In the markets:

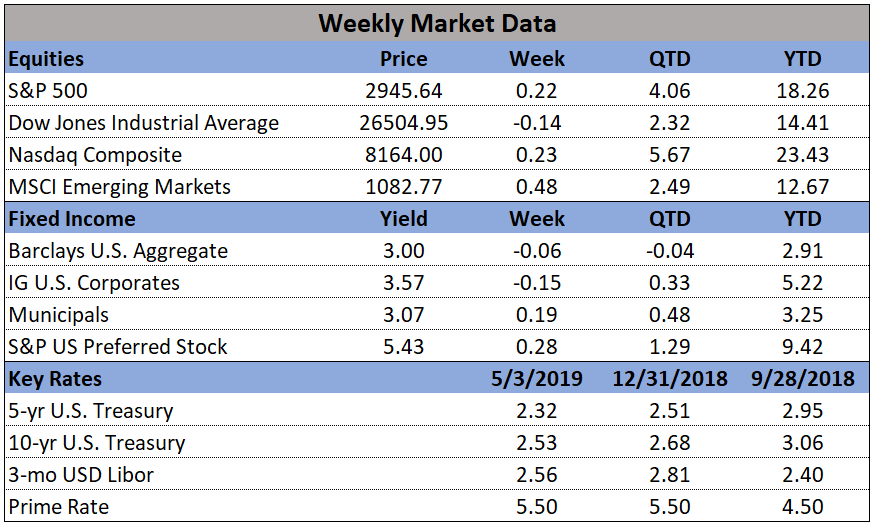

U.S. Markets: An impressive rally on Friday erased earlier intra-week losses and brought the major indexes back to roughly flat for the week. The Dow Jones Industrial Average ended the week down 38 points, closing at 26,504, a small decline of -0.14%. The technology-heavy NASDAQ Composite gained 0.2% ending the week at 8,164. By market cap, the smaller cap benchmarks outperformed large caps with the small cap Russell 2000 rising 1.4%, the mid cap S&P 400 added 0.4%, and the large cap S&P 500 gained 0.2%.

International Markets: Canada’s TSX finished the week off -0.7%, and the UK’s FTSE 100 closed the week down -0.6%. Markets were mixed on Europe’s mainland with France down -0.4%, but Germany’s DAX rising 0.8%. In Asia, China’s Shanghai Composite, which has had a rough go of late, fell an additional -0.3%. Japan’s Nikkei was closed this week as the nation welcomes a new emperor. As grouped by Morgan Stanley Capital International, both emerging and developed markets finished the week up 0.8%.

Commodities: Gold retraced some of last week’s gain by retreating -0.6% to $1281.30 an ounce. Silver also finished down for the week by -0.2% to $14.98 an ounce. Oil finished down a second week with West Texas Intermediate crude retreating -2.2% to $61.94 per barrel. Copper, seen as a barometer of global economic health due to its variety of industrial uses, finished down a third consecutive week, giving up -2.6%.

April Summary: All major US indices were higher for the month of April. The Dow rose 2.6%, and the NASDAQ gained 4.7%. Large caps and mid caps each gained 3.9%, while small caps rose a lesser but still robust 3.3%. International markets were higher with few exceptions. Canada’s TSX rose 3% and the UK’s FTSE rose 1.9%. France’s CAC gained 4.4%, while Germany’s DAX surged 7.1%. China’s Shanghai Composite bucked the positive results by declining -0.4%, but Japan’s Nikkei surged 5%. Developed markets rose 2.9%, while emerging markets added 2.4%. Gold retreated -1.3% in April, while Silver gave up -0.9%. Oil rose 3%, but copper performed poorly, giving up -4%.

U.S. Economic News: The number of Americans applying for first-time unemployment benefits rose to a three-month high of 230,000. However, analysts noted that the higher reading was likely due to the recent Easter holiday and spring break. Economists had forecast new claims would fall to 215,000. The less-volatile monthly average of new claims rose by 6,500 to 212,500 but remained near their lowest level in almost fifty years. Continuing claims, which counts the number of people already receiving benefits, edged up 17,000 to 1.67 million.

The U.S. created 263,000 jobs in April and unemployment fell to an almost 50-year low, according to the Labor Department’s Non-Farm Payrolls (NFP) report. In the latest reading, the increase in hiring was concentrated in white collar services, construction, and health care. The only sector that suffered a large loss of employees was retail, where employment fell for a third straight month. The increase in new jobs easily surpassed economists’ forecasts of an NFP of 213,000. Meanwhile, the unemployment rate dipped 0.2% to 3.6% in March, marking the lowest level since December of 1969. The increase in pay over the last 12 months remained unchanged at 3.2%. That leveling off is thought to ease any worries at the Federal Reserve about rising wages triggering a sharp increase in inflation.

The private sector saw job growth surge by over 275,000 new positions in April, according to payrolls processor ADP. The ADP reading topped economists’ consensus expectations for 180,000 jobs added. However, Mark Zandi Moody’s Analytics chief economist cautioned that market participants shouldn’t be overly optimistic following the report. “The number overstates the case,” Zandi said. ADP’s increases in April were concentrated in the service sector, it accounted for 223,000 of the jobs added. By size, small businesses added 77,000 jobs, medium-sized businesses added 145,000, and large businesses accounted for 53,000 of the job gains.

An index of pending-home sales rose 3.8% in March according to the National Association of Realtors (NAR). Economists had expected just a 0.7% increase. The NAR’s pending-home sales index tracks the number real estate deals in which a contract has been signed but not yet closed. The number has been volatile over the past several months, but the trend has generally been down. In the details, only the Northeast region saw a decline, of 1.7%. Pending home sales were up 4.4% in the South, 2.3% in the Midwest, and a solid 8.7% in the West.

U.S. home prices rose a seasonally-adjusted 0.2% in February according to S&P CoreLogic’s Case-Shiller 20-city home price index. The reading was 3.0% higher than the same time last year, but was the slowest pace of annual growth since September of 2012. The reading missed the Econoday consensus forecast of a 3.2% yearly increase. In the details, 14 of the 20 cities reported monthly price increases, but only one city had a bigger price increase on an annual basis than in January. Major cities in California, which have been impacted by sizable tax-law changes implemented in 2017, were hit the hardest with Los Angeles, San Francisco, and San Diego showing the slowest annual price growth in the three months ending in February. Las Vegas, Phoenix, and Tampa were the top three metro areas.

Spending by US consumers jumped in March, supporting views that the economy is on firm footing. The Government’s Bureau of Economic Analysis reported spending rose 0.9% in March following a 0.1% gain the month before. The gain was the largest monthly gain in almost a decade. In addition, personal incomes increased 0.1% in March and remained on a moderate growth path. Economists had been expecting a 0.8% gain in consumer spending and a 0.4% gain in income. The closely watched core Personal Consumption Expenditures (PCE) inflation rate remained flat in March, bringing the annual rate down 0.1% to 1.6%. That reading was the lowest since September of 2017. The muted PCE inflation rate supported the Fed’s decision to stay on the sidelines this week. Jim O’Sullivan, chief U.S. economist at High Frequency Economics, said growth remains too strong for a rate cut, while inflation remains too weak for a rate hike.

Confidence among the nation’s consumers rebounded in April, reinforcing views that the economy continues growing steadily. The Conference Board reported its Consumer Confidence Index rose 5 points to 129.2 this week, whereas economists had expected a reading of 126.9. In the details, the present situation index rose 5.3 points to 168.3, and the survey of future expectations moved up to 103 from 98.3. Both are near their highest levels in a decade. Lynn Franco, Director of Economic Indicators at the board stated, “Overall, consumers expect the economy to continue growing at a solid pace into the summer months.”

Manufacturing activity expanded at its slowest pace in more than two years last month, according to the Institute for Supply Management (ISM). ISM stated its manufacturing index slipped 2.5 points to 52.8 in March. Economists had expected a reading of 54.7. Still, while ratings over 50 indicate expansion, the rate of that expansion is the weakest since October of 2016. In the details, the new-orders index slid 5.7 points to 51.7, while the employment gauge dropped 5.1 points to 52.4. The ISM index is compiled from a survey of executives who order raw materials and other supplies for their companies.

Looking ahead:

US President Donald Trump retraced his steps this weekend and added tariffs on an additional $325 billion of Chinese goods. Equity markets fell more than 1% as old fears came back into play. This will most likely increase the timeline on the US-China trade deal, a stimulus many believe the market has already priced in.

Despite this hiccup, equities have a firm footing at their current valuations. The combination of continuing job growth, a dovish Fed, and a strong first quarter earnings season has the ability to keep markets high. Trade-sensitive names will likely correct in the short-term, but won't drag the broader market with them. Chinese equities and funds with high China exposure are expected to under-perform over the next 2-3 months.