 300,000 threshold most analysts use to indicate a “healthy” jobs market. Continuing claims, which counts the number of people already receiving benefits, fell by 27,000 to 1.7 million. That number is reported with a one-week delay.

Sentiment among the nation’s homebuilders remained flat in March as conditions continue to stabilize following some weakness last year. The National Association of Home Builders (NAHB) reported its monthly sentiment index for March remained unchanged at 62, missing economists’ forecasts for a one-point increase to 63. In the details of the report, the index that tracks current sales conditions rose 2 points to 68, and the gauge of sales over the next six months jumped 3 points to 71. However, the index that measures the traffic of prospective buyers fell 4 points to 44. Economists consider the sentiment index an early read on future new construction. “Builders report the market is stabilizing,” NAHB said in its release. Analysts immediately noted that “stabilizing” isn’t the same as “growing.”

Sales of existing homes rebounded in February, surging 11.8% and hitting an 11-month high. The National Association of Realtors (NAR) reported existing-home sales ran at a seasonally-adjusted annual rate of 5.51 million last month, its biggest month-over-month increase since December 2015. The reading easily beat the consensus forecast of a 5.12 million pace. In the details, the February pace of sales was 1.8% lower than a year ago, and the median sales price during the month was $249,500, 3.6% higher compared to a year ago. First-time buyers accounted for 32% of sales in February, still well below their long-time average of 40% and making zero progress since the crisis. Ian Shepherdson, chief economist for Pantheon Macro noted that the February sales numbers, if sustained, “challenge the market narrative that housing is going to be a drag on the economy for the foreseeable future.”

New orders for domestic manufactured goods rose less than expected at the beginning of the year and shipments continued to fall further, according to the Commerce Department’s Factory Orders report. The report serves as further evidence of a slowdown in manufacturing activity. The report showed factory goods orders edged up 0.1% in January, after rising the same amount in December. The data showed decreases in orders for computers and electronic products, as well as declines in demand for primary metals and fabricated metal products. Economists, however, had expected a 0.3% increase. Shipments of factory goods fell 0.4% after dropping 0.2% in December. They have now declined for four consecutive months, the longest streak since mid-2015.

A survey of economic conditions in the U.S. rose last month for the first time in five months. The Conference Board reported its Leading Economic Index (LEI) increased 0.2% in February, potentially a sign that growth is poised to pick up a bit after a slow start at the beginning of the year. The improved reading was spurred by higher stock prices, lower interest rates, and availability of credit. However, those gains were offset by weaker job creation and somewhat higher, though still low by historical standards, levels of layoffs. Six of the 10 components that compose the leading index rose in February. The consensus was for only a 0.1% increase. Of concern, however, is that the LEI is now slowing on a long-term basis. Ataman Ozyildirim, Director of Economic Research at the board stated, “Despite the latest results, the U.S. LEI’s growth rate has slowed over the past six months, suggesting that while the economy will continue to expand in the near-term, its pace of growth could decelerate by year end.”

Business activity in the private sector continued to decelerate in March, suggesting that real GDP growth could be notably weaker in the first quarter than previously anticipated. Research firm Markit reported its Flash Purchasing Managers Index (PMI) for the manufacturing sector fell 0.5 points to 52.5—its lowest level since June of 2017. Markit’s Manufacturing PMI has been down four of the past five months. Output growth was the weakest in almost three years and new orders and employment also expanded at slower rates. Similarly, the Services Flash PMI fell 1.2 points, also down four of the past five months, to 54.8. New services orders growth eased and hiring was the weakest since May of 2017. Optimism about business conditions in the next 12 months took another dip, down to its lowest level since June of 2016.

The Federal Reserve voted to hold rates steady, signaled it’s almost done raising interest rates, said the economy is in a “good place” and that inflation posed little threat. In a radical departure from its earlier forecasts, the Fed now forecasts no further interest rate increases this year and only one in 2020. In December, the Fed had anticipated a total of four future rate hikes. Adding to the dovish policy stance, senior Fed officials also announced they will begin to taper the runoff of its $4 trillion balance sheet in May and end it in September. That is a much quicker ending of “quantitative tightening” than anyone considered just three months ago. Chairman Jerome Powell said the central bank can afford to be patient because the economy is growing at a steady pace, unemployment is low and inflation is tame. “The U.S. economy is in a good place, and we will use our monetary policy tools to keep it there,” Powell said. “It’s a great time for us to be patient and watch and wait to see how things evolve.”