In the markets:

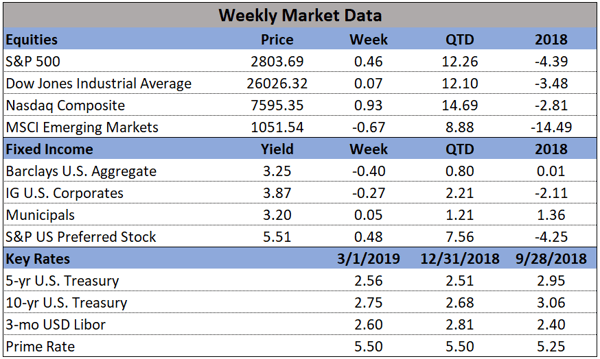

U.S. Markets: The major U.S. market indexes finished the week in mixed fashion, with the technology-heavy NASDAQ Composite performing the best while smaller-cap benchmarks lagged. The Dow Jones Industrial Average was essentially unchanged declining just 5 points to 26,026 while the NASDAQ gained 0.9% finishing the week at 7,595. By market cap, the large cap S&P 500 rose 0.4%, while the mid cap S&P 400 declined -0.4%, and the small cap Russell 2000 finished the week essentially flat.

International Markets: International markets were mixed on the week. Canada’s TSX rose 0.3% while the United Kingdom’s FTSE finished down -1%. On Europe’s mainland France’s CAC 40 added 0.9%, Germany’s DAX finished up 1.3%, and Italy’s Milan FTSE rose 2.1%. In Asia, China’s Shanghai Composite surged 6.8%, while Japan’s Nikkei gained 0.8%. As grouped by Morgan Stanley Capital International, developed markets added 0.8% while emerging markets finished down -1.3%.

Commodities: Following two weeks of gains, Gold ended the week down -2.5% (-$33.60) to $1299.20 an ounce. Silver finished the week down a steeper -4.1% to $15.26 an ounce. Crude oil also retreated after two weeks of gains, giving up -2.6% to $55.80 per barrel for West Texas Intermediate crude. Copper, seen as an indicator of global economic health due its variety of industrial uses, retreated -0.7%.

February Summary: Major markets around the world were positive in February. The Dow Jones Industrial Average rose 3.7% and the NASDAQ Composite gained 3.4%. The large cap S&P 500 added 3%, the mid cap S&P 400 rose 4.1%, and the small cap Russell 2000 gained 5.1%. Major international markets were also green across the board. Canada’s TSX added 2.9% and the United Kingdom’s FTSE gained 1.5%. France’s CAC 40 added 5%, Germany’s DAX rose 3.1%, and Italy’s FTSE MIB gained 4.7%. In Asia, China’s Shanghai Composite surged 13.8% and Japan’s Nikkei rose 2.9%. However, many secondary emerging markets did not fare as well. Emerging markets, as a group, were off -1.5%, while developed markets, as a group, rose 2.5%. Precious metals finished in the red with Gold off -0.7% and Silver down -2.7%. Oil had a strong month of February as West Texas Intermediate crude oil gained 6.4%, and copper also had a strong month, up 5.3%.

U.S. Economic News: Construction on new houses sank to a more than two-year low in December, according to the Commerce Department. The report, which had been delayed due to the recent government shutdown, showed starts had tumbled 11% to an annual rate of just 1.08 million in the last month of 2018 from 1.21 million in November. The reading was the lowest since September 2016. In the details, the biggest decline took place in multi-unit dwellings of two units or more which plummeted 20% in December versus just a 6.7% decline in single-family homes. However, analysts note that the slump is most likely temporary. Building permits, which give an indication of future building activity, edged up 0.3% to a 1.326 million unit rate suggesting a likely pickup in housing starts in the spring.

Factory activity across the country slowed in January, weighing on the Chicago Federal Reserve’s National Activity Index (CFNAI). The CFNAI registered a -0.43 for the first reading of the year, a sharp reversal from the positive 0.05 the month before. In the details, the decline was led by production-related indicators. Due to the volatile nature of the monthly data, analysts frequently turn to the less-volatile three-month average, which decreased to a neutral reading last month from a positive 0.16 in December. The CFNAI is a weighted average of 85 economic indicators, designed so that zero represents trend growth and a three-month average above 0.70 suggests an increasing likelihood of a period of sustained inflation.

The nation’s consumers showed a huge rebound in confidence in February as the government shutdown came to an end and the stock market continued its recovery. The Conference Board’s Consumer Confidence Index surged 9.7 points in February to 131.4, exceeding the consensus forecast of just a 3.8 point increase. The reading was the first increase in four months and the biggest gain since August 2015. The rebound in February was led by higher expectations, but consumers’ assessment of present conditions also improved. Confidence was higher across all demographic and most income groups. The current level of confidence remains consistent with above-trend economic growth and suggests consumer spending will remain the driving force of the current expansion.

The Q4 GDP report showed the U.S. economy slowed to a 2.6% annualized rate in the final quarter of last year, down from 3.4% the previous quarter. A slowing housing market and bigger trade deficit weighed after robust growth midyear. Despite slowing, the reading still exceeded economists’ forecasts of 1.9% Q4 growth. The slowdown at the end of 2018 kept the U.S. from reaching at the 3% annual growth level. At 2.9%, 2018 growth matched 2015 as the biggest increase since the end of the 2007-2009 financial crisis.

International Economic News: Canada’s economy practically came to a standstill in the final quarter of last year, shrinking by 0.1% in December. Statistics Canada reported the service sector managed a 0.2% expansion, but was offset by a 0.7% decline in manufacturing. On an annualized basis, GDP grew 0.4% the fourth quarter—the worst quarterly performance in two and half years and well below economists’ expectations for a 1% annualized increase. While a slowdown was widely expected due to lower oil prices, the result was much weaker than most analysts expected. Consumption spending grew at its slowest pace in almost four years, housing fell by the most in a decade, and business investment dropped sharply a second straight quarter.