In the markets:

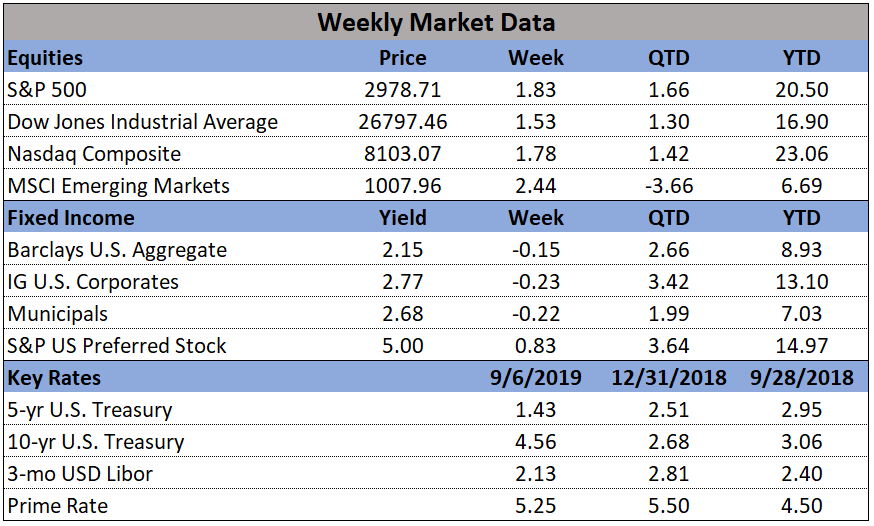

U.S. Markets: Domestic markets recorded a second week of gains as optimism grew that progress would be made in the U.S.-China trade dispute. The Dow Jones Industrial Average gained 394 points last week and closed at 26,798, a gain of 1.5%. The technology-heavy NASDAQ Composite added 1.8% and regained the 8000-level finishing the week at 8,103. By market cap, the large-cap S&P 500 returned to within 2% of its recent highs adding 1.8%. The S&P 400 Mid Cap index and small cap Russell 2000 index rose 1.6% and 0.7%, respectively.

International Markets: Canada’s TSX gained 0.6% while the United Kingdom’s FTSE added 1.0%. On Europe’s mainland France and Germany each rose for a third consecutive week. France’s CAC 40 tacked on an additional 2.3% while Germany’s DAX gained 2.1%. In Asia, China’s Shanghai Composite surged 3.9% and Japan’s Nikkei rallied 2.4%. As grouped by Morgan Stanley Capital International, developed markets rose 2.1%, while emerging markets added 2.6%.

Commodities: Precious metals reined in some of their recent gains, restrained by the strength in the equities markets. Gold retreated -$13.90 to $1515.50 an ounce, a decline of -0.9%. Silver spiked to over $19.50 an ounce before closing down -1.2% to $18.12 an ounce. Oil managed a second week of gains, West Texas Intermediate crude oil rose 2.6% to $56.52 per barrel. The industrial metal copper, sometimes referred to as “Dr. Copper” for its ability to forecast global economic growth, rallied 3.2%.

U.S. Economic News: The number of Americans seeking first-time unemployment benefits ticked up last week, but remained near their lowest levels in almost half a century. The Labor Department reported initial jobless claims edged up by 1,000 to 217,000 last week, exceeding the consensus forecast of 213,000. The less-volatile monthly average of new claims rose by 1,500 to 216,250. Thomas Simons, senior money market economist at Jefferies LLC wrote in a note to clients, “The labor market remains tight and solid, layoff activity is light and there is no evidence in the economic data that suggests that these conditions will change any time soon.” Continuing claims, which counts the number of people already receiving benefits, fell by 39,000 to 1.66 million.

Payrolls processor ADP reported 195,000 private-sector jobs were added last month. Economists had only expected 150,000. By size, small businesses added 66,000 jobs, medium-sized 77,000, and large companies added 52,000. By occupation the strength was concentrated in education and the healthcare sectors. Paul Ashworth, chief U.S. economist at Capital Economics, stated “The U.S. economy is hanging in there, even though the manufacturing sector specifically is in recession.”

Contrary to the cheery ADP number reported above, the Bureau of Labor Statistics’ monthly Non-Farm Payrolls (NFP) said the economy added just 130,000 new jobs in August. The reading was the smallest increase in three months, giving further evidence to analysts that hiring is slowing amid global growing trade tensions. Economists had forecast that 170,000 new jobs would be added. Analysts note the soft employment figures mean the Federal Reserve is still on track to cut interest rates at its meeting later this month. The gain was even weaker if hiring tied to the upcoming U.S. census is stripped out. The government reported the private sector added less than 100,000 new jobs last month, just a little more than half the number reported by ADP above. Chief U.S. economist Steven Blitz of TS Lombard stated, “When the numbers soften like this, the economy is slowing.” The unemployment rate remained unchanged at 3.7%.

A pair of surveys of the manufacturing sector revealed that the manufacturing sector remains under pressure as U.S.-China trade tensions persist. The Institute for Supply Management (ISM) acknowledged a “notable decrease” in business confidence in its latest manufacturing survey. ISM’s manufacturing index for August fell to 49.1 from 51.2 in July. Readings below 50 indicate a contraction in activity. The latest reading is the lowest since January of 2016. Economists had expected the index to slip to just 51.0. In the details of the report, the new orders index sank 3.6 points to 47.2, while the production index fell 1.3 points to 49.5. Of the eighteen manufacturing industries surveyed, only nine reported growth and only three reported gains in new orders. Separately, IHS Markit reported that its manufacturing Purchasing Managers Index (PMI) improved moderately in the final reading in August. The index rose to 50.3 in August from the 49.9 flash reading. It was still below July’s 50.4 and is the lowest reading since September 2009. Richard Moody, chief economist at Regions Financial Corp., stated that inventory overhang, slowing vehicle sales, and Boeing’s trouble with its 737 MAX have all contributed to the sector’s weakness.

The U.S. trade deficit declined 2.7% in July, but the overall trade gap is still huge and growing, analysts say. Higher exports of drugs, oil, and vehicles lowered the trade deficit by 3% in July, but the nation’s trade gap is still greater now than at the same time last year. The deficit now stands at $54 billion, down $1.5 billion from June, the government said. Economists had forecast a deficit of $53.4 billion. Although the deficit with China has fallen after the imposition of U.S. tariffs, the gap has increased with Mexico, the European Union and South Korea. The U.S. trade gap through the first seven months of 2019 totaled $374 billion vs. $346 billion in the same span in 2018.

The Federal Reserve’s “Beige Book”, a collection of anecdotal information on current economic conditions from each of its twelve districts, found economic activity was holding steady or improving in most sectors except manufacturing and farming. The overall economy expanded at the same “modest pace” seen in earlier reports this year, the survey said. While there was continued uncertainty over U.S. trade policy with China, a majority of business owners “remain optimistic about the near-term outlook,” the Fed found. Manufacturing and agriculture were the two weak spots in the late summer. Many economists think that weak manufacturing and agriculture will not be enough to push the economy into a recession. This edition of the Beige Book report seems to fit with the same 2% growth rate seen in the first half of the year.

Federal Reserve Chairman Jerome Powell stated Friday that the most recent monthly gauge of the U.S. labor market fit into an overall picture of a robust jobs market and economy. In a question-and-answer session Powell said the outlook for the economy remains favorable and the future is likely to be one of moderate economic expansion. Powell said the central bank is “not forecasting or expecting, a recession.” “Incoming data for the U.S. suggests that the most likely outlook for the U.S. is still moderate growth, a strong labor market, and inflation continuing to move back up,” he said. Repeating his message from Jackson Hole, Wyo., Powell said there are “significant” downside risks facing the economy and said the Fed is going to monitor all these factors.