In the markets:

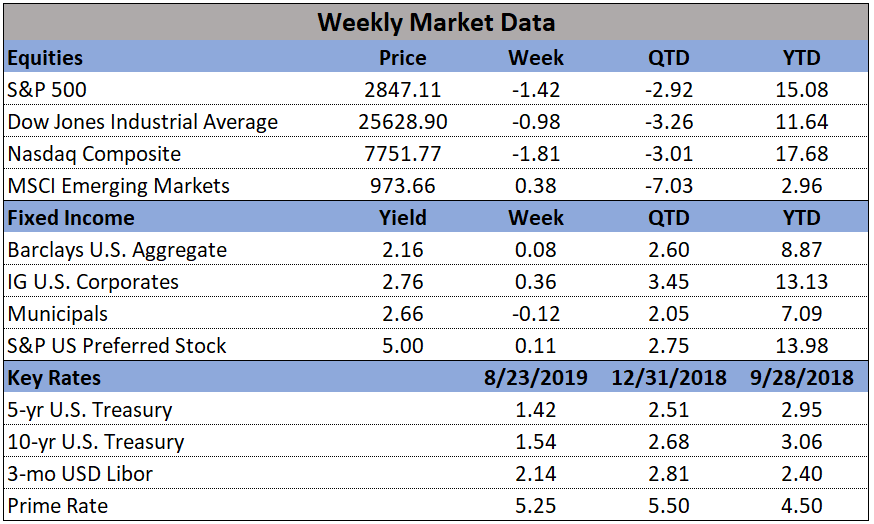

U.S. Markets: U.S. markets suffered their fourth consecutive week of losses as the lingering trade dispute between China and the U.S. escalated dramatically at the end of the week. Friday started with China announcing retaliatory tariffs on $75 billion worth of U.S. goods. President Trump responded in a torrent of tweets that “American companies are hereby ordered to immediately start looking for an alternative to China…” - sending financial markets into a tailspin. The Dow Jones Industrial Average retreated -1.0% to end the week at 25,629. The technology-heavy NASDAQ Composite fell a steeper -1.8% and closed at 7,751. By market cap, large caps fared the best with the S&P 500 finishing down -1.4%, while the mid cap S&P 400 and small cap Russell 2000 retreated -2.0% and -2.3%, respectively.

International Markets: International markets were a mixed bag of gains and losses. Canada’s TSX and the UK’s FTSE finished down -0.7% and -0.3%, respectively, but major markets on the European mainland were mostly up. France’s CAC 40 rose 0.5% and Germany’s DAX added 0.4%. Italy’s Milan FTSE gained 0.7%. In Asia, China’s Shanghai Composite rebounded 2.6% while Japan’s Nikkei rose 1.4%. As grouped by Morgan Stanley Capital International, developed markets gave up -0.5% last week, while emerging markets retreated -1.2%.

Commodities: Precious metals continued to benefit from the woes of the financial markets. Gold rose $14 to $1537.60 per ounce, a gain of 0.9%. Silver rose 1.7% to $17.41 per ounce. Energy, though, retraced all of last week’s gain and finished the week lower. West Texas Intermediate crude oil finished the week down -1.2% to $54.17 per barrel. The industrial metal copper, seen by analysts as an indicator of global economic health due to its wide variety of uses, retreated -2.5%.

U.S. Economic News: The number of Americans seeking first-time unemployment benefits fell last week, suggesting a slower economy has yet to impact the country’s labor market. The Labor Department reported initial jobless claims declined by 12,000 to 209,000—back to near 50-year lows. Economists expected claims to total a seasonally-adjusted 215,000. The less volatile monthly average of new claims remained relatively unchanged, rising just 500 to 214,500. Continuing claims, which counts the number of people already receiving benefits, fell by 54,000 to 1.67 million. That number also remains near a 40-year low.

Sales of existing homes rose 2.5% last month, a positive reversal after total sales were down the previous month the National Association of Realtors (NAR) reported. Although transactions in the Northeast declined, the other three major U.S. regions all recorded sales increases. Total sales were at a seasonally-adjusted annual rate of 5.42 million in July, up 0.6% from the same time last year. NAR chief economist Lawrence Yun attributed the increase to lower mortgage rates stating, “Falling mortgage rates are improving housing affordability and nudging buyers into the market; however, the supply of affordable housing is severely low.” The median existing-home price for all housing types in July was $280,800, up 4.3% from July 2018 ($269,300). July’s price increase marks the 89th straight month of year-over-year gains.

Manufacturing activity in the U.S. fell into contraction for the first time since September of 2009, according to research firm Markit. Markit reported its Flash Manufacturing Purchasing Managers’ Index (PMI) fell 0.5 points to 49.9 this month, with the components that measure new orders and exports both shrinking at their fastest pace in a decade. The collapse in demand was attributed to weakness in the auto sector and overall global economy. Inventories also adjusted lower as uncertainty continued to grow over future demand.

For the services side of the economy, which makes up the vast majority of the U.S. economy, Markit reported its flash PMI dropped 2.1 points to 50.9, remaining just barely in expansion. The reading was a three-month low. In the details, new orders were the weakest since March of 2016 and backlogs declined for the first time this year. Both indicators suggest weaker demand going forward. Furthermore, business expectations for the next 12 months were at their lowest level since data started being tracked nearly a decade ago.

Minutes from the Federal Reserve’s Open Market Committee (FOMC) meeting in July revealed that Fed officials agreed to cut short-term interest rates but that the cut was a “recalibration” rather than a “pre-set course” for more easing. The minutes also showed that two members were in favor of a 50 basis point cut, based primarily on weak inflation readings. The summary indicated that policymakers viewed the move as a “mid-cycle adjustment,” an expression Chairman Jerome Powell used in a news conference afterward that was seen as contributing to a stock market sell-off after the July 30-31 meeting. Markets had been pricing in an interest rate easing cycle, so Powell’s use of the term raised concern that the Fed might not be as accommodative with policy as had been priced in. This is old news now, of course, but ultimately the FOMC voted to lower the central bank’s benchmark rate by 25 basis points to a target range of 2% to 2.5%. It was the first rate cut in 11 years, dating to the financial crisis.