In the markets:

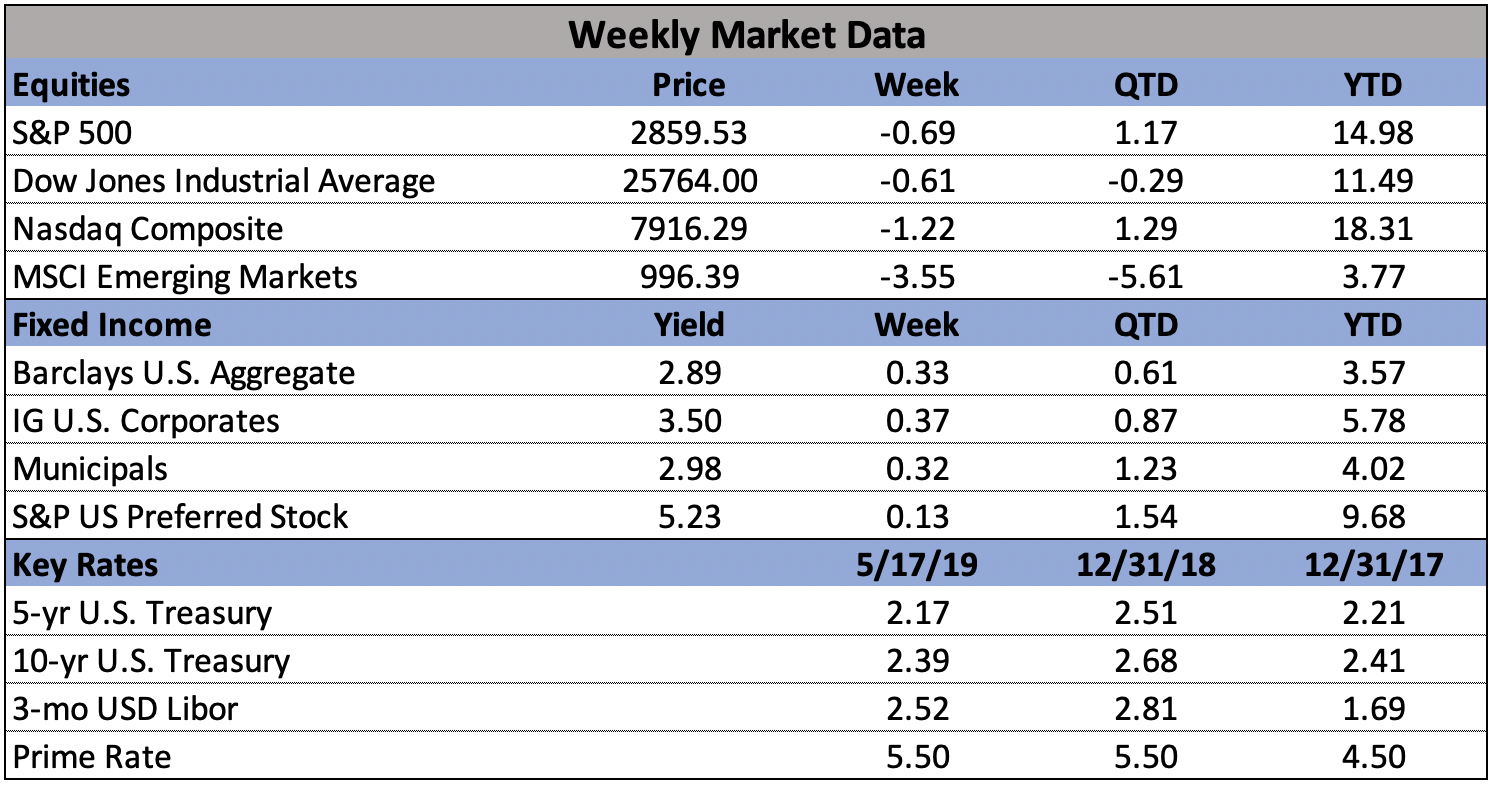

U.S. Markets: The major U.S. indexes ended the week lower despite a midweek rally that erased most of Monday’s steep losses. Large caps outperformed smaller-cap benchmarks, and the small cap Russell 2000 index finished the week as the only major index back in “correction” territory (down 10% from recent highs). The Dow Jones Industrial Average finished the week down -0.7% to 25,764. The technology-heavy NASDAQ Composite fell a steeper -1.3%, following last week’s -3% decline. The large cap S&P 500 retreated -0.8%, while the mid cap S&P 400 index and Russell 2000 index ended the week down a much larger -2.3% and -2.4%, respectively.

International Markets: Canada’s TSX rose 0.6%. Major European markets finished the week solidly to the upside with all major indexes rebounding from last week’s declines. The United Kingdom’s FTSE rose 2%, while France’s CAC 40 gained 2.1% and Germany’s DAX added 1.5%. But In Asia, China’s Shanghai Composite ended down -1.9% and Japan’s Nikkei declined -0.4%. As grouped by Morgan Stanley Capital International, developed markets finished down -0.9% while emerging markets plunged over -4.0%.

Commodities: Precious metals retreated, with gold declining -0.9% to $1275.70 an ounce and silver falling -2.7% to $14.39. Oil rebounded following 3 consecutive weeks of declines by rising 2% to $62.92 per barrel. The industrial metal copper, seen by some as a barometer of world economic health due to its variety of uses, declined for a fifth straight week, down -1.3%.

U.S. Economic News: The Labor Department reported the number of Americans seeking first-time unemployment benefits fell by 16,000 to 212,000, their lowest level in a month. The decline pulled new jobless claims back near a 50-year low. Economists estimated new claims would total 217,000. The less-volatile monthly average of new claims rose by 4,750 to 225,000. Continuing claims, which counts the number of people already receiving benefits, fell by 28,000 to 1.66 million. That number is reported with a one-week delay.

Confidence among the nation’s homebuilders rose to a 7-month high as headwinds in the housing market continue to ease. The National Association of Home Builders’ (NAHB) monthly confidence index rose 3 points to 66 this month, its highest reading since last fall. Economists had expected just a one point increase. In May, the sub-gauge that tracks current sales conditions jumped 3 points to 72, while the component that measures expectations over the next six months ticked up a point to 72. The NAHB’s index of buyer traffic rose 2 points to 49. Economists use the NAHB’s confidence index as a gauge of likely home building industry activity. If builders are more confident in market conditions, they’re more likely to break ground on more houses, leading to more jobs and overall economic activity.

Construction on new homes climbed almost 6% last month, but the reading remained below last year’s pace. The Commerce Department reported housing starts increased to an annualized rate of 1.24 million last month, exceeding forecasts of a 1.21 million pace. Meanwhile permits to build new homes rose less than 1% last month to a 1.3 million annual rate. That suggests builders are unlikely to increase construction beyond current plans. Both housing starts and permits are running below last year’s pace. In the details, single-family homes, which represent the bulk of new homes being built and sold, advanced 6.2% to an 854,000 annual rate. Work on multi-dwelling units, such as apartments, rose a smaller 2.3% to a 359,000 annual rate.

Sentiment among the nation’s consumers jumped to a 15-year high this month according to the University of Michigan’s Consumer Sentiment index. The index surged 5.2 points to 102.4, blowing away economists’ expectations of a reading of 97.1. In the details, the index for consumer expectations shot higher, rising to 96 from 87.4 in April. In addition, the measure of current economic conditions ticked up a tenth of a point of 112.4. In its release, the University of Michigan pointed out the tight jobs market fueled the increase in confidence. In addition, they noted, the readings were recorded before the trade negotiations with China broke down. Richard Curtin, chief economist of the survey noted, “Those who held negative views about the impact of tariffs on the economy and pricing had values on the expectations index that were 25 points lower, and expected the year-ahead inflation rate to be 0.6 percentage points higher.” That suggests the index is set up for weaker readings ahead.

The trade dispute with China doesn’t appear to have added much to U.S. inflation (at least not yet), according to the Bureau of Labor Statistics (BLS). The BLS reported import prices rose 0.2% in April, predominantly due to an increase in the cost of oil. Ex-energy there was little evidence of rising inflation. The increase was well below Wall Street forecasts of a 0.7% increase. Excluding fuel, import prices actually fell 0.1% - their fourth consecutive decline. Over the past 12 months, import prices have fallen 0.2% despite the higher cost of oil. In contrast, import prices were rising at a 3.5% annual rate a year earlier. The decline stems mainly from a stronger U.S. dollar that has made foreign goods less expensive for Americans.

Sales at the nation’s retailers fell last month for the second time, a sign that Americans are pulling back on spending in an economy facing increasing headwinds. The Commerce Department reported retail sales dropped 0.2% last month, missing expectations of an increase of 0.1%. Sales declined across most major segments including automobiles, home improvement centers, and internet retailers. In the details, sales fell 1.1% at car dealers, slid 1.3% at electronic stores, and were down 1.9% at home and garden centers. This report suggests Americans are showing more restraint with their spending this year than last. Some letup was expected following last month’s 1.7% surge, but the drop is a caution sign for the broader U.S. economy – after all, consumer outlays account for more than two-thirds of the nation’s economic activity.

In the New York region, the Empire State manufacturing index rose to a 6-month high of 17.8 in May, following a reading of 10.1 in April. The improvement was predominantly due to a decline in inventories that suggests that some of the buildup in stockpiles amid rising global trade tensions may have unwound this quarter. The inventories index plunged 12.5 points to -4.1. Furthermore, the new-orders index and shipments index rose 2.2 points and 7.7 points, respectively. Analysts note that manufacturing has been one of the weak points of the economy this year, so this report could either indicate that the economy is improving—or perhaps be an outlier.

The Philadelphia Fed reported its manufacturing index also improved, rising to a four-month high of 16.6. The reading was up 8.1 points from April, but lagged economists’ estimates of a 10.1 increase. In the details, readings were mixed. The shipments index rose while the new-orders index declined. The index for inventories fell into negative territory. Of note, the employment index increased 4 points to 18.2—its highest reading in five months. Ian Shepherdson, chief economist at Pantheon Macroeconomics summed up both the New York and Philadelphia manufacturing reports stating, “In short, the industrial economy is weak, but it probably is no longer weakening. The re-escalation of the trade war is a wild card, but China’s stimulus means that the global manufacturing story is beginning to turn around.”

On a national level, industrial production declined 0.5% in April the Federal Reserve reported. The decline was much deeper than the 0.1% economists expected. Most major market groups reported worse production in April, the Fed said. Ex-autos, manufacturing production was down -0.3%. Stephen Stanley, chief economist at Amherst Pierpont Securities noted that manufacturers have been negatively affected by both the imposition of tariffs by China and on a rising dollar writing, “Manufacturers have without question borne the brunt of the negative impacts from the imposition of tariffs, the retaliation from China, and the uncertainty regarding the outlook for trade policy. Factories have also been hit by the strengthening in the dollar last year.”