In the markets:

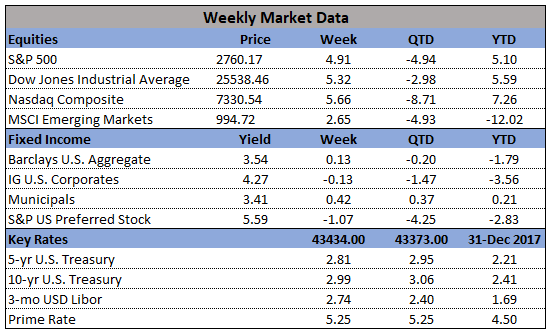

U.S. Markets: The major U.S. indexes rebounded strongly this week as Federal Reserve Chair Jerome Powell said that the federal funds rate is “just below” a neutral level (from his previous “a long way” from neutral), instantly moderating expectation of future interest rate hikes. The comments sparked a rally that lifted the S&P 500 to its best weekly gain since December of 2011. The Dow Jones Industrial Average surged over 1,250 points closing at 25,538, a gain of 5.2%. The technology-heavy NASDAQ Composite rallied 5.6%, ending the week at 7,330. By market cap, the large cap S&P 500 gained 4.8%, while the mid cap S&P 400 and small cap Russell 2000 each rose 3.0%.

International Markets: Canada’s TSX retraced all of last week’s loss by closing up by 1.2%. In Europe, the United Kingdom’s FTSE 100 rose 0.4%, while on the mainland France’s CAC 40 rose 1.2%, Germany’s DAX closed up 0.6%, and Italy’s Milan FTSE added 2.5%. In Asia, China’s Shanghai Composite added 0.3%, Japan’s Nikkei surged 3.3%, and Hong Kong’s Hang Seng rose 2.2%. As grouped by Morgan Stanley Capital International, developed markets rose 1.6%, while emerging markets jumped 3.4%.

Commodities: Precious metals finished the week slightly down with Gold losing a quarter of a percent to end the week at $1220.20 an ounce, while Silver gave up -0.2% to close at $14.22 an ounce. Oil had its first positive week in two months by rising 1.0%, closing at $50.93 per barrel for West Texas Intermediate crude. Copper, also known as “Dr. Copper” by some analysts for its ability to forecast global economic growth due to its variety of industrial uses, rose 0.76%.

November Summary: For the month of November, the Dow Jones Industrial Average rose 1.7%, while the NASDAQ Composite added just 0.3%. By market cap, the S&P 500 gained 1.8%, mid caps added 2.9%, and small caps rose 1.4%. Canada’s TSX rose 1.1%, while the FTSE retreated -2.1%. France’s CAC 40 shed -1.8%, Germany’s DAX lost -1.7%, but Italy’s Milan FTSE rose 0.7%. China’s Shanghai Composite was off -0.6%, while Japan’s Nikkei rose 2%. Developed markets as a group rose 0.5%, while emerging markets as a group rebounded by a much larger 4.9%. Precious metals were mixed, with gold rising 0.4% and silver slipping -0.4%. The industrial metal copper rose 4.9%. Oil was the worst asset class by a mile, plunging over -22%.

U.S. Economic News: The number of Americans who applied for first-time unemployment benefits last week hit a 6-month high, but the reading remained well below historical standards. The Labor Department reported that initial claims for unemployment insurance rose 10,000 to 234,000, its third consecutive increase. The consensus was for a decline of 4,000 to 220,000. The four-week moving average of claims, which smooths out the week-to-week volatility, rose 4,750 to 223,250—its highest level in five months. Still, the reading is extremely low by historical standards, and economists state labor market conditions remain tight.

In the U.S. Economy:

Confidence among the nation’s consumers pulled back slightly, according to the Conference Board’s Consumer Confidence Index which fell 2.2 points this month to 135.7—its first decline in five months. Still, the index remained near its highest level since October 2000 and continues to indicate above-trend economic expansion. The decline last month was predominantly due to a 4.1-point slide in consumer expectations, the most in almost a year, as the outlook for business conditions and income growth moderated. The present situation index—how Americans feel about the economy right now - rose 0.8 point to 172.7, its highest level since December 2000. Consumer purchasing plans for the next six months were broadly in line with seasonal expectations. Lynn Franco, senior director of economic indicators at the board noted, “Overall, consumers are still quite confident that economic growth will continue at a solid pace into early 2019. However, if expectations soften further in the coming months, the pace of growth is likely to begin moderating.”

In the Windy City, a broad measure of the U.S. economy from the Chicago Federal Reserve showed slightly stronger growth last month. The Chicago Fed National Activity Index increased to 0.24 in October from 0.14 in the previous month. Due to the volatile nature of this indicator, analysts prefer to look at the three-month moving average which ticked up to 0.31 from 0.30. This suggests a modest acceleration of economic growth during the course of the fourth quarter. Only one of the four broad categories of indicators increased last month, but three continued to make positive contributions to the index. The Chicago Fed index is a weighted average of 85 economic indicators, designed so that zero represents trend growth and a three-month average above 0.70 suggests an increasing likelihood of a period of sustained increasing inflation. The Diffusion Index, which is based on 85 individual indicators, climbed 0.08 point to 0.32—its highest level this year and consistent with above-trend growth.

The government’s Bureau of Economic Analysis reported that the economy grew 3.5% in the third quarter, matching consensus forecasts and keeping the economy on track for around 3% growth for the year. In addition, on a year-over-year basis, real GDP was up 3.0% - its fastest pace since the second quarter of 2015. In the details, corporate profits from current production increased 3.4% in the third quarter, the most since 2014. The increase was led by a solid gain in domestic non-financial industries. Profits were up 10.3% year-over-year as companies locked in benefits from the lower corporate tax rate. However, the main engine of the U.S. economy, consumer spending, rose at a 3.6% pace instead of the earlier-reported 4%, and the increase in state and local government spending was trimmed -1.2% to just 2%. Richard Moody, chief economist at Regions Financial summed up the report stating, “The bottom line here is that the U.S. economy carried a good deal of momentum into the home stretch of 2018 and 2019 should be another year of solid growth, even if growth falls a bit shy of this year’s pace.”

Looking Ahead:

On Saturday, U.S. President Donald Trump and Chinese President Xi Jinping had a two-hour working dinner at the G20 summit in Argentina. The result was a 90-day trade truce between the two nations, and a tentative promise from China to “buy significantly more goods to help correct the trade imbalance”. Markets were elated by the news, with the Dow opening 427 points (1.7%) higher on Monday morning. As long as trade talks continue to go well, this meeting could mark the end of rising trade tensions between the two nations. Markets will continue to reward positive trade talks and improved relationships. U.S. commodities markets also jumped at the news of increased imports from China.

As we enter the final month of 2018, markets are appearing to recover from the bruising they received in October and November. That said, 90% of 70 asset classes are still projected to post negative earnings for the year. According to Deutsche Bank, this has not occurred for more than a quarter of a century.

Finally:

Many investors, despite being invested in diversified portfolios, have seen a significant decrease in the balances of their investment accounts. Despite the instinct to blame oneself or one’s financial advisor, it is important to realize that there were very few safe harbors from the damages of the October-November swoon. Stocks and bonds fell across the board, and Treasury yields fell all quarter long. To take a lesson from Warren Buffet, “When the market is down don’t sell, BUY!”