Most of the major U.S. indexes closed higher for the week as large declines on Wednesday were offset by a strong rally on Thursday.

U.S. Markets: The Dow Jones Industrial Average added 356 points for the week, closing at 25,669 for a gain of 1.4%. The technology-heavy NASDAQ Composite, however, reversed last week’s gain and fell ‑0.3%. By market cap, mid caps led the way with a 0.7% gain, while the large cap S&P 500 index rose 0.6% and small cap Russell 2000 added 0.4%.

International Markets: Canada’s TSX ended the week essentially flat, down just -0.02%. In Europe major markets finished the week in the red with the United Kingdom’s FTSE off by -1.4%, while France’s CAC 40 and Germany’s DAX down -1.3% and -1.7%, respectively. In Asia, China’s Shanghai Composite and Hong Kong’s Hang Seng plunged -4.5% and -4.1%, while Japan’s Nikkei managed a loss of just -0.1%. As grouped by Morgan Stanley Capital International, emerging markets finished down a third consecutive week, off -2.3%, while developed markets ended the week down -0.4%.

Commodities: Energy finished down a third consecutive week with West Texas Intermediate crude oil closing at $65.21 per barrel, a loss of -3.6%. Precious metals continued their downtrend as well. Gold retreated -2.9% to close at $1,184.20 an ounce, while Silver gave up -4.3%, closing out the week at $14.63 an ounce. Copper, seen by some analysts as an indicator of global economic health due to its variety of uses, fell for a third straight week by falling over -4%.

U.S. Economic News: The number of Americans applying for new unemployment benefits fell again last week, back to near their post-recession lows. The Labor Department reported Initial Jobless Claims declined by 2,000 to 212,000. Economists had forecast a reading of 215,000. The more stable monthly average of new claims declined 1,000 to 215,500. Layoffs remain near their lowest levels of the past 50 years. Continuing claims, which counts the number of people already collecting unemployment benefits, dropped by 39,000 to 1.72 million. Chief economist Stephen Stanley of Amherst Pierpont Securities stated, “Initial claims appear to be trending gently lower this year from levels that were already the lowest in decades.”

International Economic News:

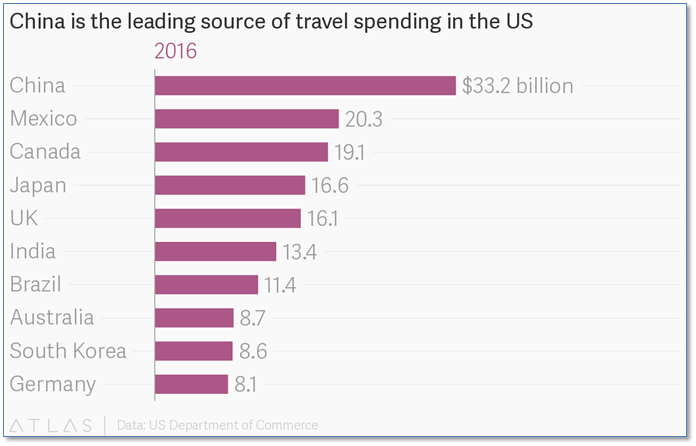

The Trump administration and China agreed to resume trade talks for the first time in more than two months. The news triggered the biggest stock surge in four months. Top White House economic adviser Larry Kudlow said that China would send its vice commerce minister Wang Shouwen for talks in Washington with U.S. Treasury undersecretary for international affairs David Malpass. While not necessarily a breakthrough, Brookings Institute senior China fellow David Dollar indicated they were a positive step towards preventing further escalation. "They're talking about talking", he said. Rajiv Biswas, Asia Pacific chief economist at IHS Markit stated, “Wang Shouwen faces a very difficult negotiation to try to bridge the large gulf in positions between China and the US. Although the resumption of US-China trade talks is good news, the process of finding a trade deal is likely to be protracted.”

- Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.