In the markets:

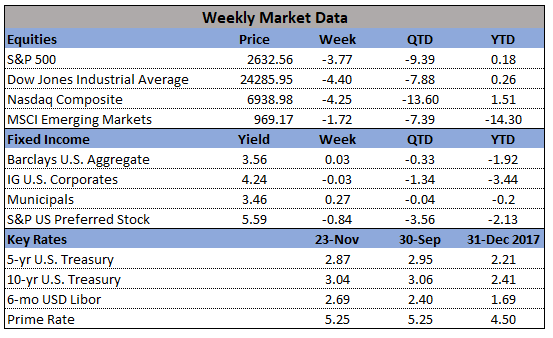

U.S. Markets: U.S. stocks endured a second week of losses, primarily due to sell-offs on Monday and Tuesday. Declines were particularly evident in technology stocks, but energy stocks were also particularly weak as crude oil prices continued to tumble. The Dow Jones Industrial Average fell over 1120 points last week, ending the week at 24,285, a loss of -4.4%. The Nasdaq Composite gave up 309 points, to close at 6,938, a loss of -4.3%. By market cap, the large cap S&P 500 fell -3.8%, the mid cap S&P 400 index gave up -2.2%, and the small cap Russell 2000 ended the week down -2.5%.

U.S. Markets: U.S. stocks endured a second week of losses, primarily due to sell-offs on Monday and Tuesday. Declines were particularly evident in technology stocks, but energy stocks were also particularly weak as crude oil prices continued to tumble. The Dow Jones Industrial Average fell over 1120 points last week, ending the week at 24,285, a loss of -4.4%. The Nasdaq Composite gave up 309 points, to close at 6,938, a loss of -4.3%. By market cap, the large cap S&P 500 fell -3.8%, the mid cap S&P 400 index gave up -2.2%, and the small cap Russell 2000 ended the week down -2.5%.

International Markets: Canada’s TSX fell 1.0%, while across the Atlantic the United Kingdom’s FTSE ended down -0.9%. Major mainland European markets also finished in the red: France’s CAC 40 fell -1.6%, Germany’s DAX retreated -1.3% and Italy’s Milan FTSE ended down -0.9%. In Asia, China’s Shanghai Composite reversed last week’s gain by falling -3.7%. Japan’s Nikkei ended the week down a slight -0.16%. As grouped by Morgan Stanley Capital International, developed markets fell -1.9% while emerging markets ended down -2.8%.

Commodities: Precious metals ended the week mixed. Gold rose just $0.20, closing at $1223.20 an ounce, while Silver reversed most of last week’s gain by falling -1.0% and ending the week at $14.24 an ounce. Energy continued to trade down. Crude oil fell for a seventh consecutive week, collapsing over 11% to $50.42 per barrel. The industrial metal copper, viewed by analysts as an indicator of global economic growth due to its variety of uses, retraced some of last week’s gain by falling -1.1%.

U.S. Economic News: The number of people applying for new unemployment benefits rose by 3,000 to 224,000, hitting its highest level in over four months. Economists had expected claims to decline by 2,000 to 214,000. Notably, the previous week’s reading was revised up by 5,000 to 221,000. The monthly average of new claims, smoothed to iron out the weekly volatility, also increase by 2,000 to 218,500. Although the level of claims rose, they remained low both by historical standards and compared to the size of the labor force.

In the U.S. economy:

Leading indicators show that the U.S. economy  continues to grow, but the pace of that growth is expected to moderate. The Conference Board’s Leading Economic Index (LEI) edged up 0.1% in October, its smallest gain in five months, but beating expectations for an unchanged reading. Five the ten LEI components advanced last month, led by stronger consumer expectations. Over the past six months, the strength among the individual indicators has diminished, but still remains consistent with broad-based growth. Ataman Ozyildirim, economist at the board, stated “The index still points to robust economic growth in early 2019, but the rapid pace of growth may already have peaked. While near-term economic growth should remain strong, longer-term growth is likely to moderate to about 2.5% by mid- to late 2019.” The LEI is a weighted gauge of 10 indicators designed to signal peaks and valleys in the business cycle.

continues to grow, but the pace of that growth is expected to moderate. The Conference Board’s Leading Economic Index (LEI) edged up 0.1% in October, its smallest gain in five months, but beating expectations for an unchanged reading. Five the ten LEI components advanced last month, led by stronger consumer expectations. Over the past six months, the strength among the individual indicators has diminished, but still remains consistent with broad-based growth. Ataman Ozyildirim, economist at the board, stated “The index still points to robust economic growth in early 2019, but the rapid pace of growth may already have peaked. While near-term economic growth should remain strong, longer-term growth is likely to moderate to about 2.5% by mid- to late 2019.” The LEI is a weighted gauge of 10 indicators designed to signal peaks and valleys in the business cycle.

Americans are still optimistic about the U.S. economy, but the recent stock market volatility has made wealthier households more anxious about their financial situations. The University of Michigan’s consumer sentiment index fell 1.1 point to 97.5 this month. The index has been down in four of the past five months, indicating a gradual erosion in consumer sentiment. Both the current conditions and expectations sub-indexes declined. Of note, the biggest decline in sentiment occurred among the wealthiest one-third of U.S. households. This stands to reason, as wealthier Americans are more likely to have more invested in the stock market. In contrast, sentiment among Americans in the bottom third rose sharply.

Looking ahead:

In the week preceding the G20 summit, where U.S. and Chinese presidents Donald Trump and Xi Jinping are expected to meet and discuss a trade agreement, Donald Trump said he is likely to raise tariffs from 10 to 25%, as well as adding more Chinese goods to the tariff list. Trump also threatened Apple’s iPhone and laptop computers with tariffs. If Trump and Xi do not assuage trade worries, U.S. commodities, industrials, manufacturing, and consumer discretionary sectors are expected to take the largest hit. An increase in tariffs will only increase the damage.

Cyber Monday shattered records with $7.9 billion spent online, up 19.3 percent over 2017. Foot traffic in brick & mortar shops is down as more people move to buy online. Transactions on mobile devices is up 55.6 percent, for a total of $2.2 billion in transactions. Amazon, riding on the coattails of the Cyber Monday and Black Friday growth, is expected to capture more than have of the U.S. e-commerce this year. Overall, holiday sales are expected to be up in 4Q 2018. This uptick will likely help markets rally through the end of the year, but may not be enough to outweigh the U.S.-China trade war.

Several large corporations are facing serious issues, namely Facebook, Apple, and General Motors. Facebook remains embroiled in several lawsuits alleging the company disregarded user privacy, as well as an accusation that CEO Mark Zuckerberg illegally forced several competitors out of business. Apple has come under fire for anti-trust allegations, with prosecutors accusing the company of monopolizing the app industry and abusing app developers looking to sell on the App Store. General Motors has entered a full restructuring, laying off 15% of salaried workers and discontinuing 6 vehicle models. The declared goal of the restructuring process is to cut losses on certain lines and free capital to power innovation of clean energy vehicles.