Major U.S stock indices were down for the week on growing concerns of a potential trade war with China. However our Short Term Indicator turned Bullish based on strong fundamentals.

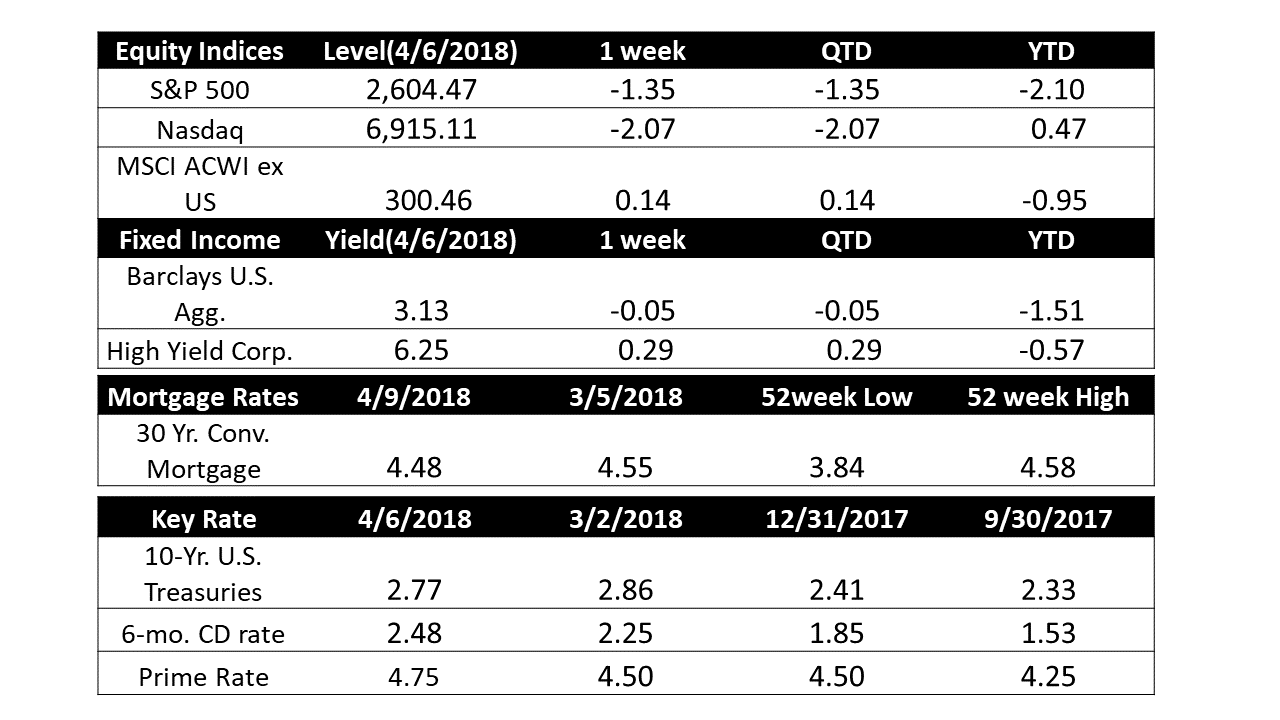

- U.S. Markets: Growing tensions between China and the United States exacerbated fears of an all-out trade war between the world’s top two economies. China announced that it would retaliate for the U.S. tariffs on steel and aluminum with new tariffs on its own targeting roughly 130 U.S. products. The U.S. countered with an additional list of proposed tariffs on 1,300 Chinese products. The tit-for-tat escalation led the Dow Jones Industrial Average to a -170 point loss for the week closing at 23,932. The technology-heavy NASDAQ Composite suffered a steeper -2.1% decline ending the week at 6.915. By market cap, small caps showed slight relative strength with the small cap Russell 2000 ending down -1.05%, while the large cap S&P 500 and mid cap S&P 400 retreated ‑1.4% and ‑1.3%, respectively.

- International Markets: Canada’s TSX retraced all of last week’s gain falling -1%. Across the Atlantic, the United Kingdom’s FTSE had a second strong week of gains, rising 1.8%. On Europe’s mainland, major markets were green across the board. France’s CAC 40 added 1.8%, Germany’s DAX gained 1.2%, and Italy’s Milan FTSE surged 2.3%. In Asia, markets were mixed. China’s Shanghai Composite retreated -0.9%, while Japan’s Nikkei followed last week’s strong performance with an additional 1.9% gain. Hong Kong’s Hang Seng Index finished down -0.8%. As grouped by Morgan Stanley Capital International, developed markets finished down -0.4% despite Europe’s gains, and emerging markets fell -2.5%.

- Commodities: As a safe-haven from all the volatility in the stock market, investors flocked to precious metals for refuge. Gold rose 0.7%, or $8.80 an ounce ending the week at $1336.10. Similarly, silver added 0.6% to close at $16.36 an ounce. The industrial metal copper, viewed as a barometer of global economic health due to its variety of uses, gained 1.2% last week. Energy, however, had its second week of losses falling over -4.4%. West Texas Intermediate crude oil fell -$2.88 per barrel, ending the week at $62.06. Brent North Sea crude oil finished down -3.2% finishing trading at $67.11 a barrel.

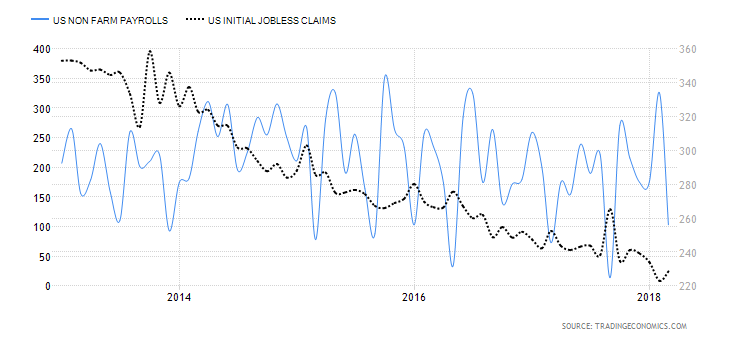

- Interest Rates : The Fed Chair Powell commented on a gradual interest rate hike , given the unemployment remained unchanged. The Fed had raised interest rates by a quarter of a percentage point in March, to a range of 1.5 percent to 1.75 percent. Officials indicated that they considered the economy and labor market to be healthy, and that they expected to raise rates twice more this year and three times in 2019.

- U.S. Economic News: The Labor Department said the number of Americans seeking new unemployment benefits jumped by 24,000 to 242,000 last week, but remained near historically low levels. Analysts consider readings below 300,000 as indicative of a “healthy” jobs market. Claims have been below the key 300,000 threshold for 161 consecutive weeks, the longest stretch since the late 1960’s. The unemployment rate remained unchanged at 4.1%. For more information on this please click here.

-

International Economic News: Japan and China scheduled their first high-level economic talks in more than 8 years later this month as both countries look forward to promoting better bilateral ties ahead of a three-way summit with South Korea scheduled in May. Chinese Foreign Minister Wang Yi plans to visit Japan later this month to discuss cooperation on China’s Belt and Road Initiative as well as trade and investment with his Japanese counterpart Taro Kono. Also attending will be Chinese Commerce Minister Zhong Shan and Finance Minister Liu Kun. The leaders of the two countries will also discuss cooperation on the “free and open indo-Pacific” strategy championed by Japanese Prime Minister Shinzo Abe.

Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.