While the other indices were mixed last week the NASDAQ Composite performed the best, helped in particular by a strong performance by heavily-weighted Apple. In the meantime our Short Term Indicator remains Bullish.

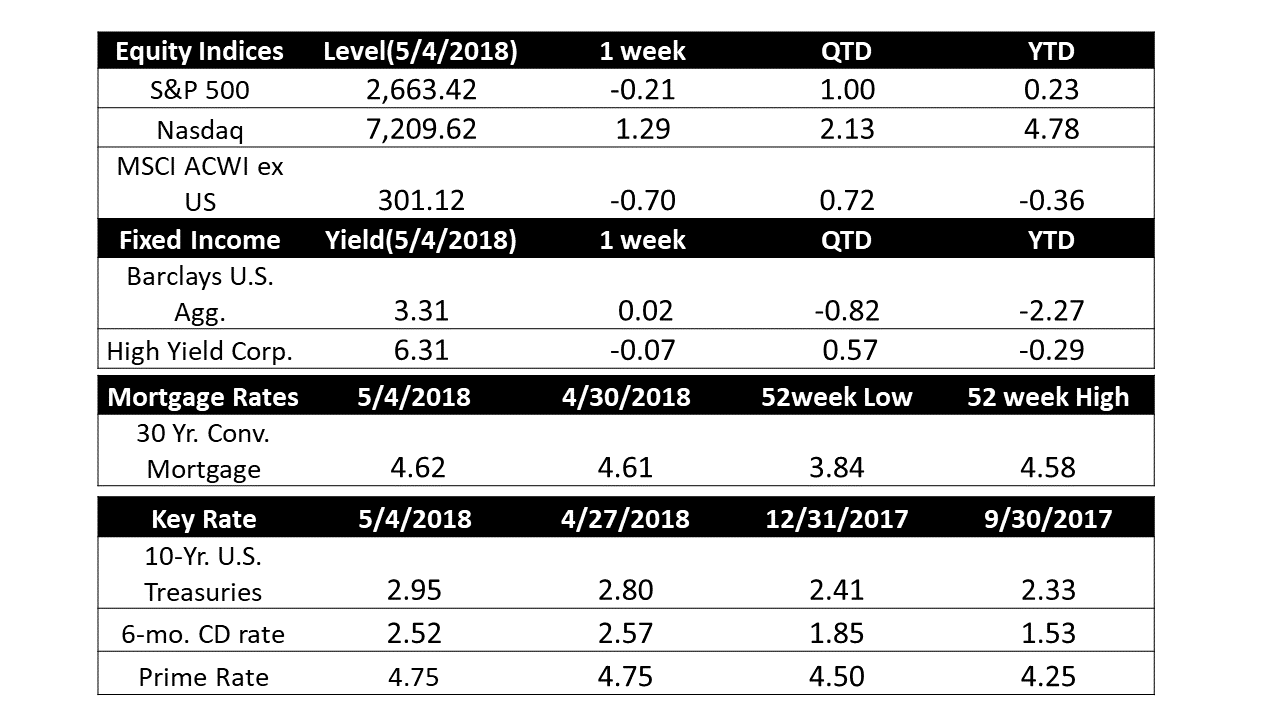

U.S. Markets: The Dow Jones Industrial Average finished the week down 48 points closing at 24,262, a loss of -0.2%. The NASDAQ Composite rose 89 points, or 1.3%, ending the week at 7,209. By market cap, smaller cap stocks ended the week in positive territory with the small cap Russell 2000 adding 0.6% and the mid cap S&P 400 index rising 0.3%, while the large cap S&P 500 declined -0.2%.

International Markets: Canada’s TSX rallied for a fourth consecutive week, ending the week up 0.4%. An even longer winning streak is found in the United Kingdom’s FTSE, which rose a sixth straight week, up 0.9%. Markets were also positive on Europe’s mainland, where France’s CAC 40 gained 0.6%, Germany’s DAX surged 1.9%, and Italy’s Milan FTSE gained 1.7%. In Asia, China’s Shanghai Composite rose for a second week adding 0.3%, while Japan’s Nikkei ended the week flat. Most international markets were negative, however, did not do nearly as well as the “headline” markets mentioned above. As grouped by Morgan Stanley Capital International, developed markets finished the week down -0.1%, while emerging markets slipped -1.8%.

Commodities: The rally in energy continued. West Texas Intermediate crude oil rose 2.4% to close at $69.72 per barrel. Precious metals finished the week mixes with Gold falling -0.7% to close at $1314.70 an ounce, while Silver managed a slight gain by rising 0.1% to close at $16.52 an ounce. Copper, seen as a barometer of global economic health due to its variety of uses, rose 0.7% for the week.

Monthly Summary - APRIL: For the month of April, the Dow Jones Industrial Average added 0.3%, while the Nasdaq Composite ended the month essentially flat, up just 0.04%. By market cap, the large cap S&P 500 added 0.3%, the mid cap S&P 400 gave up -0.3%, and the small cap Russell 2000 gained 0.8%. Developed International markets on the whole did much better than the U.S. market, while Emerging International markets lagged for the month. Canada’s TSX gained 1.6%, while the United Kingdom’s FTSE surged 6.4%. On Europe’s mainland, France’s CAC 40 rallied 6.8%, Germany’s DAX added 4.3%, and Italy’s Milan FTSE jumped 7%. In Asia, China’s Shanghai Composite ended the month down -2.7%, while Japan’s Nikkei rallied 4.7%. Developed markets finished the month of April up 1.5%, while emerging markets were down -2.8%. Precious metals were mixed for the month with Silver rising 0.8% but Gold retreating -0.6%. The industrial metal copper ended the month up 0.9%. Energy had its third consecutive month of gains as West Texas Intermediate crude oil rallied a robust 5.6%.

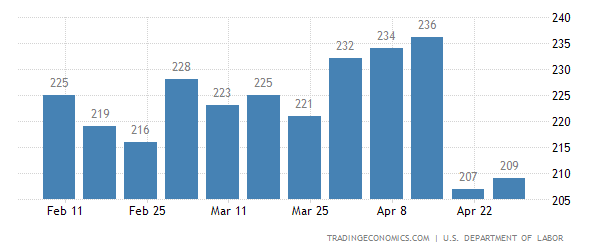

U.S. Economic News: Looking at the big picture, the U.S. labor market is in its best shape of the nine-year economic expansion. The low level of claims suggests that solid job growth will continue and the unemployment rate will continue to fall. Continuing claims, which counts the number of people already receiving unemployment benefits, fell by 77,000 to 1.76 million.

The number of Americans filing for unemployment benefits rose by 2 thousand to 211 thousand in the week ending April 28, from the previous week's unrevised level of 209 thousand and missing market expectations of 225 thousand. For more on this story click here

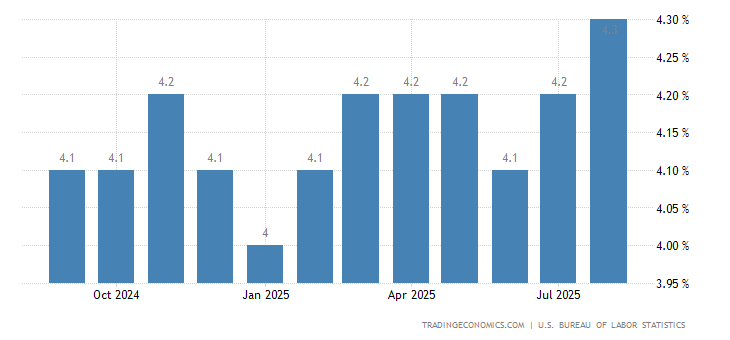

The unemployment rate fell to a 17-year low and the U.S. added 164,000 new jobs in April, according to the Bureau of Labor Statistics’ Non-Farm Payrolls report. The nation’s unemployment rate fell 0.2% to 3.9%, after holding at 4.1% for six months in a row. The U6 rate also includes people who can only find part-time work and those that are no longer looking for a job. The U6 rate fell to 7.8% in April, the first time it’s dropped below 8% since 2006.

Spending by the nation’s consumers increased 0.4% in March after remaining unchanged in February, the Commerce Department reported. On an annualized basis, consumer spending grew at a 1.1% annualized rate in the first quarter—its slowest in almost five years. Data showed Americans spent more on new cars and trucks and paid more to heat and power their homes. Consumer spending accounts for roughly two-thirds of the nation’s economic activity.

International Economic News: Canada’s economy rebounded in February more than economists had estimated, a good indication that the nation is poised to emerge from its recent soft patch in growth. Statistics Canada reported Gross Domestic Product expanded 0.4% in February, following a 0.1% contraction the previous month. Economists anticipated a 0.3% gain.

The United Kingdom’s economy remains stuck in the slow lane as its services sector grew at a slower-than-expected pace last month. Research firm IHS Markit reported its Purchasing Managers’ Index (PMI) for the industry saw only a modest rebound from the almost 2-year low posted in March. The reading of 52.8 was the weakest services PMI reading since September of 2016. Based on its three industry surveys, Markit estimates an expansion in the United Kingdom consistent with a “disappointingly subdued” quarterly rate of 0.25%. While 0.25% is an improvement over the 0.1% seen in the first quarter, it’s considerably slower than the growth seen in the second half of last year.

- Please visit our website www.pacificinvestmentresearch.com for more insights. Email us at info@pacificinvestmentresearch.com if you have any questions.