In the markets:

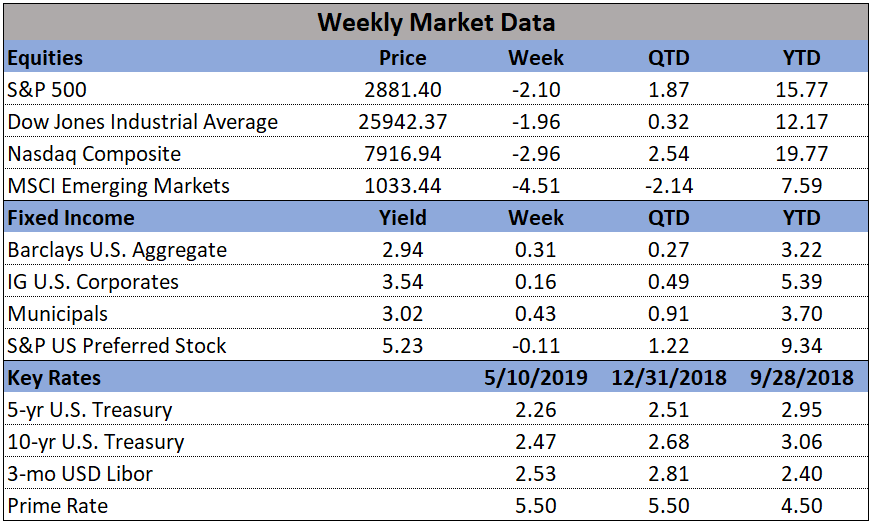

U.S. Markets: A rally late Friday afternoon pulled the major U.S. indexes back from their worst weekly declines since the end of last year as the trade tensions between the U.S. and China continued to escalate. The technology-heavy NASDAQ Composite performed the worst, falling over -3% to 7,916, while the Dow Jones Industrial Average fell -2.1% to 25,942. By market cap, small caps performed the worst with the Russell 2000 giving up -2.5%, while the large cap S&P 500 and mid cap S&P 400 retreated -2.2% and -2.4%, respectively.

International Markets: Like the U.S., international markets were a sea of red last week. Canada’s TSX fell -1.2% and the UK’s FTSE 100 dropped -2.4%. On Europe’s mainland, France’s CAC 40 ended down -4.0% and Germany’s DAX fell -2.8%. In Asia, China’s Shanghai Composite had its third consecutive week of losses, giving up -4.5%, while Japan’s Nikkei dropped -4.1%. As grouped by Morgan Stanley Capital International, developed markets fell -2.5%, while emerging markets plunged -5.1%.

Commodities: Precious metals ended the week mixed, despite the volatility in the financial markets. Gold rose 0.5% ending the week at $1287.40 an ounce, but Silver ended down -1.3% to $14.70 an ounce. Energy had its third consecutive down week, retreating -0.5% to $61.66 per barrel. Copper, viewed by some analysts as a barometer of global economic health due to its variety of industrial uses, closed down a fourth week in a row, giving up -1.6%.

U.S. Economic News: The number of Americans applying for new unemployment benefits fell slightly last week to 228,000, remaining near multi-decade lows in one of the strongest labor markets in decades. The Labor Department reported initial jobless claims fell by 2,000, far less than the drop of 12,000 that economists had expected. The more stable monthly average of new claims rose by 7,750 to 220,250. Continuing claims, which counts the number of people already receiving benefits, increased by 12,000 to 1.68 million. That number is reported with a one-week delay.

The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) report showed that the number of job openings in the U.S. rebounded to a near-record high of 7.49 million in March and that companies are still hiring despite an economy that is not growing as quickly as it was a year earlier. The month before, job openings had fallen to a nine-month low of 7.14 million. In the details, transportation and warehousing companies increased their number of openings by 87,000, while construction firms advertised 73,000 new positions. The closely-watched “quits rate” remained flat at 2.5% among private-sector employees. Analysts watch that number for the underlying health of the economy as it is assumed that workers would only leave their jobs if they were confident of finding more lucrative ones. While the pace of hiring has slowed since last fall, there still remains more jobs available than there are unemployed Americans. Julia Pollak, a labor economist at employment marketplace ZipRecruiter stated, “Job openings have now exceeded the number of unemployed Americans for 13 straight months.”

Wholesale prices rose a modest 0.2% in April, indicating that inflation remains under control. Economists had predicted a 0.3% gain. Over the past year, wholesale inflation remained at a low 2.2% increase. The price for gas and services rose the most last month, while food costs fell 0.2%. Excluding food, energy, and trade margins, the so-called core PPI rose 0.4% last month. On an annual basis, core PPI increased to 2.2% in April. For consumers, rising rent costs and the higher cost of fuel led to an increase in inflation for the second month in a row, but price pressures remain far below levels that could threaten the U.S. economy. The Bureau of Labor Statistics’ CPI rose 0.3% last month, missing economists’ forecasts of a 0.4% advance. Over the past 12 months, the cost of living edged up to 2% from 1.9%. Ex-food and energy, core CPI at the consumer level rose just 0.1% for the third month in a row. Chief economist David Berson of Nationwide wrote in a note to clients, “This rise in inflation will not be enough to get the Fed to change the expected flat course of monetary policy — especially with a growing risk of trade tensions causing a slowdown in economic growth.”

The U.S. trade deficit rose slightly in March, but remained below year-ago levels in a sign that the gap may not weigh on the economy as much this year as it did in 2018. The chief reason was a smaller trade gap with China. The Commerce Department reported the trade deficit with China fell in March to its lowest level in more than three years, primarily due to a decline in imports amid the growing trade dispute with the Trump White House. In March, the trade deficit rose 1.5% to $50 billion. Economists had expected a gap of $50.1 billion. Imports rose 1.1% as oil, food, and industrial supplies increased. However, the U.S. imported fewer cell phones, consumer electronics, and other household goods—products that come primarily from China.

According to the Federal Reserve’s second edition of its Financial Stability report, debt issuance to riskier areas of the business sector has picked up but the sector “is resilient”. The report noted the share of newly issued large loans to corporations with high leverage increased over the last nine months and now exceeds previous peak levels observed in 2007 and 2014 when underwriting quality was poor. Federal Reserve economists note there is worry that this small corner of the debt market could serve as a powder keg that could worsen the next economic downturn. Leveraged loans are floating-rate loans made to businesses rated below investment grade, often used to finance mergers and private-equity deals. The Fed has tried to rein in that area of lending in the past, but has faced significant resistance from banks and politicians.

Looking ahead:

Despite the equity markets reacting negatively to US-China trade, economic data remains very positive. The trade war should not be underestimated, but it is currently one of only a few negative market indicators. This current sell-off is a short-term correction and not a trend reversal. That said, we remain partly hedged with expectations for further declines in the short-term.