In the markets:

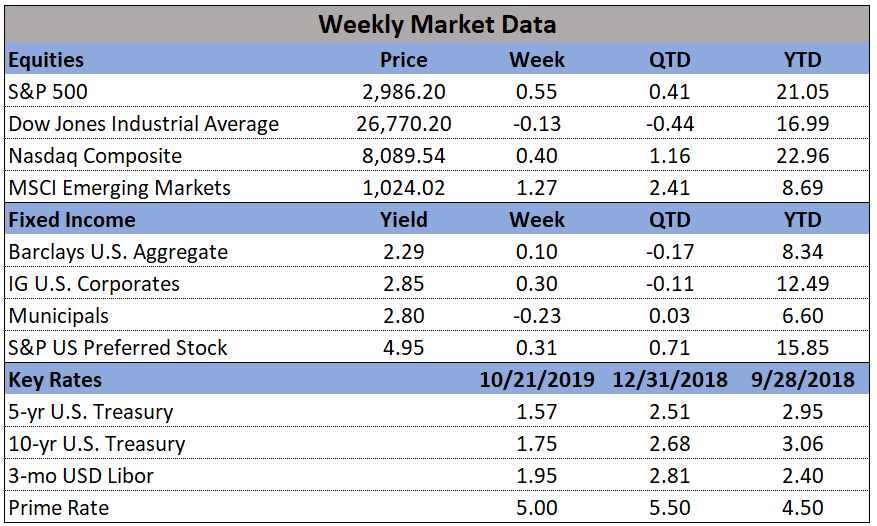

U.S. Markets: All but one of the major indexes recorded modest gains this week as earnings season kicked in. The gains brought the large-cap S&P 500 within less than 1% of its record high before falling back on Friday. The small cap Russell 2000 outperformed, but remained in correction territory—down over 10% from its August 2018 peak. The Dow Jones Industrial Average was the only index to finish the week lower, closing at 26,770, a decline of -0.2%. The technology-heavy NASDAQ Composite rose 0.4%, while the large cap S&P 500 added 0.5%. The S&P 400 midcap index and small cap Russell 2000 were the winners this week, rising 1.1% and 1.6%, respectively.

International Markets: Canada’s TSX fell for a fourth consecutive week, giving up -0.2%. Across the Atlantic, the United Kingdom’s FTSE retraced last week’s gain by declining -1.3%. On Europe’s mainland, France’s CAC 40 fell -0.5% while Germany’s DAX rose 1%. In Asia, China’s Shanghai Composite declined -1.2%, while Japan’s Nikkei surged 3.2%. As grouped by Morgan Stanley Capital International, developed markets rose 1.1% while emerging markets added 0.6%.

Commodities: Precious metals rebounded slightly last week. Gold rose 0.4%, finishing the week at $1494.10 an ounce, while Silver managed a 0.2% gain, to $17.58 an ounce. Crude oil retraced some of last week’s gain by retreating -1.5% to $53.87 per barrel of West Texas Intermediate crude. The industrial metal copper, viewed by analysts as a barometer of global economic health due to its wide variety of industrial uses, finished the week up 0.3%.

U.S. Economic News: The number of Americans seeking first-time unemployment benefits rose slightly last week, but remained near a half-century low. The Labor Department reported initial jobless claims, a rough way to measure layoffs, increased by 4,000 to 214,000 last week. Economists had forecast a reading of 215,000. Most of the increase in new jobless claims was concentrated in the state of California. No other state reported significant changes. The less-volatile monthly average of new claims rose by 1,000 to 214,750. Continuing claims, which counts the number of people already collecting unemployment benefits, declined by 10,000 to 1.68 million. Those claims have remained below 2 million since early 2017. Thomas Simons, senior money market economist at Jefferies LLC wrote, “Claims remain near historically low levels and reflect a very solid labor market.”

The number of houses under construction in September declined by 9%, the Commerce Department reported, but a recent surge in permits suggests the decline is most likely just a brief pause. Housing starts slid to an annual rate of 1.26 million last month, revised down from 1.39 million in August. The slowdown was predominantly concentrated in new buildings with five units or more, such as apartment complexes. New construction on single-family homes actually rose slightly to an annual rate of 918,000, marking the highest level since the start of 2019. Economists had expected starts to decline to 1.32 million. Meanwhile, permits to build new houses fell about 3% to a 1.39 million annualized pace—but that number is 8% higher compared to the same time last year.

A survey of the nation’s homebuilders surged to an almost two-year high this month, thanks to dramatically lower mortgage rates. The National Association of Home Builders (NAHB) reported its survey of home-builder sentiment rose to 71 in October, up from 68 in the prior month. Readings over 50 indicate that confidence is improving. At the beginning of the year the index stood at a 3 ½ year low of 56. Builders are even more optimistic about the future. The NAHB sub index that tracks builder expectations for the next 6 months rose to a 19-month high, very close to a post-recession peak.

Sales at U.S. retailers fell last month, ending a streak of six consecutive months of solid gains that helped fuel economic growth through the middle of the year. The Commerce Department reported retail sales fell 0.3% last month, missing the consensus forecast for a 0.3% increase. In the details, sales fell almost 1% at auto dealers, despite the fact they reported a strong increase in the number of new vehicles sold. Sales also declined 0.7% at gas stations, reflecting lower prices at the pump. Auto and gas sales represent an outsized portion of overall retail sales. The softness was widespread, however. Sales also fell at home centers, department stores and internet retailers. The drop in Internet sales was the first this year. The only segments of the retail industry that recorded strong sales were health stores and pharmacies.

The Conference Board reported its index that measures the nation’s economic health slipped last month and is likely to remain soft in the months ahead. The Leading Economic Index (LEI), a weighted gauge of 10 indicators designed to signal peaks and valleys in the business cycle, slipped 0.1% in September—its second decline in a row. The index fell mostly because of weakness among American manufacturers, whose sales have suffered from sluggish exports and disruptions in their supply chains caused by the U.S. trade war with China. The narrowing spread between short-term and long-term U.S. interest rates — often a precursor to recession — was another negative. Ataman Ozyildirim, director of business cycles research at the board, stated “The LEI reflects uncertainty in the outlook and falling business expectations, brought on by the downturn in the industrial sector and trade disputes. Looking ahead, the LEI is consistent with an economy that is still growing, albeit more slowly, through the end of the year and into 2020.”

The Federal Reserve’s Beige Book, a collection of anecdotes collected by each of the Federal Reserve member banks from business contacts within their respective regions, reported the U.S. economy may seem to be slowing a bit, and has only expanded at “a slight to modest pace” since early September. Business activity varied across the country, with the Midwest and Great Plains reports more downbeat than those from the Southern and Western regions. The U.S. - China trade dispute continued to affect business activity. Manufacturers were starting to lay-off workers in a number of districts because orders were weak, but other firms said they wanted to retain scarce workers and so are cutting hours but not jobs. In general, slower but continued economic growth was the forecast. “Business contacts mostly expect the economic expansion to continue; however, many lowered their outlooks for growth in the coming 6 to 12 months,” the report said.