In the markets:

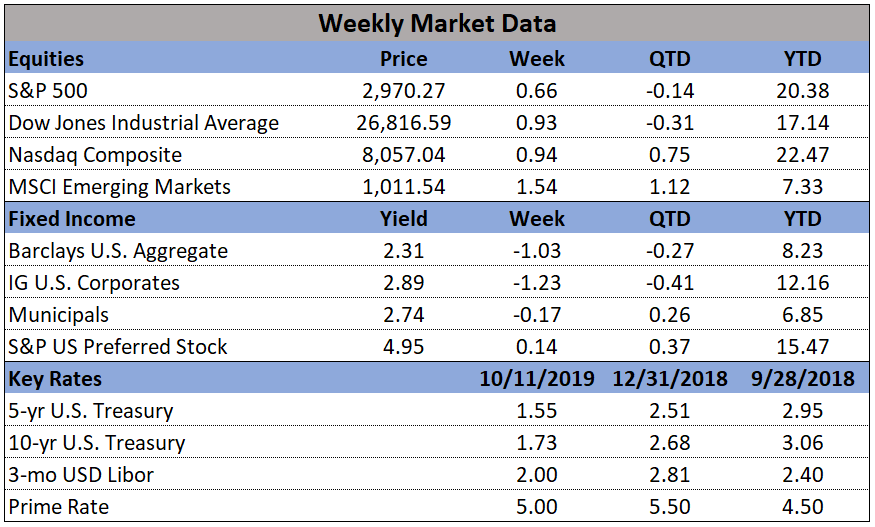

U.S. Markets: Reports of progress in U.S.-China trade negotiations sent stocks soaring higher on Friday, lifting the S&P 500 to its best daily gain in two months. All of the major U.S. indexes recorded gains for the week with the technology-heavy NASDAQ Composite faring the best. The NASDAQ regained the 8,000-level rising 74 points, or 0.93%, to end the week at 8,057. The Dow Jones Industrial added 242 points finishing the week at 26,816, also a gain of 0.9%. By market cap, the large cap S&P 500 added 0.6%, the midcap S&P 400 rose 0.7%, and the small cap Russell 2000 rebounded the most, up 0.8%.

International Markets: Canada’s TSX was the only major international market to finish down, giving up -0.2%. Across the Atlantic, the United Kingdom’s FTSE rebounded 1.3%, while France’s CAC 40 rose 3.2%, Germany’s DAX added 4.2%, and Italy’s Milan FTSE gained 3.2%. In Asia, China’s Shanghai Composite added 2.4% while Japan’s Nikkei added 1.8%. As grouped by Morgan Stanley Capital International, developed markets rose 2.2% last week, while emerging markets added 1.9%.

Commodities: Precious metals sold off as equity markets rallied. Gold retreated -1.6%, or $24.20, ending the week at $1488.70 an ounce. Silver gave up -0.5%, closing at $17.54 an ounce. Following two consecutive down weeks, West Texas Intermediate crude oil rebounded 3.6% finishing the week at $54.70 per barrel. The industrial metal copper, viewed by many analysts as a barometer of global economic health due to its variety of uses, finished the week up 2.6%.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits fell last week, remaining near a 50-year low. The Labor Department reported applications for U.S. unemployment benefits declined by 10,000 to 210,000. Economists had expected new claims would total a seasonally-adjusted 220,000. The reading showed that layoffs still haven’t risen despite signs that hiring and the economy have slowed. In the report, claims remained elevated in Ohio and Michigan—two states with large auto industries. Some 250,000 workers have been on strike for nearly a month and the prolonged standoff has forced parts suppliers to idle workers as well. The more stable monthly average of new claims, meanwhile, edged up by 1,000 to 213,750 nationwide. Continuing claims, which counts the number of people already collecting unemployment benefits, increased by 29,000 to 1.68 million. These claims have remained below 2 million since early 2017.

The number of job openings fell to an 18-month low in August as hiring and the economy continue to slow. The Labor Department’s JOLTS (Job Openings and Labor Turnover Survey) report showed that job openings slipped to 7.05 million from 7.17 million in July—its third consecutive decline. Although the number of job openings still far exceeded the number of Americans officially classified as unemployed (5.8 million), they’ve declined almost 8% since the beginning of the year. In the details, openings fell the most in manufacturing and information services such as media and public relations, while more jobs were available in trade, transportation, and construction. The closely-watched “quits rate”, which counts the number of people leaving their jobs voluntarily (presumably for a better paying one) slipped to 2.6% from 2.7% among private-sector employees. The quit rate for private-sector workers bottomed out at 1.4% at the end of the 2007-2009 Great Recession and has hovered at or near a cycle peak of 2.6% for the past year.

Despite fears of a looming recession, the sentiment of the nation’s consumers rebounded to a three-month high, according to preliminary data released by the University of Michigan. U of M’s October print on consumer sentiment rose 2.8 points to 96, while its current economic conditions reading also rose 4.9 points to 113.4. Although the U.S.-China trade dispute has yet to be resolved and concerns over Britain’s exit from the European Union remain, the data overall indicates that consumer spending will be strong enough to keep the record-long expansion alive. However, most consumers expect to see a slowdown next year. "A slower pace of overall economic growth is still anticipated, including some modest increases in the national unemployment rate during the year ahead," the report said.

Sentiment among the nation’s small business owners fell to near the lowest level of Donald Trump’s presidency, as tariffs and economic uncertainty continued to weigh on the outlook of owners across the country. The National Federation of Independent Business (NFIB) optimism index declined 1.3 points to 101.8 in September. The reading was its third drop in four months. While the gauge remains elevated by historical standards, the reading is its lowest since March and close to January’s 101.2, which was the weakest reading since Trump’s term began in early 2017. Analysts expected a reading of 102. The report adds to signs that the economy is cooling but not yet sliding into recession.

At the consumer level, inflation in the U.S. remained in check last month, led by falling prices in gasoline and vehicles. The Bureau of Labor Statistics reported consumer-price inflation remained flat in September—its smallest change since the beginning of the year. Economists had expected a 0.1% advance. Over the past 12 months, the increase in the cost of living remained unchanged at 1.7%. The low rate of inflation, reflected in the CPI as well as other price barometers, may give the Federal Reserve the freedom to trim rates if growth in the economy continues to slow. Core CPI, which strips out the volatile food and energy components, ticked up 0.1% in September. The yearly increase in the core rate remained unchanged at 2.4%.

Prices sank at the wholesale level in September, indicating lower inflation ahead. The Producer Price Index (PPI) posted its steepest decline last month since the beginning of the year, falling -0.3%. Economists had expected a gain of 0.1%. The decline lowered the annual rate of wholesale inflation to 1.4% from 1.8% - its lowest level in almost three years. Similarly, the “core” measure that strips out the volatile food, energy, and trade-margin categories remained flat in September. The annual rate of the core PPI dropped to 1.7% from 1.9%. In the details, wholesale prices for goods fell -0.4%, with three-quarters of the decline reflecting the lower cost of gasoline. Wholesale food prices rose 0.3%, however. Overall, the report signals there doesn’t appear to be any inflation building up at earlier stages of the production process.

Federal Reserve Chairman Jerome Powell stated the consensus among his colleagues at the Federal Open Market Committee (FOMC) of the U.S. central bank is that the record-long U.S. economic expansion can continue, but there are risks. “FOMC participants continue to see a sustained expansion of economic activity, strong labor market conditions, and inflation near our symmetric 2 percent objective as most likely. Many outside forecasters agree,” Powell told the National Association for Business Economics annual meeting in Denver. Acknowledging recent economic data Powell stated, “Clearly things are slowing a bit,” but he added this might be another pause that refreshes the expansion. These slowdowns have occurred a few times in this expansion, he noted. Officials will meet again on Oct. 29-30; investors see an 80% chance the Fed will trim rates at that meeting by another quarter point to a range of 1.5-1.75% according to the CME Group’s FedWatch tool.