In the markets:

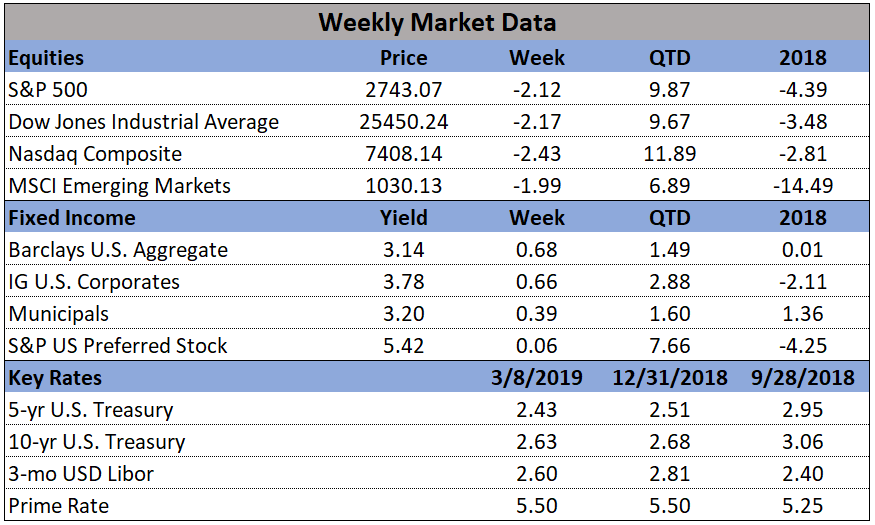

U.S. Markets: U.S. stocks performed poorly this week with major indexes suffering declines almost every trading day. The smaller-cap indexes, which are typically more volatile, fared the worst while the technology-heavy Nasdaq Composite had its first weekly decline since late December. The Dow Jones Industrial Average shed 576 points this week to close at 25,450—a decline of -2.2%. Similarly, the NASDAQ finished down -2.5%. By market cap, the large cap S&P 500 fell -2.2%, the mid cap S&P 400 declined -3.4% and the small cap Russell 2000 dropped -4.3%.

International Markets: International markets were also hit by selling pressure. Canada’s TSX finished down -0.4%, while the United Kingdom’s FTSE was essentially flat. France’s CAC 40 declined -0.6%, Germany’s DAX fell -1.2%, and Italy’s Milan FTSE ended down -1%. In Asia, China’s Shanghai Composite was off -0.8%, and Japan’s Nikkei retreated -2.7%. As grouped by Morgan Stanley Capital International, developed markets gave up -1.8% while emerging markets fell a slightly greater -2%.

Commodities: Gold failed to benefit from the selling in the financial markets. The precious metal ended the week essentially unchanged, up just $0.10 to $1299.30 an ounce. Silver managed a slightly higher gain, up 0.6% to $15.35 an ounce. Oil retraced some of last week’s declined rising 0.5% to $56.07 per barrel. Copper, commonly seen as a barometer of global economic health due to its variety of uses, finished the week down -1.3%, its second consecutive weekly decline.

U.S. Economic News: The number of people applying for new unemployment benefits fell slightly, keeping jobless claims near their lowest levels in fifty years. The Labor Department reported claims fell by 3,000 to 223,000 in the week ended March 2. Economists had forecast a reading of 225,000. The monthly average of new claims, used to smooth out the weekly volatility, also slipped by 3,000 to 226,250. Continuing claims, which counts the number of people already receiving benefits, declined by 50,000 to 1.76 million. That number is reported with a one-week delay. Thomas Simons, senior market economist at Jeffries LLC, noted that layoff activity in the private sector remained minimal. “Survey evidence suggests that employers are generally having a hard time filling positions, so they’re not particularly inclined to be letting go of the workers they currently have.”

The Bureau of Labor Statistics’ monthly Non-Farm Payrolls report (NFP) showed the U.S. added just 20,000 jobs last month, its smallest increase in over a year and a half. The number of new nonfarm jobs created was well below the consensus forecast of 172,000. Hiring was nil in the construction industry and slumped in the retail and shipping industries. Nonetheless, the pace of hiring was strong enough to put further downward pressure on the nation’s unemployment rate, which fell to just 3.8% from 4%. The NFP report showed hiring was strongest among professional firms and health-care companies. Professional firms created 42,000 new jobs and health providers added 21,000 jobs. They also have been the fastest growing industries throughout the nearly 10-year-old expansion.

Private payrolls-processor ADP reported that private hiring slowed to a three-month low last month. According to the economist who prepared the data, private-sector employment “throttled back” in February as employers added just 183,000 new jobs, compared with 300,000 in January. The gain was very close to forecasts of 180,000. In the details of the report, small firms added 12,000 jobs, medium-sized businesses added 95,000, and large companies added 77,000. The slowdown was most pronounced in retail and travel industries, ADP said. The professional-services sector had the biggest gain in February, followed by health care and education. Mark Zandi, chief economist at Moody’s Analytics, said in a statement, “Job gains are still strong, but they have likely seen their high-water mark for this expansion.” Zandi now sees GDP running at a 0.3% annual rate in the first quarter, far below the 2.6% rate reported in the final quarter of last year. This slowdown “will start to show in payroll data,” he said.

Construction of new homes, known as housing starts, surged nearly 19% in January, the Commerce Department reported. The jump brought the annual pace of housing starts to 1.23 million, higher than the 1.21 million rate forecast. Single-family starts increased an even higher 25% in January to a 926,000 rate. Meanwhile, permits to build new homes—a gauge of future building activity, rose 1.4% to an annual rate of 1.35 million, driven by an increase in multi-family housing. However, permits for single-family homes fell 2.1% in January to a pace of 812,000 units, the lowest level since August 2017, suggesting weakness in single-family homebuilding in the months ahead.

Sales of new homes ticked up in December as the housing market managed a slight gain for 2018. The Commerce Department reported new home sales ran at a seasonally-adjusted annual rate of 621,000, up 3.7% from November, but down 2.4% from the same time a year ago. The December reading beat the consensus forecast of a 600,000 rate, but prior months were given sizable downward revisions. The median sales price was $318,700, down 7% from a year ago. At the current sales pace, the housing market has 6.6 months of available supply, a bit more inventory than is generally considered to be a balanced housing market.

Companies that operate on the “service” side of the economy, which makes up roughly 70% of the U.S. economy, grew last month at their fastest pace in three months. The Institute for Supply Management (ISM) reported its Non-Manufacturing Index rebounded 3.0 points in February, the most in over a year, to 59.7 as services activity accelerated markedly. The consensus was for just a 0.5 point gain to 57.2. In the details, the index for production and new orders both rose sharply to near 65—exceptionally strong readings that are their highest in 14 years. In addition, all 18 of the industries tracked by ISM reported their business expanded in February. Joshua Shapiro of MFR Inc. summed up the report succinctly writing, “Absent a trade war with China, the signal here appears to be that all is well.”

The latest Federal Reserve Beige Book, a collection of anecdotal information on current economic conditions by each of the Federal Reserve’s member banks, found “slight” growth in many regions as the government shutdown weighed. Ten of the Federal Reserve’s 12 districts saw “slight-to-moderate” growth in late January and February, while St. Louis and Philadelphia reported “flat economic conditions”. Overall, the tone of the report was somber. The partial government shutdown led to slower activity in six of the Fed’s districts, with the impact hitting a wide range of sectors including retail, auto sales, tourism, real estate, restaurants, and manufacturing. Consumer spending was “mixed” and several districts said retail and auto sales were lower due to harsh winter weather and higher costs of credit. Analysts widely expect the Fed to hold its benchmark interest rate steady at its meeting later this month.